Crown Castle (NYSE: CCI) reported positive 2020 results. Moreover, CCI is projecting revenue and profitability growth in 2021 and beyond on the strength of its existing carrier customer relationships and a couple of new deals.

In many respects, CCI has already done the heavy lifting. The company now is enjoying the financial benefits of the infrastructure and site rental agreements it put in place over the past 20 years.

At year-end 2020, the company had 40,099 towers that average 2.1 tenants per tower, more than 80,000 route-miles of fiber optic cable, and roughly 50,000 small cells in service. All these infrastructure assets, located in the U.S., are generating site rental revenues.

Note that 71 percent of its towers and fiber are in the top 100 U.S. markets and enable CCI’s biggest customers to leverage those assets in their densest markets.

CCI’s top three tenants – T-Mobile (including residuals from Sprint), AT&T and Verizon – account for 74 percent of annualized site rental revenues, with at least 5-year terms remaining on existing MLAs.

Site rental revenues for 2020 reached $5.3 billion, up 4 percent from $5.1 billion in 2019. Adjusted EBITDA grew to $3.4 billion while AFFO increased to $2.6 billion, up 4 and 9 percent respectively, on a year-over-year basis.

CCI’s full year 2021 guidance involves growth in site rental revenues at 4 percent, adjusted EBITDA at 5 percent and AFFO at 12 percent. The organic contribution to site rental revenues is roughly 6 percent, comprising 6 percent from towers, 15 percent from small cells and 3 percent from fiber solutions.

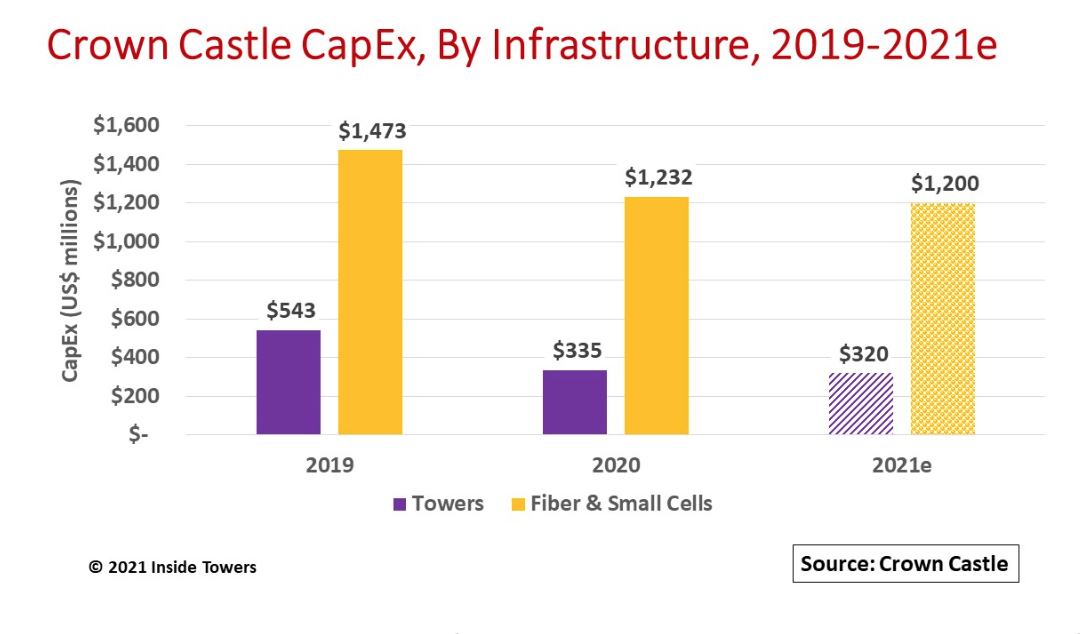

Discretionary capital expenditures for 2021 are projected at $1.5 billion, in line with 2019 levels, with roughly $1.2 billion for fiber and small cells, and $320 million for towers.

CCI does not expect to build any new towers in 2021, given its current inventory and tower locations. With Tier 1 carrier MLAs in place, CCI will offer new tenants co-locations on existing towers.

The company has an order book of 30,000 small cells that it expects to deploy at a rate of roughly 10,000 a year. It points out that planning, engineering, and installation of small cells is a 2–3-year process. Gaining site approvals and permits from municipalities is a significant portion of that cycle.

Two key growth drivers are not factored into CCI’s 2021 outlook.

CCI announced in November, a 15-year deal with DISH Network for 20,000 tower sites. “This strategic agreement established Crown Castle as DISH’s anchor tower provider and includes certain fiber transport services to further support their nationwide 5G build-out,” says CCI CEO Jay Brown. DISH deployments are expected to commence in late 2021 and ramp through 2022.

In a second deal, CCI just announced an expansion to its strategic relationship with Verizon to lease 15,000 new small cells over a 10-year period in support of Verizon’s 5G Ultra Wideband and 5G Nationwide deployment. Brown points out that the deal represents, “the largest small cell award in our history and demonstrates the value of sharing small cell and fiber infrastructure assets with multiple customers.”

Brown emphasizes that the volumes indicated in both contracts really are baseline amounts with upside expansion potential as DISH and Verizon execute on their plans.

Late last year, T-Mobile canceled about 5,700 small cells that CCI had contracted with Sprint. Most of these small cells are not yet constructed and would have been located at the same locations as other T-Mobile small cells once completed.

To terminate the contract, T-Mobile paid $362 million to CCI for future expected site rental fees from those sites and for capex that CCI already invested. This cancellation does not affect CCI’s outlook.

On a third point, CCI believes that outcomes from the recent C-band and CBRS mid-band spectrum auctions will drive substantial long-term tower and small cell infrastructure demand as spectrum winners densify their networks to meet escalating mobile data rates.

“In addition to deploying more spectrum, cell site densification has always been a key tool that carriers have used to add network capacity, enabling our customers to get the most out of their spectrum assets by reusing the spectrum over shorter and shorter distances,” Brown points out. “The nature of wireless networks requires that cell site densification will continue as the density of data demand grows, particularly given the higher-spectrum bands that have been auctioned in recent years and that have shorter propagation characteristics.”

by John Celentano, Inside Towers Business Editor

Reader Interactions