AT&T (NYSE: T) portrayed its 1Q24 results as steady, albeit modest, growth in a highly competitive environment. According to John Stankey, AT&T CEO, the company’s key strategy of focusing on delivering 5G and fiber connectivity services is working.

For the quarter, the company reported that Mobility service revenues grew 3.3 percent year-over-year to $16 billion, while EBITDA increased seven percent YOY to $9 billion. Total Mobility retail postpaid and prepaid subscribers at the end of the quarter reached 106.7 million, up two percent YoY and postpaid net adds of 389,000 in 1Q24. Postpaid phones were 71.6 million with 349,000 added in the quarter.

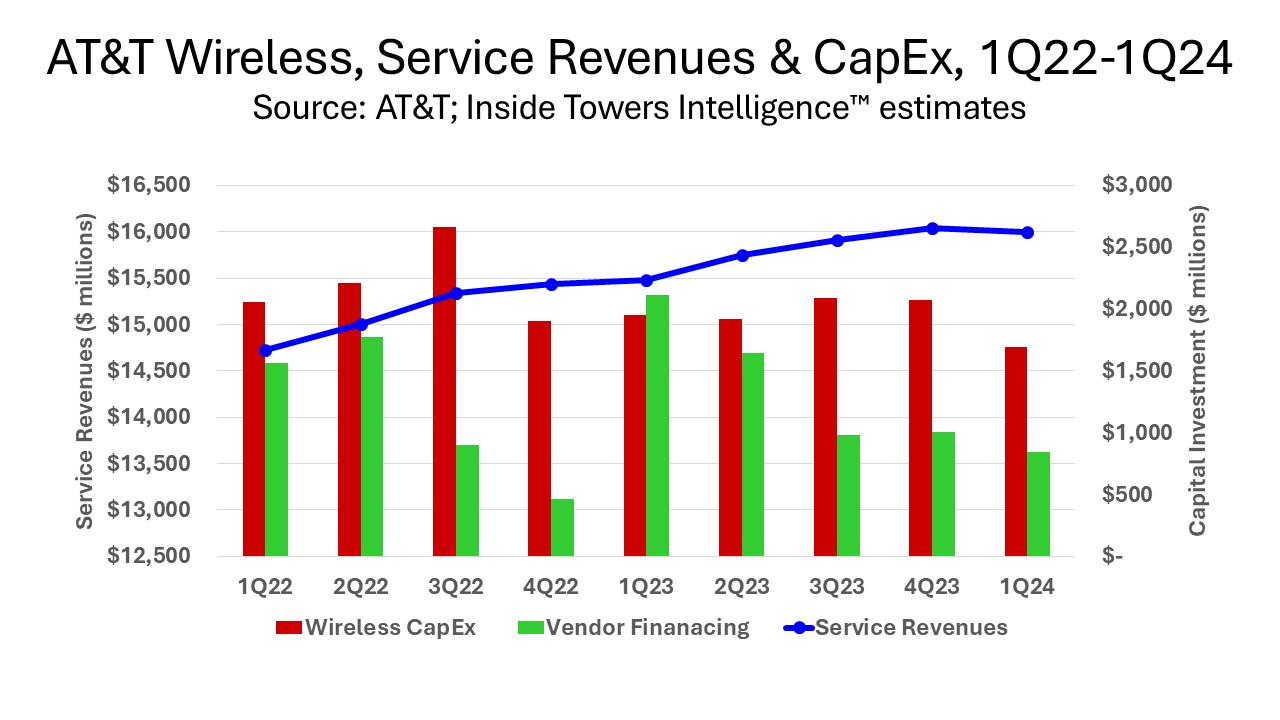

We estimate that AT&T’s wireless capital investment for the quarter totaled more than $2.5 billion including $1.7 billion in capex along with $841 million in vendor financing. The capex figure is down 13 percent YoY while vendor financing has dropped by more than 60 percent. The company expects to reduce its reliance on vendor financing under which it pays for equipment on favorable 120-day terms instead of from cash flows generated from operations.

AT&T says that a large portion of its C-band buildout is complete. Inside Towers previously reported that AT&T said it would deploy C-band/3.45 GHz dual-band radios in markets where it holds both licenses with one tower climb to save installation costs. As a consequence, AT&T expects its Mobility capex to be reduced for the full year, by 15-17 percent, according to Inside Towers Intelligence.

Fiber is AT&T’s big play and where the bulk of its capex is applied. In the quarter, the company reached 27.1 million consumer and business locations passed, up 10 percent YoY. Consumer passings account for 80 percent of the total. Its 9 million fiber connections, reached on the strength of 252,000 fiber net adds in the quarter, represent a 40 percent penetration of its addressable market.

Consumer broadband (fiber and non-fiber) revenues for 1Q24 were up eight percent to $2.7 billion. The company says it is on pace to achieve its more than 30 million locations passed by the end of 2025. With better-than- expected returns, AT&T may consider an additional 10-15 million passings either through strategic partnerships or with government subsidies.

AT&T Internet Air, the company’s fixed wireless access service, is managed under the Consumer Wireline operations, as a wireless alternative to fixed broadband. Internet Air subscribers grew to 203,000 with 110,000 net adds in the quarter alone.

Stankey made clear that AT&T is not following either Verizon (NYSE: VZ) or T-Mobile (NASDAQ: TMUS) with similar FWA strategies. He said that Internet Air is being offered nationwide either as an interim solution where legacy copper facilities are being upgraded to fiber over a longer term, or if the customer profile better fits the performance parameters of the service such as a small business with basic internet access needs versus a residence with high streaming demand.

The company reiterated its full-year 2024 guidance of wireless service revenue growth of three percent and broadband revenues to grow by seven percent. It expects overall EBITDA growth of three percent, aggregate capital investment of $21-22 billion compared to $24 billion in 2023, and free cash flow of $17-18 billion.

By John Celentano, Inside Towers Business Editor

Reader Interactions