As the demand for robust communication infrastructure surges globally, Everest Infrastructure Partners has stayed busy, building a best-in-class acquisitions-focused platform and growing its global portfolio of wireless infrastructure assets.

With an adaptable but strategic mindset, the company has embarked on a relentless pursuit to become the ‘partner of choice’ across the wireless infrastructure industry.

A Nimble Giant

Nardone said that Everest’s ability to close deals quickly and efficiently, while offering best-in-class post-transaction operating procedures, makes the company an attractive partner for tower and commercial real estate rooftop owners looking to monetize or grow their assets. “Everest is incredibly nimble, creative, and solutions-oriented,” he said, a competitive advantage that has allowed it to successfully navigate the complexities of a competitive telecom market.

Everest Infrastructure’s growth is fueled by both acquisitions and organic new site development. The company prides itself on being the “partner of choice” for major national carriers and a host of other entities, from federal, local and state governments, broadcasters and WISPs. With over 500 unique tenants across its geographies, the company’s customer base is as diverse as the assets it manages.

“Our largest customers are the national carriers,” Nardone said. “But we also work with many others including WISPs, local governments and broadcasters, making us a versatile player in the space.”

High-Touch Management and the ‘Goldilocks Effect’

One of the key differentiators for Everest is its ability to manage assets with both scale and care, explained Christopher Davis, Chief Development Officer at Everest. The company’s size allows it to contend with major industry players while still maintaining a “high-touch” approach with clients. “We have the scale and financing resources to compete with the largest tower companies in the country, but we also have a hands-on approach that allows us to work closely with each of our customers,” Davis said.

Case in point. In December 2023, Everest Infrastructure Partners and TowerCo acquired 546 wireless towers from Charter Communications covering 37 states. Davis says Everest offered a competitive valuation while also ensuring Charter would retain access and use rights to the towers post-close.

This blend of scale and personal attention has been dubbed the “Goldilocks effect,” said the Everest team – large enough to handle significant portfolios and small enough to offer customized service.

Acquisitions & Development

Brenton Atcheson, Vice President of Corporate Development at Everest, elaborated on the company’s innovation-driven approach to acquisitions. “We’ve been able to get hard deals done, unlocking value for Sellers where others saw obstacles,” Atcheson said. He highlighted their company mantra “buyer-of-choice” as a rationale for their ability to be successful in both broadly marketed transactions as well as direct to Seller acquisitions, such as their acquisition of Frontier Communications’ towers, Duke Energy’s PeakNet assets or TC Energy’s CNS Microwave, Inc. In these cases, Everest successfully acquired non-core assets from businesses not primarily focused on telecom.

Still, the telecom industry, like many others, has been affected by macroeconomic factors including interest rates. Everest has managed to circumvent these challenges with minimal impact on their acquisition strategy, according to Atcheson. “On the private side, pricing has been consistent all through the interest rate curve,” he noted. “We continue to see strong activity in the tower M&A space despite the current rate environment. We rely on our team’s unique ability to underwrite transactions down to the individual site level, which provides pricing certainty to our transaction counterparties.”

Everest also works with individual developers, providing capital and resources to support their pipeline execution. “We’ve worked with smaller developers and helped them scale, and we’ve also partnered with more established developers to create win-win situations through creative structuring of deals,” Davis said.

Regulatory concerns, particularly in states with more stringent zoning requirements, can also pose obstacles for infrastructure development. However, Everest’s team has found success by targeting “hard-to-zone, defensible tower locations” where future competition is less likely, Davis explained. This strategy has enabled the company to mitigate some of the risks associated with regulatory hurdles while continuing to expand its footprint.

A Sustainable Future, in More Ways Than One

In addition to internal efficiency measures, Everest is also exploring partnerships with carriers to enhance energy efficiency at tower sites. Atcheson remarked that while carriers typically bear the responsibility for sustainability at the operational level, Everest is keen to collaborate on solutions that reduce emissions and improve energy use across their portfolio.

Combining strategic acquisitions with creative development solutions, it’s no surprise that Everest Infrastructure Partners has emerged as a key player in the telecom infrastructure space.

The Everest team explained that its ability to maneuver evolving regulatory environments while working hand-in-hand with customers, has cleared a path to capitalize on the increased demand for connectivity, as a long-term “partner of choice.”

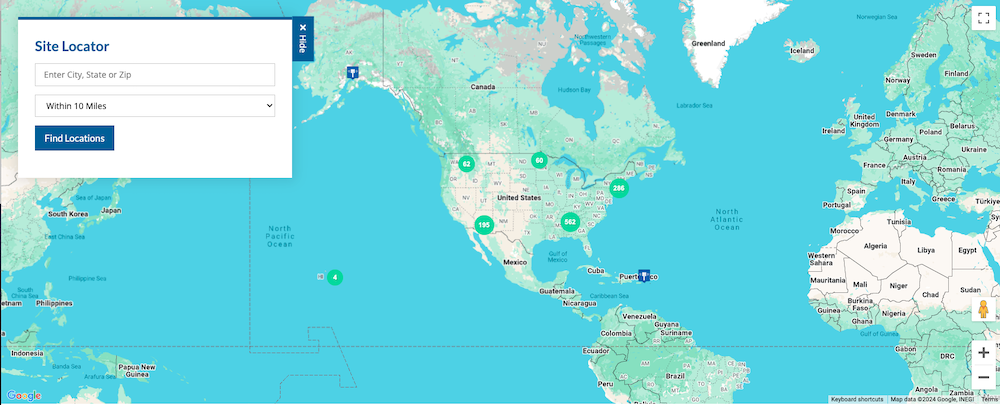

To learn more about Everest Infrastructure Partners, visit https://everestinfrastructure.com/ and its Site Locator at https://everestinfrastructure.com/site-locator/. Feel free to reach out directly to Dominic Nardone (412-482-3426), Brenton Atcheson (412-298-2750) or Chris Davis (202-236-6833).

Reader Interactions