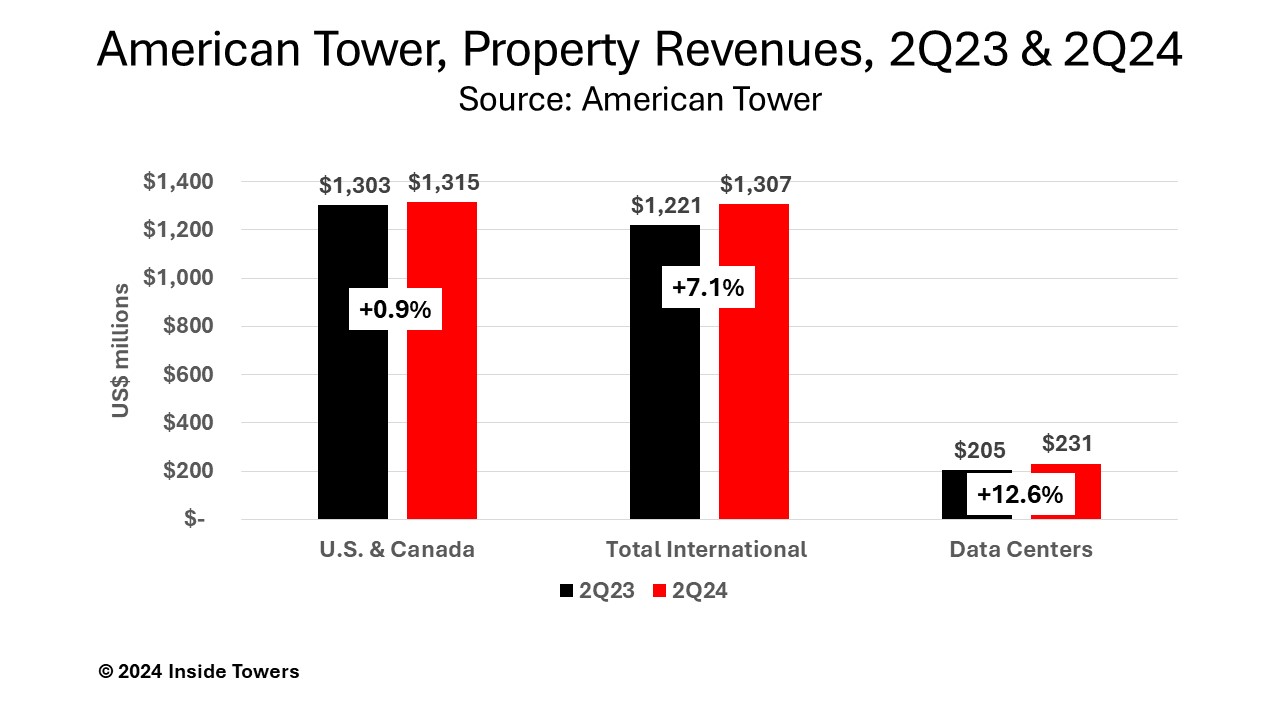

American Tower (NYSE: AMT) delivered better than expected results in 2Q24. The company reported total revenues of $2.9 billion, up nearly 5 percent from $2.77 billion in 2Q23. Total property revenue of $2.85 billion grew by the same percentage while Services revenue increased by 10 percent YoY to $47 million. Adjusted EBITDA was up by 8 percent YoY to $1.89 billion and AFFO came in at $1.3 billion, up nearly 14 percent YoY.

The U.S. & Canada segment is the company’s largest site leasing revenue source. The segment has property revenues of $1.32 billion, up just under 1 percent YoY, reflecting the company’s stable holistic master lease agreements with its largest tenants. At the end of the quarter, T-Mobile (NASDAQ: TMUS) accounted for 16 percent of property revenues, Verizon (NYSE: VZ) at 11 percent and AT&T (NYSE: T) contributed 13 percent. DISH (NASDAQ: SATS) was 1 percent and UScellular (NYSE: USM) less than half a percent. Data centers accounted for 8 percent of property revenues which grew almost 13 percent YoY to $231 million on the strength of CoreSite’s increased billings in the quarter.

American Tower is still the largest independent tower company in the world, according to Inside Towers Intelligence. At the end of 2Q24, the company reported a global total of 222,415 towers. That figure fell by 228 from 222,643 in 1Q24 which is the net result of 620 new builds and one acquisition offset by the sale or decommissioning of 849 towers. The reductions include Sprint sites in the U.S., parts of the Oi network consolidation in Brazil and tower decommissions related to the ATC India pending sale.

Property revenues were up 38 percent YoY in Asia Pacific, mainly in India. American Tower has realized the positive collection trends in India over the last several quarters, allowing it to reverse approximately $67 million of previously reserved revenue and clearing the majority of the outstanding accounts receivable from Vodafone Idea.

“Separately, we made further progress in accelerating certain payments included in the approximately $2.5 billion of potential total proceeds associated with our pending sale of ATC India,” commented Rod Smith, American Tower CFO during the company’s 2Q24 earnings call. “To date, total accelerated proceeds stand at approximately $345 million, inclusive of funds received in Q1, and we expect the remaining proceeds potentially of approximately $2.1 billion to be received at closing as we make progress towards closing, which we continue to target in the second half of 2024.”

Steve Vondran, American Tower CEO, voiced a positive outlook on the company’s primary U.S. & Canada segment where MNO tenants are still deploying 5G to support increasing mobile data demand and to extend their network reach. Vondran said this activity is driving new amendments to MLAs that will lead to organic property revenue growth on its towers, supported by increased Services revenues.

Importantly, Vondran pointed out that the company has shifted its discretionary capex allotments mainly to the developed markets. At the same time, American Tower is reducing its capex in emerging markets to focus on cost efficiencies and achieving better returns on what is already in place. Of the $1.4 billion 2024 discretionary capex, roughly 70 percent is allocated to developing markets, flipping the proportions from several years ago.

For full-year 2024, American Tower raised its midpoint guidance for property revenues to $11.19 billion, an increase of 1.5 percent YoY. It expects organic tenant billings growth in the U.S. & Canada segment of 4.7 percent, after adjusting for the impact of Sprint churn, and approximately 5 percent in international markets. The company also expects to achieve Adjusted EBITDA of $7.3 billion, up over 3 percent YoY and AFFO of $4.96 billion, a YoY increase of more than 7 percent.

By John Celentano, Inside Towers Business Editor

Reader Interactions