Colony Capital (NYSE: CLNY) is transforming itself into a full digital infrastructure company from its REIT fee-based property management and equity investment legacy.

CLNY manages a nearly $47 billion portfolio of real assets on behalf of its shareholders and limited partners. Of that total, over $23 billion or 55 percent currently is in digital real estate investments through Digital Colony, CLNY’s digital infrastructure platform. By 2023, the company expects that digital infrastructure will represent 100 percent of its assets under management.

The company is transforming itself to capture a sizable share of the escalating demand for mobile data and IoT connectivity worldwide. To serve that demand, global mobile network operators are expected to invest an estimated aggregate of $1 trillion in their network infrastructure between 2020 and 2025. Roughly 80 percent of that capex is allocated to 5G network builds. Continue Reading

There is already a trend among MNOs to outsource parts of their networks to infrastructure companies. (see, Do Wireless Carriers Need to Own Their Own Networks?). CLNY represents the prototype of a multiservice infrastructure company on which MNOs increasingly will rely for fast, efficient and cost-effective network build outs going forward.

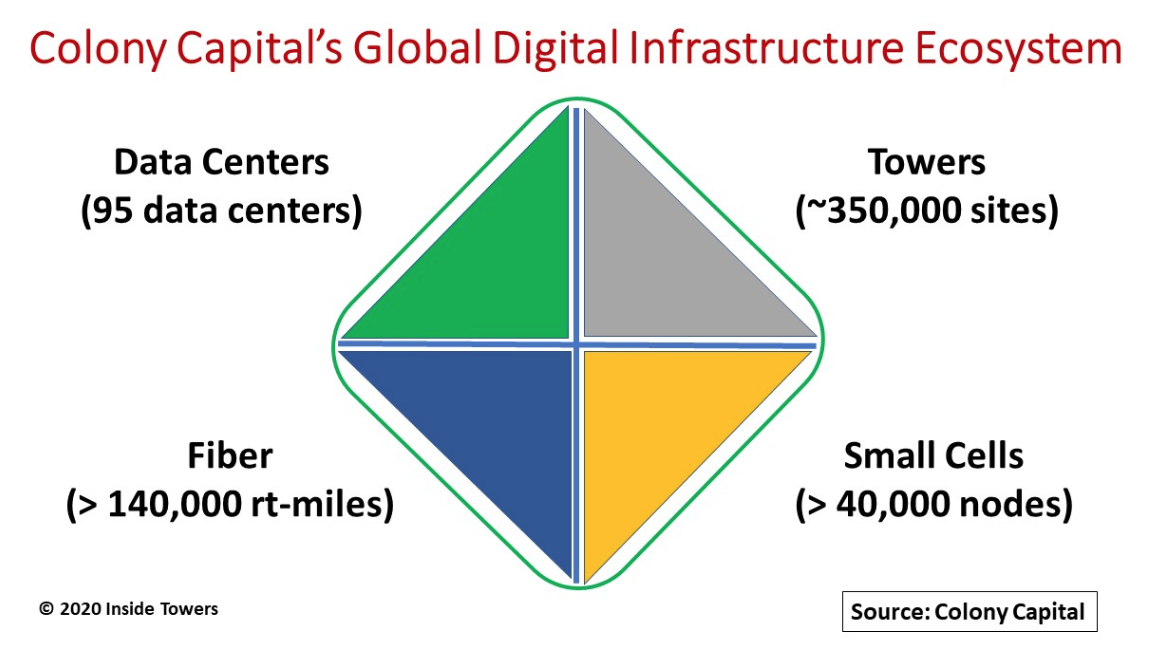

To hit its 100 percent of AUM goal, CLNY is systematically divesting its non-digital assets while amassing an array of towers, small cells, fiber and data centers that form the digital infrastructure ecosystem platform underlying converged wireless communications.

Digital Colony holds interest in 15 portfolio companies that make up its digital infrastructure ecosystem in North America, South America, and Western Europe. Throughout 2020, these portfolio companies closed significant deals to bolster Digital Colony’s infrastructure assets.

Towers are Digital Colony’s mainstay with Vertical Bridge as its flagship. Vertical Bridge acquired Eco-Site in November to become the largest private tower company in the U.S. Vertical Bridge’s inventory now consists of over 20,000 owned and master-leased towers, and a total of 290,000 total sites comprising towers, rooftops, broadcast towers, billboards and utility attachments. Also, in November, Highline bought 2,500 towers from Phoenix Tower International in Brazil. Along with MTP in Mexico, ATP in Peru, Chile, and Columbia, and Digita in Finland, Digital Colony now operates and manages over 350,000 sites.

In September, Digital Colony’s DataBank acquired 44 zColo data centers from Zayo, another portfolio company. With this deal, DataBank emerges as a leading U.S. edge co-location operator for hyperscale, technology and content customers. In October, DataBank made a strategic investment in EdgePresence that provides mobile edge computing at towers sites. EdgePresence already has installed MEC systems at 12 Vertical Bridge tower sites.

In another November deal, Vantage Data Centers acquired Hypertec’s hyperscale data centers in Canada. This transaction follows a July deal in which Vantage acquired UK-based Next Generation Data, Europe’s largest data center campus. These deals bring Digital Colony’s global co-location data center holdings to 95 sites in the U.S., Canada, Europe and Brazil, including those operated by Aptum, Vantage Europe, and Scala. Another dozen hyperscale data center campuses are under development.

The company sees fiber as the key to enabling high-speed, low latency digital connectivity. Zayo is a leading fiber cable network provider with over 136,000 route-miles across the U.S., Canada, and Western Europe. Along with Beanfield Metroconnect in Canada, Digital Colony’s fiber infrastructure spans more than 140,000 route-miles connecting nearly 40,000 on-net buildings.

Digital Colony companies are active in small cells. ExteNet Systems is a leading provider of converged wireless and fiber infrastructure in the U.S. Together with FreshWave in the UK, the two companies operate over 40,000 small cell and distributed antenna systems in outdoor and in-building applications.

Since the end of 2019, CLNY has grown its digital AUM by $12 billion through a combination of strategic acquisitions and divestments. In that time, CLNY’s digital AUM proportion has expanded from 32 percent to 55 percent of the total.

The company is on pace to reach its 100 percent AUM goal by 2023. Despite COVID-19, CLNY has completed a series of deals through 2020, with more to come. At the end of 3Q20, CLNY reported a transaction pipeline of 31 deals amounting to roughly $20 billion in enterprise value.

By John Celentano, Inside Towers Business Editor

Reader Interactions