Ericsson (NASDAQ: ERIC) knew it would happen though probably not as quickly as it did. But happen it did. In July, Ericsson announced that it had been awarded only a 2 percent market share of China’s 5G network development with 700 MHz radios. This proportion is materially lower than the 11 percent market share that Ericsson won for 2.6 GHz radio supply.

China Mobile is the first mobile network operator to award contracts under the latest round of Chinese MNO’s central procurement for 5G radios. Under the bidding rules, Ericsson believes that any share of business with China Unicom and China Telecom would be in a similar range as the China Mobile award.

In previous financial reports, Ericsson anticipated the risk of lower market share awards from the Chinese MNOs. Even though the company voiced its concerns to the Swedish Post and Telecom Authority (PTS), it accepted PTS’s decision to exclude Chinese vendors’ products from the 5G auction in Sweden. Continue Reading

Sure enough, China struck back. In response to that PTS order, Chinese MNOs awarded nearly all their 5G supply contracts to China-based manufacturers, primarily, Huawei and ZTE.

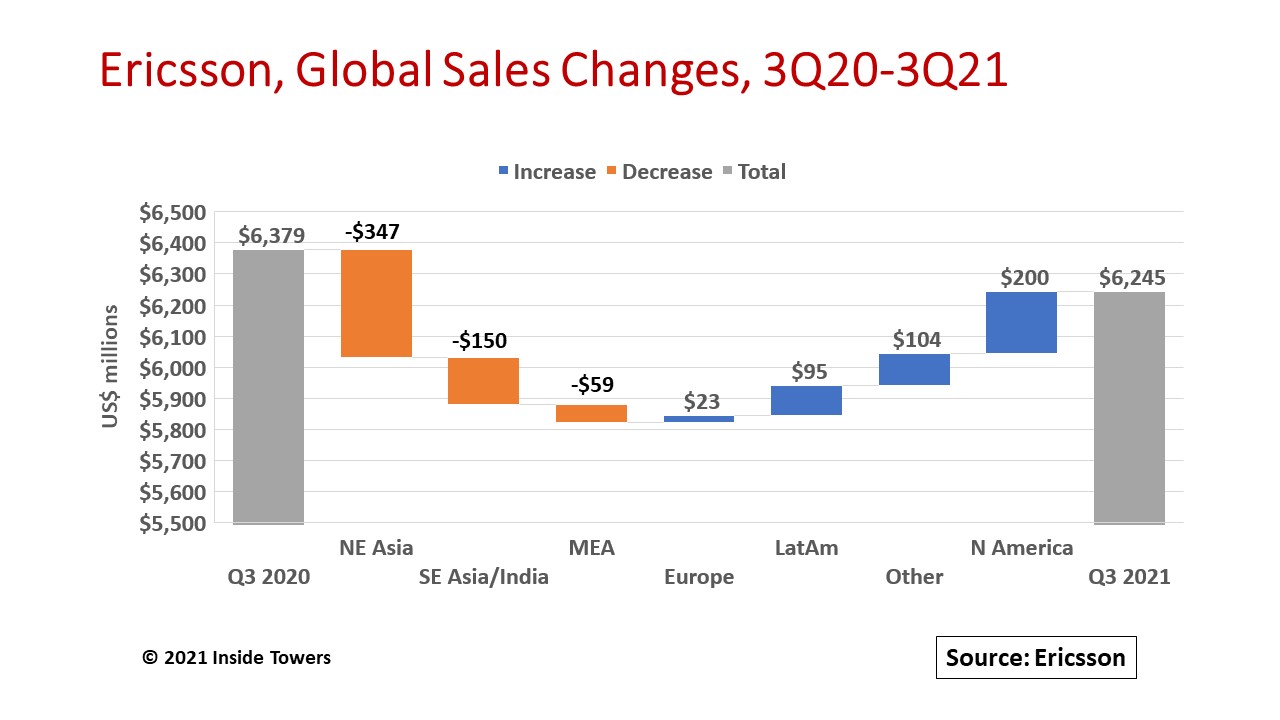

That move hit hard. Ericsson’s 3Q21 sales in its Northeast Asia market that includes mainland China, Japan, and South Korea, plummeted $347 million or 35 percent year-over-year to $632 million from $978 million in 3Q20. That decline is entirely due to that loss of market share in mainland China even as sales increased in other parts of the region.

Despite the loss, Ericsson CEO Börje Ekholm showed his competitive Nordic spirit in the company’s 3Q21 earnings call, remarking, “I like to think when you lose a contract, the day after you start to fight to win it back. It’s the thing with China. I do believe we have a chance to win back the trust to deliver products in the future. So, we’re focused on regaining that.”

China is a strategic market for Ericsson. The company remains committed to its long-term goal of 10-12 percent (or more) market share in mainland China. The Northeast Asia region represented 15 percent (and growing) of the company’s sales in 3Q20. In 3Q21, sales in the region were just 10 percent of the total. Consequently, Ericsson will right size its sales and delivery organizations in China, commencing in Q4, and will incur associated restructuring costs as it regroups.

Ericsson’s total 3Q21 sales were $6.3 billion, down 2 percent from $6.4 billion in 3Q20. It continues to innovate through a strong research and development program, investing $1.1 billion or 18 percent of 3Q21 sales.

The company remains the leading global 5G equipment supplier with 95 live networks and 149 commercial agreements at the end of the quarter. It points out that loss of market share in China has been partly offset by growth in other markets. North America, its largest global market, accounted for 36 percent of 3Q21 sales while sales increased in Europe and Latin America that together made up another 25 percent.

North American sales grew by $200 million, or 10 percent YoY, to $2.2 billion driven by strong 5G demand among MNOs in the U.S and Canada. Ericsson gained momentum in the U.S. in early October with a major 5G contract to support AT&T’s C-band deployment and 5G Standalone launch. With that deal, Ericsson now has 5G contracts with all three Tier-1 U.S. MNOs. Management highlights that these contracts are the largest in Ericsson’s history and it is gaining U.S. market share.

Sales gains in European and Latin American markets and in the Other patent licensing business counterbalanced declines in Southeast Asia, Oceania and India, and in the Middle East and Africa regions.

By John Celentano, Inside Towers Business Editor

Reader Interactions