Like the other big telecom companies, AT&T (NYSE: T) is betting its future on being able to offer its customers what it calls “converged services.” Basically, where it already has or is building out fiber infrastructure and has customers using that fiber for broadband connections, the company is pitching its wireless services as part of a communications package for consumers and businesses alike.

And it is making some progress. At the end of 3Q24, AT&T reported 9 million total Fiber subscribers, up 12 percent year-over-year. Within that total, 3.6 million or roughly 40 percent of Fiber subscribers are also AT&T Mobility subscribers. The company is investing in its fiber infrastructure in its 21-state operating area. The Wireline segment reached 28.3 million total fiber locations-passed, a 9 percent YoY increase with 40 percent of those locations connected to the fiber backbone.

AT&T is making a push to extend fiber outside of its operating area. As John Stankey, AT&T CEO stated during the 3Q24 earnings call, “ … we’ve announced plans to bring AT&T Fiber high speed Internet to even more people in new geographies through Gigapower, our joint venture with BlackRock [NYSE: BLK], as well as through recent agreements with commercial open access fiber providers.”

The company counts AT&T Internet Air, its fixed wireless access service, as part of its broadband offering. However, Stankey made clear that it will offer its FWA service only on a strategic basis, either where its fiber infrastructure cannot reach, or as a placeholder until the fiber is built out. Stankey says AT&T does not intend to deploy Internet Air in the same way T-Mobile (NASDAQ: TMUS) or Verizon (NYSE: VZ) are promoting their respective FWA services.

The AT&T Communications segment accounted for 96 percent of total operating revenues in 3Q24. Within Communications, Mobility is still the company’s big revenue generator, accounting for $21 billion or 70 percent of the total, and $9.5 billion or 82 percent of Adjusted EBITDA. Mobility service revenues for the quarter were $16.5 billion, up 4 percent YoY. Retail postpaid and prepaid subscribers grew 3 percent YoY to 107.6 million on the strength of 429,000 postpaid net adds and 403,000 postpaid phone net adds in the quarter.

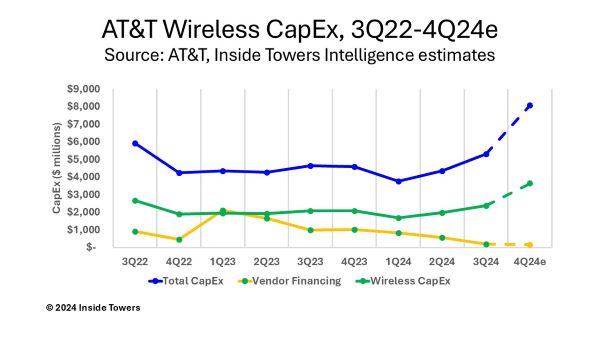

AT&T acknowledges its planned convergence growth will require continued network investment. “Capital expenditures [for 3Q24] were $5.3 billion, up approximately $650 million compared to the prior year. We expect higher capital investment in the fourth quarter as we ramp our wireless network modernization,” commented Pascal Desroches, AT&T CFO. That network modernization includes displacing Nokia (NYSE: NOK) radios with Ericsson (NASDAQ: ERIC) Open RAN units, Inside Towers reported.

“We also expect to sustain strong cash conversion in the fourth quarter and anticipate using our improved liquidity to continue reducing our short-term financing, including further paydown of vendor financing in the fourth quarter,” Desroches added. “These additional vendor financing payments put us on page for a full year capital investment at the high end of our guidance range of $21 billion to $22 billion. Our free cash flow is tracking to the midpoint of our guidance range of $17 billion to $18 billion.”

Wireless capex was up 22 percent sequentially in the quarter to $2.4 billion. Of the total capex for 2024, Inside Towers Intelligence estimates that wireless capex will account for almost $10 billion, with nearly 40 percent of the full-year budget to be spent in 4Q24. Expect AT&T to offer more insights into its 2025 spending plans at its Analyst and Investor Day conference in December and when it releases its 4Q24 results in January.

By John Celentano, Inside Towers Business Editor

Reader Interactions