American Tower Corporation (NYSE: AMT) yesterday reported financial results for the quarter ended June 30, 2017.

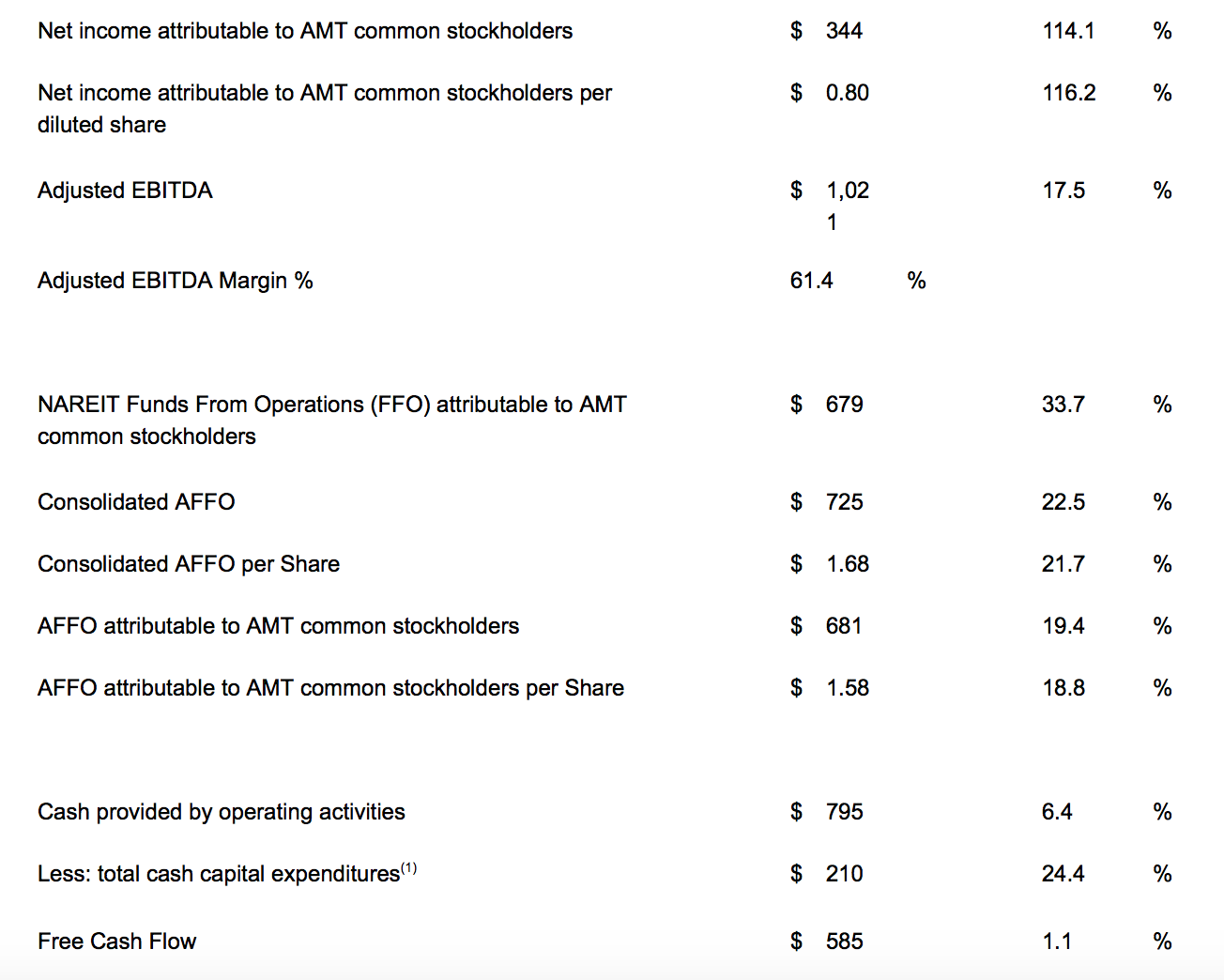

Jim Taiclet, American Tower’s Chief Executive Officer stated, “The second quarter of 2017 represented our 17th consecutive quarter of double-digit growth in property revenue, Adjusted EBITDA and Consolidated AFFO per Share, driven by strong demand for our tower real estate from Los Angeles to São Paolo to Paris. Organic Tenant Billings Growth in the U.S. of over 6% was complemented by Organic Tenant Billings Growth of more than 10% in our international markets, where the pace of advanced handset adoption and mobile data usage growth continues to require the addition of substantial network equipment on our sites.

“As we seek to continue to capitalize on the worldwide competitive advantage we have built over the last 20 years, we remain committed to our core principles, our employees and the investment discipline that has enabled us to build a distinctive global portfolio. As a result of the ever-increasing consumer appetite for mobile broadband and our strategic positioning in key markets spanning five continents, we believe that we are on track to sustain strong growth in Consolidated AFFO per Share and our dividend for many years to come.”

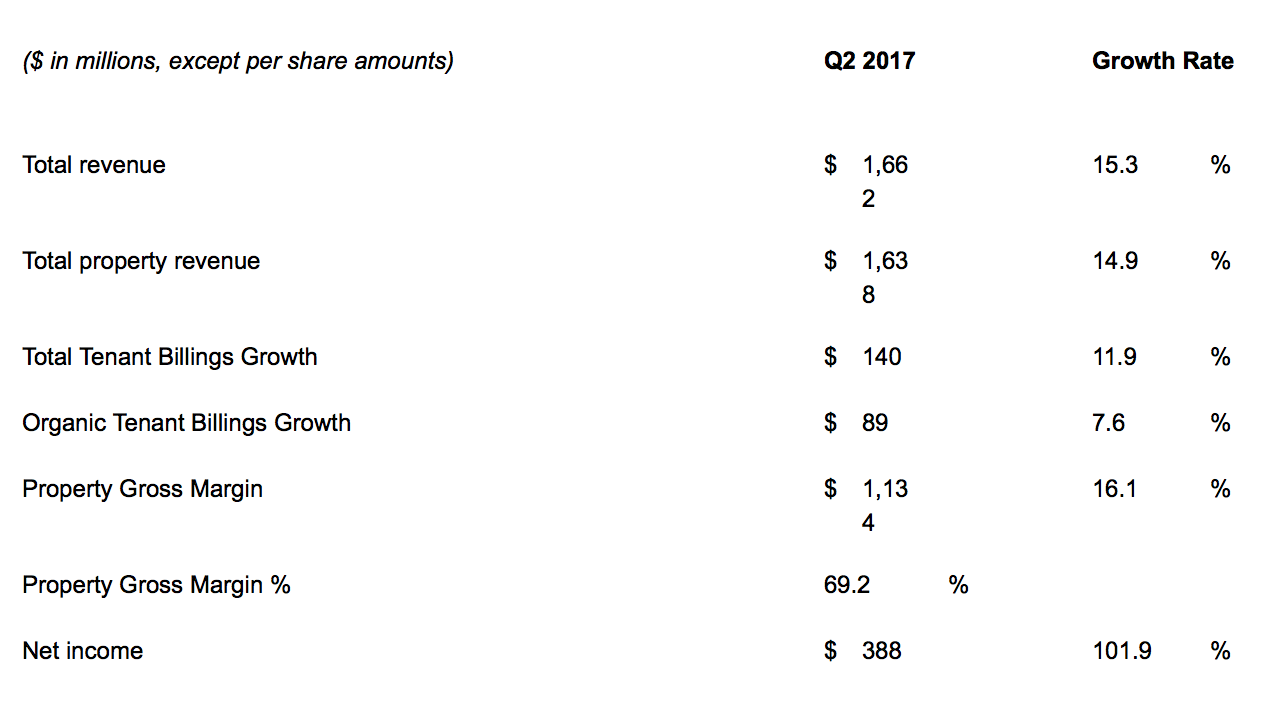

CONSOLIDATED OPERATING RESULTS OVERVIEW

American Tower generated the following operating results for the quarter ended June 30, 2017 (all comparative information is presented against the quarter ended June 30, 2016).

AMT is bucking dire predictions for the tower industry — prophecies like: “AT&T was never coming back to the market; Sprint was going to migrate to government land; small cells were going to replace macrosites, or at least suck up all the capex; AT&T would have ‘relocation’ towers built adjacent to existing sites; and so on,” wrote MoffettNathanson Analyst Nick Del Deo in a client report.

During the second quarter of 2017, the company spent $79 million to acquire 152 sites, including 54 towers in Brazil part of the final tranche of its previously announced transaction with a subsidiary of TIM Participações S.A., bringing the final number of towers acquired under that deal to 5,873, for a total of $842 million. AMT has agreements to acquire up to 1,200 sites in Colombia, up to 1,400 sites in Paraguay and up to 100 additional sites in Mexico.

AMT’s tower acquisitions in emerging markets should help its top line going forward, according to Zacks Equity Research. “Higher adoption of smartphones/tablets, increased deployment of 3G/4G networks, significant margin improvement and dividend hikes also bode well.”

View the full report here.

July 28, 2017

Reader Interactions