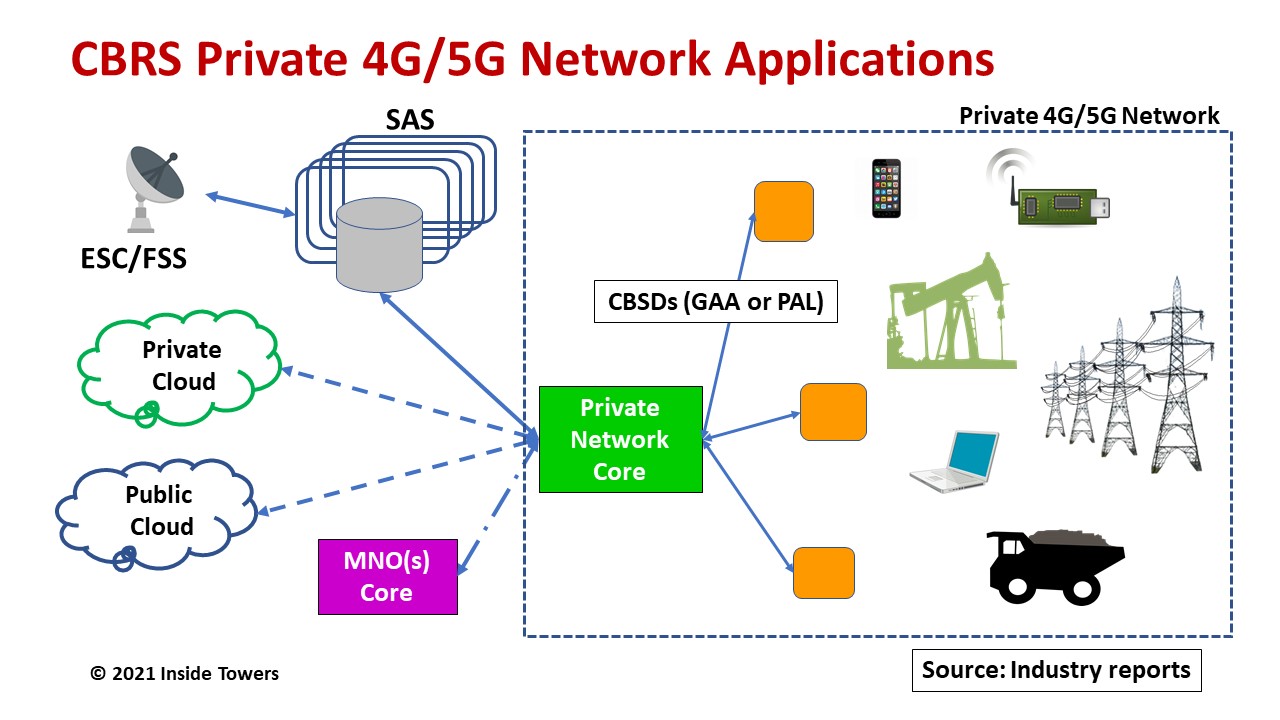

New 3.5 GHz Citizens Broadband Radio Service (CBRS) spectrum enables enterprise and industrial organizations to establish private networks using 4G/5G public cellular technology.

A true private 4G/5G network is 3GPP standards-based with high performance and security, and is distinguished by three key elements:

- Dedicated spectrum, either owned or leased,

- Dedicated infrastructure – RAN and Core with backhaul connections to private/public clouds, public mobile network operators and links to the Spectrum Access System (SAS) administrators – either owned or leased,

- Dedicated Access Point Name (APN) or network ID, and Subscriber Identity Modules (SIMs) supplied and programmed to support a variety of fixed and mobile devices.

MNOs provide their largest commercial customers with virtual private network configurations by partitioning portions of their proprietary infrastructure and spectrum for that exclusive use. 5G network slicing will help MNOs offer tailored services for specific business applications.

In shared public network configurations, however, MNOs still control spectrum, network infrastructure, APNs, SIM cards and user functions, device access and data security, and traffic prioritization. Conversely, public networks often cannot meet special requirements for coverage, capacity, reliability, security, low latency, or low power devices.

Prospective private network operators can buy 3GPP-compliant RAN and Core equipment from major telecom OEMs or numerous smaller, specialized equipment manufacturers. Many industrial-grade devices are available in bands suitable for private LTE. The 5G device ecosystem is growing rapidly and soon will surpass the 4G ecosystem. These devices support dual universal SIM/embedded SIM options for seamless device movement between private and public networks.

The Need for Speed (Spectrum)

The private network challenge is accessing enough spectrum for what and where the operator needs it. In mining, oil and gas, and utilities, companies can lease MNO spectrum, acquire licensed Upper 700 MHz A Block, or use new frequencies such as Anterix’ 900 MHz, 3.5 GHz CBRS, or 5.8 GHz. Spectrum auctions are an option. In FCC Auction 73, oil and gas producer Chevron bought 700 MHz licenses for its private LTE network in the Gulf of Mexico.

Sub-1 GHz frequencies offer superior propagation characteristics, especially in remote areas and are cost-effective to deploy, though data throughput is limited. By contrast, mid-band CBRS spectrum delivers higher throughput.

Industries will benefit from greater spectrum access. At the 2021 ENTELEC conference, consultant Louis Lambert showed how new spectrum and equipment availability enable “the digital transformation opportunity for the energy sector, and other industrial verticals along with access to data analytics, edge compute, and Industry 4.0.”

CBRS Auction Catalyst

FCC Auction 105 opened 150 MHz of 3550-3700 MHz CBRS spectrum in three user access tiers: Incumbents, Priority Access Licenses (PALs) and General Authorized Access (GAA).

Incumbent Access includes U.S. Navy radar stations and authorized federal users in the 3550-3700 MHz band, Fixed Satellite Service (FSS) earth stations in the 3600-3650 MHz band, and Part 90 grandfathered wireless broadband licensees (GWBL) in the 3650-3700 MHz band. Grandfathered Wireless Protection Zones (GWPZs) are geographic areas and frequencies in which Part 90 GWBLs are protected from GAA transmission. FSS exclusion zones extend over a 150 km radius and include a GWPZ or GWBL. In these exclusion zones, CBRS fixed radio devices (CBSDs) are prohibited from operating in the 3650-3700 MHz range.

Five FCC-selected SAS administrators – Amdocs, CommScope, Federated Wireless, Google, and Sony – ensure Incumbents and PALs are protected from GAA interference. SASs also monitor environmental sensing capability (ESC) systems that automatically detect and protect radar use.

Auction 105 offered seven out of ten 10 MHz PALs of 100 MHz in 3550-3650 MHz in each of 3,233 U.S. counties. Bidders could buy up to four PALs per county, ensuring spectrum availability for high caliber 4G or 5G performance in those areas.

GAA Opportunities

The GAA tier is licensed-by-rule to permit open, flexible access within the 3550-3700 MHz band to the widest group of potential users. However, GAA users must not interfere with Incumbents or PALs and must accept interference from these users.

SASs protect county-wide PALs from GAA interference only when active CBSDs are deployed in a county. Otherwise, GAA users can request access to any unused PAL spectrum.

In Auction 105, oil and gas producers Chevron, Oxy USA and EOG Resources, and 12 utilities led by Southern California Edison, San Diego Gas & Electric, and Alabama Power collectively spent nearly $181 million for 436 PALs in 185 counties. By comparison, GAA grants involving 10 MHz or 20 MHz blocks cost several hundred dollars a year per sector and can operate where they do not interfere with Incumbent or PAL usage.

The GAA outlook is positive, as CommScope explained in a recent blog.

When GWBLs expire, the associated GWPZs will also be retired, freeing 50 MHz of the 3650-3700 MHz band for GAA use. Roughly 700 GWPZs remain under SAS protection until all GWBLs expire by January 2023.

C-band spectrum clearing is prompting FSSs to vacate CBRS frequencies or discontinue operations altogether, making available another 100 MHz in the non-PAL 3600-3700 MHz portion of the band. About 300 FSSs remain protected but by the end of 2021, over 250 will relocate to another band leaving that spectrum available for GAA use.

By John Celentano, Inside Towers Business Editor

Reader Interactions