BCE Inc. (NYSE: BCE), Canada’s largest communications company by total combined wireless and wireline customer connections, according to Inside Towers Intelligence, and the Public Sector Pension Investment Board (PSP Investments), based in Ottawa, Ontario and one of Canada’s largest pension investors, announced the creation of Network FiberCo. This partnership aims to accelerate the development of fiber infrastructure through Ziply Fiber in underserved markets in the United States. BCE announced its $3.65 billion acquisition of Ziply Fiber in November, Inside Towers reported.

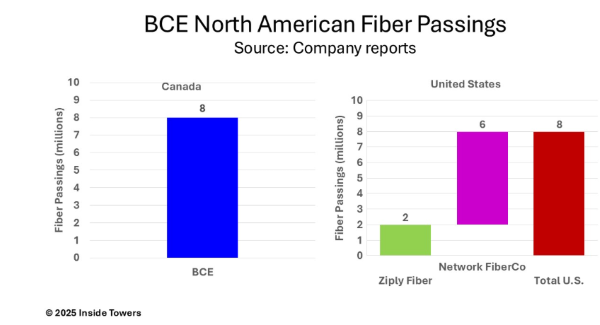

Network FiberCo will focus on last-mile fiber deployment outside of Ziply Fiber’s incumbent service areas in the Pacific Northwest. Network FiberCo plans to develop approximately one million fiber passings in addition to Ziply Fiber’s two million in existing states: Washington, Oregon, Idaho, and Montana. It will also target the development of up to five million additional passings to potentially reach up to eight million total U.S. fiber passings. BCE says that the Ziply Fiber acquisition and long-term partnership with PSP Investments will create a North American fiber broadband operator with potential for 16 million combined fiber passings. PSP Investments has agreed to a potential commitment exceeding $1.5 billion.

BCE will own 49 percent of Network FiberCo through Ziply Fiber, while PSP Investments will hold 51 percent via its High Inflation Correlated Infrastructure Portfolio, pending BCE’s Ziply Fiber acquisition. Network FiberCo will rely mainly on non-recourse debt financing for capital. BCE and PSP Investments will share the equity funding needed for fiber expansion.

BCE’s proposed acquisition of Ziply Fiber marks a strategic entry into the U.S. broadband market. The telecom company claims its operational skills paired with PSP Investments’ infrastructure expertise will help Network FiberCo achieve significant growth and meet fiber deployment goals for Ziply Fiber.

BCE points out that the U.S. fiber broadband market offers substantial growth potential due to lower penetration rates compared to Canada and cost-effective construction enabling large scale deployments. Network FiberCo aims to expand organically and through acquisitions, maximizing returns via its capital-efficient structure.

Once the acquisition of Ziply Fiber is finalized, BCE will take full ownership of Ziply Fiber’s operations. As a subsidiary of BCE, Ziply Fiber will continue managing its current network and implementing its fiber-to-the-home build strategy within its footprint. Ziply Fiber will collaborate with Network FiberCo as the sole internet service provider for locations serviced by Network FiberCo.

“Today’s announcement represents a pivotal step in BCE’s fiber growth strategy. By bringing PSP Investments’ financial resources and acumen to Ziply Fiber, we are creating a scalable, capital-efficient platform to fund U.S. fiber footprint expansion,” comments Mirko Bibic, President and CEO, BCE and Bell Canada.

The transaction is expected to close in the second half of 2025, subject to customary closing conditions and the closing of BCE’s acquisition of Ziply Fiber.

By John Celentano, Inside Towers Business Editor

Reader Interactions