MasTec (NYSE: MTZ), based in Coral Gables, FL, is a large engineering and contracting company. The company reported nearly $10 billion in revenues for full-year 2022, and had 32,000 employees working from roughly 800 locations throughout North America. Its primary activities include engineering, construction, installation, maintenance and upgrade of communications, energy, utility, and other infrastructure.

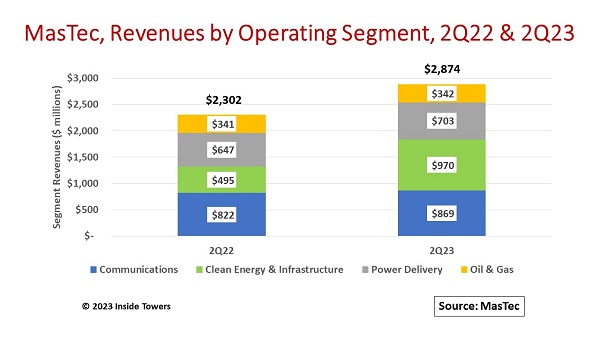

MasTec’s Communications segment has contracts with mobile network operators and wireline communications service providers. Projects involve 5G macrocell and small cell deployments, fiber-to-the-home and rural broadband along with smart city and private network installations. Communications accounted for $822 million or 36 percent of MasTec’s total business in 2Q22, but grew just six percent to $869 million in 2Q23, accounting for 30 percent of revenues.

The company serves a diversified base of customers through five operating segments: Communications, Clean Energy and Infrastructure, Power Delivery, Oil and Gas, and Other. MasTec says its labor-based construction services are focused on a variety of end users in these segments. A significant portion of its services are provided under multi-year master service agreements and other service contracts with major customers, and the balance coming from contracted work for specific infrastructure projects or jobs.

Despite the slowdown in Communications that is affecting many other large and small contracting companies, MasTec has the size and scale to diversify its Communications work into other segments.

Its Clean Energy and Infrastructure (CE&I) segment is its fastest growing segment, primarily performing installation and construction of power generation facilities such as wind, solar, biomass, natural gas, hydrogen, and battery storage for renewable energy. CE&I produced revenues of $970 million in 2Q23, up 96 percent on a year-over-year basis and accounting for 34 percent of total revenues for the quarter, up from 22 percent of the year ago total.

Power Delivery segment primarily serves the energy and utility industries through the engineering, construction and maintenance of power transmission and distribution infrastructure, including electrical and gas transmission lines, distribution network systems and substations; and environmental planning and compliance services including Electric Vehicle Grid Impact.

MasTec performs engineering, construction and maintenance services for natural gas and water pipelines in the energy and utilities industries through its Oil and Gas segment. The PD and O&G segments together contributed over $1 billion in 2Q23, accounting for 36 percent of the total but only growing at single-digit rates YoY.

The company still believes that there will be significant fiber network expansion resulting from the combination of telco spending and government programs that are expected to stimulate greater private investment in telecom infrastructure.

Nonetheless, in its 2Q23 earnings presentation on Friday, MasTec cut its full-year midpoint guidance for revenues to $12.9 billion from $13.1 billion and Adjusted EBITDA to $1.08 billion from $1.13 billion. Its stock promptly nosedived by nearly 18 percent.

“While margins improved as expected, we did begin to see tighter management of capex by a number of customers,” commented MasTec CEO José Mas on the company’s earnings conference call. He added that he expected revenue for the rest of the year will likely be light in the Infrastructure and Energy Alternatives unit, which MasTec bought last year for more than $700 million.

Mas also acknowledged that a number of customers are delaying projects as they sort through the implications of the Inflation Reduction Act, with executives trying to understand the rules of the law and delaying project starts until they have clarity.

By John Celentano, Inside Towers Business Editor

Reader Interactions