Iridium Communications (NASDAQ: IRDM) sees increasing demand for its low earth orbit satellite services. Despite COVID-19 impacts on its key commercial aviation and maritime markets, Iridium posted total revenues for full-year 2020 at $583.4 million, up 4 percent from 2019.

New revenue-generating services are enabled by Iridium NEXT, the company’s next generation constellation of 66 LEO satellites, launched two years ago. Iridium NEXT accommodates a range of applications encompassing voice and data, IoT and broadband connections all operating on L-band in the 1-2 GHz frequency range.

“We continue to see a clear lane to be the long-term growth leader in L-band for satellite mobility, IoT, broadband and Safety services,” comments Matt Desch, Iridium CEO. “Top line growth should improve as the economy regains its footing. In the coming year, we will be rolling out a number of new services and devices along with our partners that open up new industry segments and long-term revenue streams.”

The company expects pandemic headwinds affecting aviation and maritime markets to persist into late 2021.

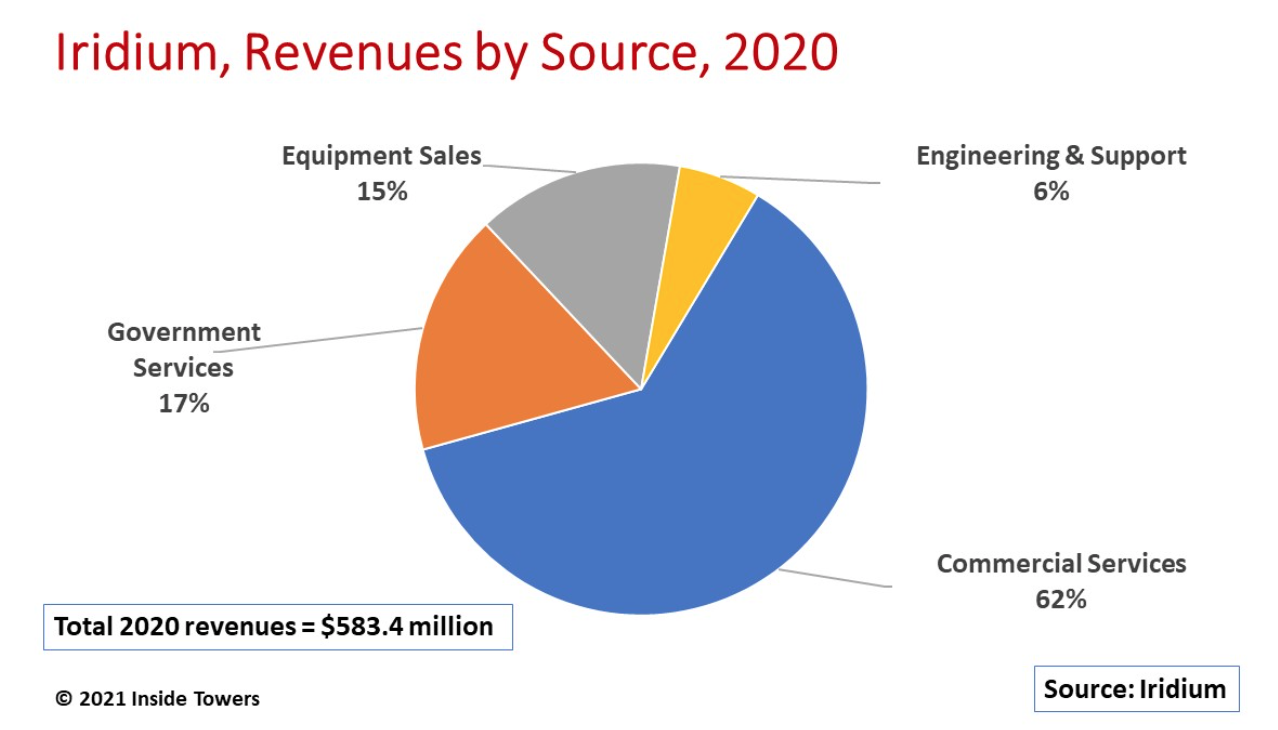

Commercial services, the largest portion of Iridium’s business, represented 62 percent of the total 2020 revenue. Iridium’s commercial customers are diversified across maritime, aviation, oil and gas, mining, recreation, forestry, construction, transportation, and emergency services markets. At year-end 2020, the company had 1.3 million commercial customers, an increase of 14 percent from a year ago.

New supply relationships and product launches in 2020 laid the foundation for subscriber growth in the IoT and maritime markets. The expansion of Iridium Edge line of finished IoT devices and cloud connectivity with Iridium Cloud Connect in the industrial heavy equipment market boosted the company’s IoT business.

Iridium saw increases in voice and data satellite phone services, even though global travel was curtailed, and subscribers altered their normal routines. Push-to-talk demand grew as global enterprise and government customers bought new Icom radio products, allowing them to rapidly extend the reach of their group PTT communications without installing expensive ground terminal equipment.

Desch points out, “Each of these relationships and products extends Iridium’s reach into new market segments, which is allowing us to take market share as well as grow the overall size of the market with new products that lower the cost of entry for subscribers.”

Case in point, the Iridium Global Marine Distress and Safety System service challenges the monopoly of the maritime safety industry, giving the company access to 50,000 Safety of Life at Sea (SOLAS)-class vessels that are required by maritime law to maintain this L-band safety service. While these big ships are the primary targets, the cost, coverage, and capability of its new GMDSS terminal make Iridium’s system an affordable option for hundreds of thousands of smaller vessels that are not required to have GMDSS equipment on board.

Iridium Certus broadband service for aviation and maritime applications continues to expand as terminal equipment becomes available and is adopted by maritime customers. New Iridium Certus aircraft antennas are expected in 2021.

Iridium Certus mid-band applications will roll out in 2021 with availability of the new Iridium 9770 modem. Iridium Certus mid-band leverages small, low-cost passive antennas that are ideal for IoT applications in agriculture, transportation, and drones and will see use in the military, among first responders, and in maritime and aviation applications.

Iridium’s hosted payload services for Aireon’s global aircraft tracking and surveillance system will expand in 2021 throughout Aireon’s customer base of airports, airlines and other aviation stakeholders.

Iridium’s current voice and data solutions for the U.S. government improve situational awareness for military personnel and track critical assets in tough environments around the globe. Iridium’s Enhanced Mobile Satellite Services contract is a seven-year, $738.5 million fixed-price airtime contract with the U.S. Space Force signed in September 2019. Iridium’s engineering and support services provide USG with secure, private access to Iridium Certus broadband and mid-band services, driving incremental pay-for-use revenues.

Desch makes an important distinction regarding LEO competition. He says, “We view ourselves as complementary to the many [millimeter wave frequency] Ka and Ku band LEO mega constellations being announced or developed today, [notably SpaceX’s Starlink]. Iridium’s L-band spectrum and small, low-cost and highly mobile antennas operate in a very different market space than these new LEOs which physically must offer services to large and very high-speed commodity broadband terminals. We expect Iridium will likely end up collaborating on dual-band products and services with several of them.”

By John Celentano, Inside Towers Business Editor

Reader Interactions