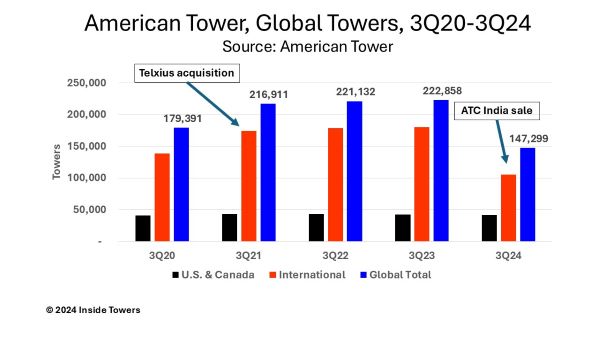

American Tower (NYSE: AMT) has slimmed down. In the aftermath of its ATC India sale that closed on September 12, as Inside Towers reported, the company reported 147,299 towers in its worldwide portfolio at the end of 3Q24, 75,559 fewer towers than in 3Q23. Total property revenue was $2.5 billion, down one percent on a year-over-year basis, a result of unfavorable foreign exchange rates and the lingering churn due to Sprint decommissions. Adjusted EBITDA of $1.7 billion was also down one percent YoY while AFFO of $1.2 billion was up 3 percent YoY.

U.S. & Canada segment tallied 41,298 towers or 28 percent of the total at the end of the quarter. The region, however, accounted for $1.3 billion or 54 percent of total property revenue for the quarter. International markets with 72 percent of towers led by Latin American and Europe in towers counts, contributed $918 million or 37 percent of total revenues while CoreSite data centers added $234 million to make up the 9 percent balance.

American Tower spent $433 million total cash capex for the quarter for activity that included 494 new tower builds mainly in Africa and Europe, 17 towers acquisitions, mainly in Europe and the sale or decommissioning of 341 towers, mainly in Africa and U.S. & Canada.

The company sees an upward trend in requests for new colocations on its towers superseding amendments. It attributes this growth activity to its major mobile network operator customers both in the U.S. and Europe, moving forward with 5G mid-band spectrum build outs and the growing need for network densification to meet mobile data demand. Much of this new colocation activity is reflected in its services revenue which came in at $52 million in 3Q24, double the 3Q23 figure.

In the aftermath of the ATC India deal, Steve Vondran, American Tower CEO, reiterated that lessons learned “have led us to refine our approach to investment underwriting and prioritize capital deployment to our developed markets,” namely Europe and its CoreSite data center business.

The company’s European operations have evolved through the acquisition of select portfolios across Germany, France and Spain. These countries have attractive growth prospects.

Vondran points out that American Tower has its largest portfolios in these countries, “where mobile data consumption is expected to grow at about a 20 percent CAGR over the next five years and where governments have advocated for nationwide coverage through various activities, including spectrum auctions and subsidy programs like the new deal in France, Spain’s 5G UNICO to support rural 5G development and the Gigabit Infrastructure Act at the broader EU level.” He adds, “Our disciplined approach to market entry and effective operational execution have yielded an attractive growth profile in Europe.”

On the data center side, Vondran explains that “ … since closing the CoreSite transaction at the end of 2021, we’ve achieved record-breaking leasing each year and are on pace again to deliver a new high mark in 2024. As we’ve highlighted on past calls, our portfolio is optimally positioned to benefit from accelerating demand for hybrid and multi-cloud IT architecture due to its ability to facilitate seamless, secure, nationwide low-latency interoperability, including native cloud access to a diverse set of customers.”

Based on performance in the quarter and growing demand potential, American Tower raised its midpoint guidance for full 2024 for total property revenue to $9.9 billion, up one percent compared to 2023, Adjusted EBITDA to $6.8 billion, a two percent YoY increase, and AFFO to $4.9 billion, up 7 percent over the 2023 level. The company expects to invest nearly $1.6 billion in 2024 capex in its tower and data center portfolios.

By John Celentano, Inside Towers Business Editor

Reader Interactions