BCE, Inc. (NYSE: BCE), formerly Bell Canada Enterprises, is Canada’s largest telecommunications company with wireless, wireline and media business units. In its 3Q21 earnings call, BCE showed operating and financial metrics returning to pre-pandemic levels.

“Operationally, our objective was to improve steadily each quarter from the trough experienced in Q2 of 2020, when COVID began to significantly affect our business, and that’s exactly what we’ve done,” says Mirko Bibic, BCE President & CEO.

He noted that 3Q21 was a milestone in BCE’s recovery as total revenue and adjusted EBITDA rebounded to pre-pandemic 3Q19 levels despite COVID-related headwinds still affecting wireless roaming, business wireline customer spending and media advertising.

Bell Wireless, operating as Bell Mobility, reported 3Q21 service revenues of $3.8 billion, an increase of nearly 3 percent over $3.7 billion in the same period in 2020 while Adjusted EBITDA reached $2.3 billion, a 5 percent YoY gain.

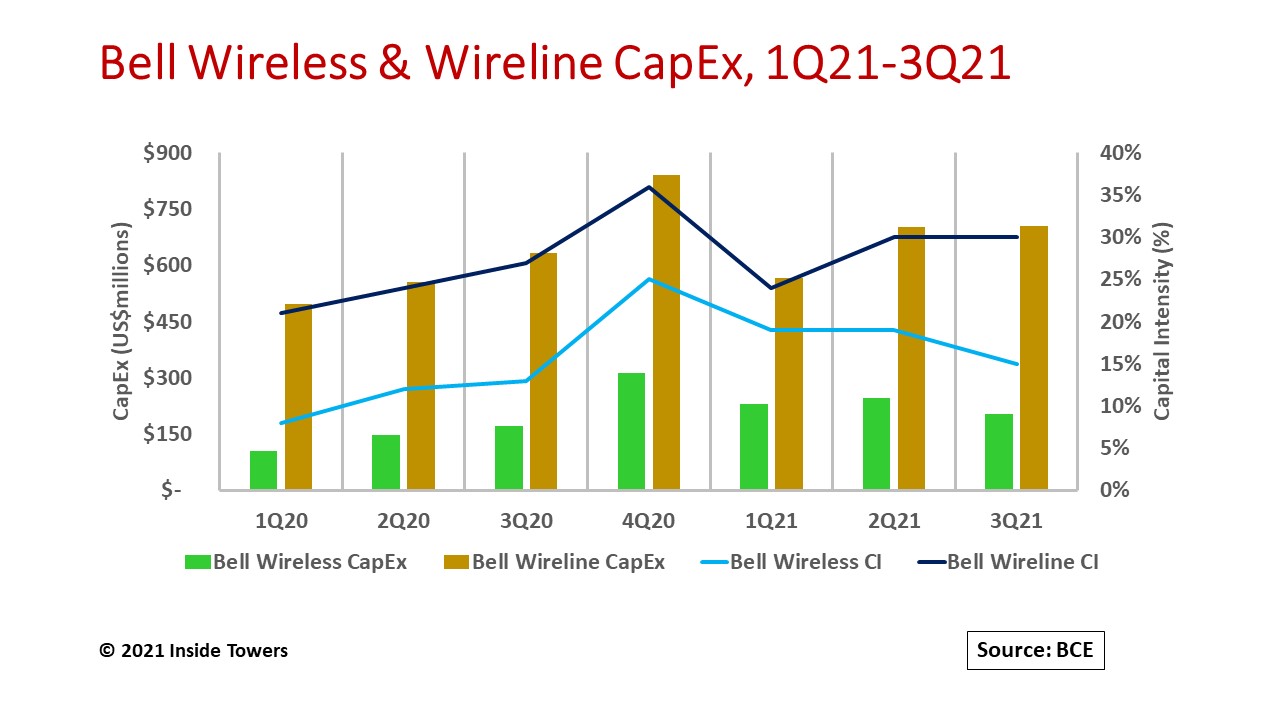

Wireless capital expenditures through nine months of 2021 were $677 million, a 62 percent jump from $419 million over the same period in 2020. Capital intensity (capex/service revenues) rose to 18 percent from 11 percent, respectively. Note that capital intensity above 15 percent indicates network expansion while figures below 15 percent suggest more of a maintenance mode.

As pandemic restrictions eased throughout 2021, Bell resumed its two-year accelerated broadband network plan that it announced in February. (See, Bell Canada Steps Up Its Network Builds)

The company made substantial progress with its 5G coverage in major centers across Canada, leveraging its existing 4G LTE and Advanced LTE networks that it shares with TELUS in western Canada. (See, Wireless Network Sharing, Canadian style) Bell Wireless ended 3Q21 with almost 9.4 million postpaid and prepaid subscribers, a 3 percent gain over the 9.1 million subscribers at the end of 3Q20.

Bell Mobility was the second biggest winner behind Rogers Communications in Canada’s recent 3.5 GHz spectrum auction, as Inside Towers reported. It spent nearly $1.7 billion for a total of 271 licenses, along with 490 licenses to transition from incumbent users, covering 90 percent of Canada’s population in urban and rural markets.

Bell Wireless’ 5G currently is operating in non-standalone mode utilizing dynamic spectrum sharing and the 4G core. With 3.5 GHz spectrum, the company expects to launch a 5G standalone network, what it calls, “true 5G,” commencing in 2022.

The company has a strategic agreement with Amazon Web Services (AWS) to accelerate 5G innovation and cloud adoption and is working with VMware Cloud and AWS to support enterprise business and government organizations in managing their hybrid cloud strategies.

At its roots, BCE is a telephone company. The debate still rages over where the telephone actually was invented, in Canada or the U.S. Alexander Graham Bell was living in Canada when he created the device to transmit and receive voice signals but he filed for a patent in the U.S. The Bell Telephone Company of Canada (later renamed Bell Canada) got its start around the same time as its U.S. counterparts.

Bell Wireline operates around 10 million connections in its eastern Canada home markets and accounts for roughly 56 percent of BCE’s total service revenues.

Through nine months ending September 30, Bell Wireline reported service revenues of $7.0 billion, flat on a YoY basis. Data revenues, mainly high-speed internet connections, accounted for two-thirds of the total, and grew 3 percent YoY while voice revenues declined 8 percent in the same period.

Responding to post-pandemic demand for internet connectivity, Bell Wireline is rapidly extending broadband to its residential and business customers through a combination of fiber-to-the-home and fixed wireless access, also called wireless home internet. Retail high-speed internet subscribers were 3.8 million at the end of 3Q21, up 4 percent from 3.7 million in 3Q20. Residential voice subscribers declined 8 percent YoY to 2.3 million.

The company increased its wireline network investment by 17 percent on a YoY basis to nearly $2.0 billion through the end of 3Q21 reaching a capital intensity of 28 percent. That compares to $1.7 billion in capex and a 24 percent capital intensity in the same nine-month period in 2020.

“Even as we focus on recovering from those [pandemic] impacts, we pushed ahead with our capex acceleration plan, building the best broadband infrastructure and remaining comfortably on track to hit our upside network expansion targets for 2021,” Bibic added.

BCE did not provide guidance for full-year capex, instead indicating its overall capital intensity for wireless and wireline operations will be in the 18-20 percent range. Expect a 4Q21 capex spike.

By John Celentano, Inside Towers Business Editor

Reader Interactions