Sweden’s Ericsson (NASADQ: ERIC) and Finland’s Nokia (NYSE: NOK) have become dominant global telecom equipment manufacturers yet are based in small Scandinavian countries. Moreover, they both are competing with larger suppliers, namely, China’s Huawei and ZTE, and South Korea’s Samsung, which have access to large skilled worker pools and extensive material resources.

More importantly, ERIC and NOK have filled the supplier void in the big North American market after the demise of Canada’s Nortel Networks and the U.S.’s Lucent Technologies.

There are several reasons why both companies’ rose to prominence.

Founded over 150 years ago, each company focused on telecommunications from the late 1980s and gained traction in the 1990s with the advent of digital wireless communications. (Remember Nokia cell phones?)

ERIC and NOK count Tier 1 MNOs around the world as customers. Furthermore, they will replace Huawei in MNOs in Western countries that flagged Huawei as a security risk.

Both companies maintain active research and development programs to offer state-of-the-art wireless network technologies that help MNO customers to transition from 4G to 5G, and to create new 5G revenue opportunities.

Still, they are fierce competitors and go head-to-head for market share in key regional markets. They are the prime suppliers to Tier 1 MNOs in both the U.S. and Canada. Both are positioned to capture a sizable share of the growing 5G network equipment market in Europe.

ERIC has a bigger share of the Chinese mobile carrier market than NOK, where they compete with Huawei and ZTE. Note that Huawei’s MNO sales are 50 percent greater than either ERIC’s or NOK’s, with 60 percent of its sales in China.

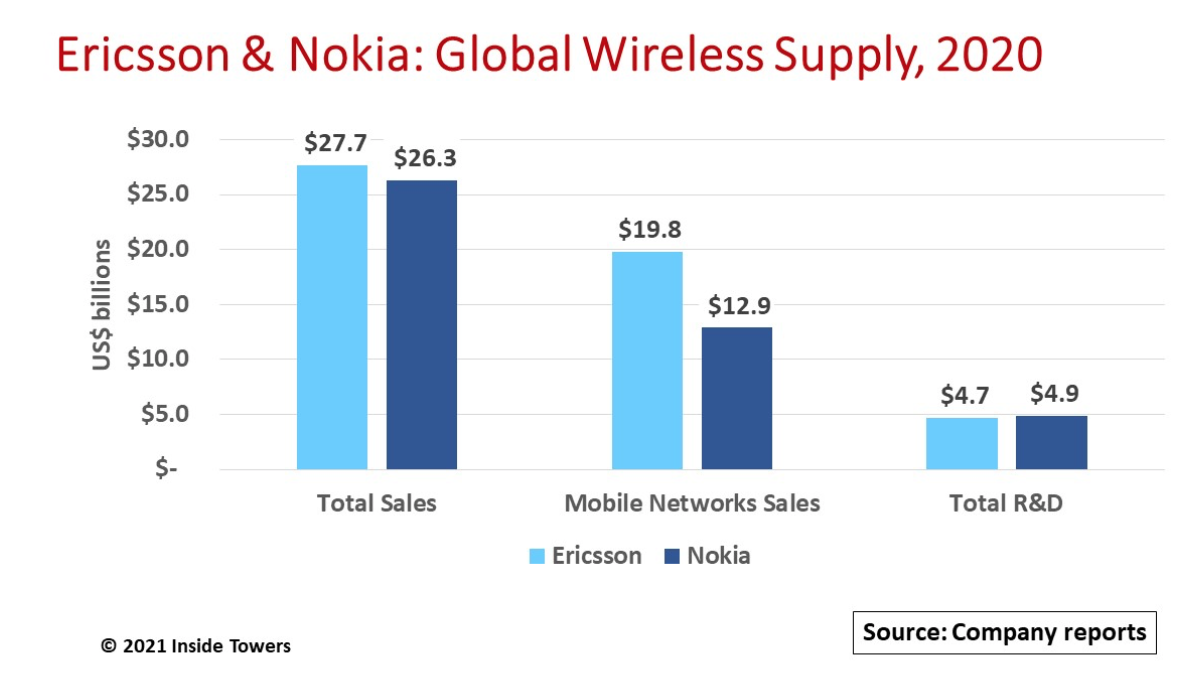

Both companies’ 2020 financial results reflect similarities and where they differ.

ERIC has total 2020 sales of $27.7 billion. Its Networks business unit which sells RAN and CORE equipment to MNOs accounted for $19.7 billion or 71 percent of total sales. ERIC CEO Börje Ekholm says, “5G is now a reality and we are a global leader with 127 contracts as well as 79 live networks [at year-end 2020].”

As a global supplier, North America accounted for 37 percent of ERIC’s 2020 sales. Another 29 percent came from Asia, largely in China and India, while 20 percent was from Europe and Latin America. Interestingly, ERIC’s sales in Sweden are just 1 percent of the total.

The company’s largest sales increase is in Northeast Asia (mainly, China) with North America contributing double-digit growth and new demand in Southeast Asia, Oceania, and India.

Ekholm adds, “China is aggressively rolling out 5G…it’s an important market for us…more from a technology leadership point of view than volume.”

R&D is fueling ERIC’s future growth. The company invested $4.7 billion or 17 percent of sales with projects such as dynamic spectrum sharing, cloud-native 5G core, and network slicing.

The company acknowledges the rise of Open RAN but suggests that speed-to-market and price-performance are the main reasons why MNOs will continue using integrated (hardware and software) solutions for their 5G network deployments for some time.

ERIC sees single-digit sales growth for network equipment in 2021 as it strives to improve operating margins and profitability through 2022 and beyond.

By comparison, NOK’s overall 2020 sales were $20.3 billion, down 6 percent from 2019. Its Mobile Networks business accounted for $12.9 billion or nearly 50 percent of 2020 total sales. That figure is down 9 percent on a year-over-year basis due to a decrease in overall network deployment and planning services among several major MNO customers, both in the U.S. and China.

The company’s outlook on 5G RAN product demand is positive, bolstered by a five-year T-Mobile 5G expansion deal, announced in January. NOK believes its “4G+5G” global market share is 27-28%, excluding China. To date, the company has 195 5G commercial agreements and 45 live 5G networks with a high conversion rate of existing customer 4G networks to 5G.

NOK President and CEO Pekka Lundmark qualifies the outlook, “[MNOs] are clearly our largest customer group, over 80%, but the growth is increasingly on the Enterprise side. We can expect that the [MNO] market will remain flattish…but the Enterprise market is expected to grow close to double-digit over several years to come.”

The company’s overall R&D investment was $4.9 billion, or 19 percent of total sales. Networks R&D investments were roughly 17 percent of Networks sales, a comparable level of investment to ERIC. The company is now shipping 43 percent of all its 5G products with the advanced ReefShark processors, with a goal of reaching 100 percent by 2022.

With current market conditions, NOK expects 2021 sales in Mobile Networks to decline by 3-5 percent, primarily due to loss of market share in China and price competition in North America.

By John Celentano, Inside Towers Business Editor

Reader Interactions