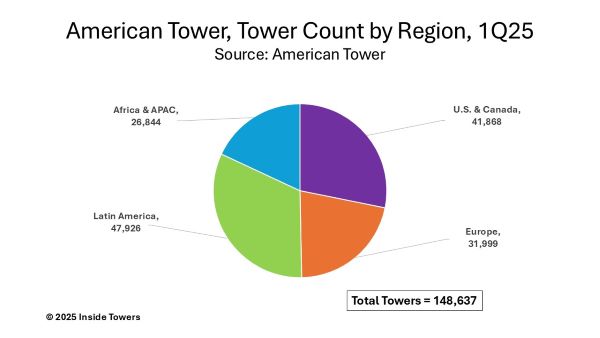

American Tower (NYSE: AMT) is the third largest independent tower company in the world behind Altius and Indus Towers, both based in India, according to Inside Towers Intelligence. At the end of 1Q25, American Tower reported its portfolio comprised 148,637 towers, up one percent year-over-year. During the quarter, the company built a total of 449 new towers, primarily in Africa and Europe, acquired 242 towers, mainly in North America, and sold or decommissioned another 151 sites.

In the quarter, total revenue increased two percent to $2.6 billion. Total property revenue increased by 0.2 percent to $2.5 billion. Net income declined 46 percent to $499 million, primarily due to foreign currency fluctuations. Adjusted EBITDA increased 1.9 percent to $1.7 billion. AFFO decreased 1.0 percent to $1.3 billion.

Steve Vondran, American Tower President and CEO, highlighted a strong start to 2025, with property revenue, adjusted EBITDA, and attributable AFFO per share exceeding initial expectations. He emphasized the resilience of mobile data demand and network investments, particularly in 5G equipment upgrades by U.S. carriers, which are expected to continue through 2026.

The company said that 1Q25 marked the fifth consecutive quarter of sequential increases in application volumes and services revenue, with the latter growing over 140 percent year-over-year. International markets, such as Nigeria and Brazil, also saw positive developments, driven by improved pricing dynamics and network upgrades.

CFO Rod Smith reported consolidated organic tenant billings growth of 4.7 percent, with 3.6 percent growth in the U.S. & Canada region (5.0 percent excluding Sprint churn) and 6.7 percent internationally. The U.S. services business recorded its highest revenue and gross profit since 2021, with applications rising nearly 30 percent quarter-to-quarter.

The CoreSite data center business achieved robust results, adding 11 MW of capacity through developments in its New York 3 and Chicago 2 sites. The data center operations showed strong leasing and pricing trends, reinforcing its position as a high-return segment with mid-teens stabilized yields.

The company reaffirmed 2025 guidance for organic tenant billings growth of approximately five percent, with U.S. & Canada growth of 4.0-4.5 percent (5.0-5.5 percent excluding Sprint churn). Growth in international markets is expected to reach six percent.

American Tower maintained its $1.5 billion discretionary 2025 capital allocation focus on developed markets, including $610 million for data center developments.

Management emphasized its strategy is designed to enhance efficiencies, optimize the portfolio mix, and seize growth opportunities across both developed and emerging markets. At the same time, they recognized potential risks associated with foreign exchange volatility, macroeconomic uncertainties, and specific customer events in certain emerging markets.

While emphasizing a cautious outlook for 2025, they reaffirmed their confidence that the sustained demand for mobile data will continue to drive activity on towers.

By John Celentano, Inside Towers Business Editor

Reader Interactions