AT&T (NYSE: T) turned in good operating results on the strength of its 5G and fiber network performance. In its 4Q23 earnings call, the company reported wireless service revenues of $63.1 billion for the year, up more than four percent from 2022. Wireless equipment revenues were up nearly five percent with customers opting for higher priced phones. Total postpaid and prepaid subscribers grew two percent year-over-year to 106.3 million.

The company says that its 5G network now covers 250 million people. However, the 2.4 million postpaid and prepaid net adds for the year were down from the 4.6 million net adds in 2022, reflecting caution among customers about switching carriers as living costs increased.

The company says its fiber network buildout is progressing as planned and reached 26 million passings at the end of 2023. AT&T says it is still on track to meet its goal of 30 million passings by 2025. During the company’s 4Q23 earnings, CEO John Stankey raised the possibility that the company might raise that goal by 10-15 million passings as long as it continues to realize better-than-expected returns on its fiber investment.

Total fiber connections at year-end were 8.3 million with 1.1 million fiber net adds for the year, making 2023 the sixth consecutive year that AT&T has added more than one million annual fiber connections. The company said its Internet Air fixed wireless access service is available in 35 locations and had 95,000 connections at the end of the year, adding 65,000 in the quarter alone.

The company still holds the position that it will offer Internet Air in a more opportunistic manner rather than a strategic initiative like T-Mobile (NASDAQ: TMUS) and Verizon (NYSE: VZ). AT&T intends to make Internet Air available in areas in advance of fiber deployments or in locations where fiber is not feasible.

Consumer wireline revenue rose three percent YoY to $13.2 billion. Gains in broadband connections offset declines in legacy voice and data. On the other hand, Business Wireline operating revenue fell seven percent YoY to $20.2 billion as demand continued to slow for legacy voice and data services. Business Wireless operating revenues, however, grew two percent YoY to $12.6 billion.

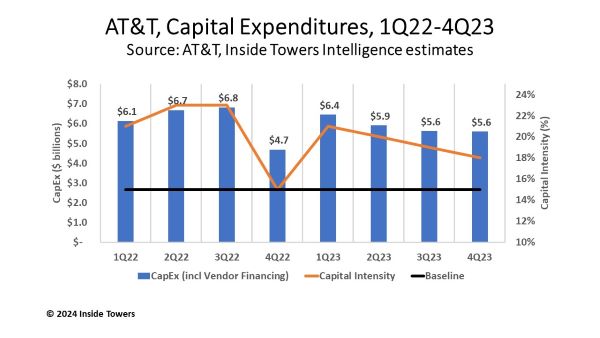

Total capital expenditure for 2023 came in at $17.9 billion, down nine percent from $19.6 billion in 2022. AT&T allocates 45-50 percent of its total capex to its wireless network, according to Inside Towers Intelligence. In turn, it relies heavily on vendor financing from its big equipment suppliers like Ericsson (NASDAQ: ERIC) to supplement its capex instead of funding capex solely from free cash flow. Vendor financing in 2023 reached $5.7 billion, up 22 percent from $4.7 billion in 2022.

The company expects total 2024 capex to be in the $21-22 billion range, a nine percent YoY decline and capital intensity to drop as well. Capital intensity is the ratio of capex to revenues. From a baseline of 15 percent, a metric used by Inside Towers Intelligence, any figure above 15 percent suggests network expansion. Any number below the baseline means the operator is in a slow build or maintenance mode.

AT&T says its capital intensity will decline from the low 20s to high teens levels at which it has been running for the past two years to the mid-teens level in 2024, as capex is reduced and revenues continue growing.

For 2024, the company expects wireless service revenue growth in the three percent range, broadband revenue growth of seven percent or more, adjusted EBITDA growth in the three percent range, and free cash flow in the $17-18 billion range.

The company’s 2024 earnings outlook includes a 7-cent-a-share charge linked to the write-down of telecom equipment purchased from Nokia as it transitions to Open RAN technology from Ericsson, Inside Towers reported.

By John Celentano, Inside Towers Business Editor

Reader Interactions