American Tower (NYSE: AMT) is no longer the number one independent tower company in the world. Yesterday the company said that it closed the previously announced sale of 100 percent of the equity interests in ATC India, its operations in India, to Data Infrastructure Trust (DIT), an infrastructure investment trust sponsored by an affiliate of Brookfield Asset Management (NYSE: BAM).

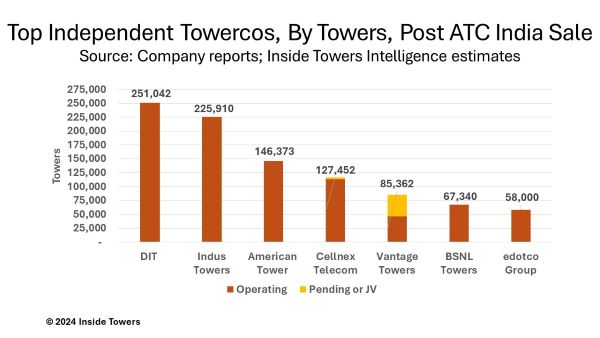

With this sale concluded, American Tower transfers to DIT the 76,042 towers that it owned in India as of June 30. DIT also owns Summit DigiTel, the second largest towerco in India with 175,000 towers. Combining the ATC India portfolio with Summit Digital moves DIT to the leading independent tower company in India, surpassing Indus Towers, which reported 225,910 towers at the end of June. In fact, the ATC India acquisition makes DIT the leading independent tower company in the world.

China Tower is the largest tower company in the world with 2,070,000 towers but is not counted among the other towercos because it is a state-owned organization. American Tower drops down to third position worldwide behind Indus Towers but has the largest global footprint of any towerco with operations in 20 countries outside of the U.S.

American Tower remains ahead of Barcelona, Spain-based Cellnex Telecom (OTC: CLNXF) which dominates the European tower business, followed by Vantage Towers, headquartered in Frankfurt, Germany, BSNL Towers, the third largest towerco in India, and Kuala Lampur, Malaysia-headquartered edotco Group, the largest towerco in Asia-Pacific.

Total cash proceeds to American Tower associated with the transaction are approximately $2.5 billion at today’s exchange rates. This sum includes roughly $320 million associated with the monetization of optionally converted debentures issued by Vodafone Idea, ATC India’s biggest MNO customer, and payments on ATC India receivables, net of withholding tax, and approximately $2.2 billion of final proceeds at closing. American Tower expects to use the proceeds to repay at closing the company’s existing indebtedness, including the repayment of the outstanding India term loan. The company is not expecting any more proceeds from this transaction.

American Tower’s current 2024 midpoint guidance, reported in the company’s Form 8-K on July 30, 2024, included full year contributions from the ATC India business. With the deal closed, company results associated with ATC India will now be reported as discontinued operations.

By John Celentano, Inside Towers Business Editor

Reader Interactions