Like its peers, Nokia’s (NYSE: NOK) 1Q20 top line sales were buffeted by the COVID-19 pandemic. The company is weathering the storm, though, showing year-to-year (YtY) profit improvements.

1Q20 consolidated revenues of €4.9 billion or $5.4 billion were down 3 percent from the 1Q19 level of €5.1 billion ($5.6 billion), mainly due to coronavirus-related supply chain disruptions in China and lower patent licensing fees. But Nokia reduced research and development (R&D) and sales, general and administration (SG&A) expenses mainly in its Networks business unit, leading to a 1Q20 operating profit of €116 million ($128 million), up nearly 300 percent from the €59 million ($65 million) operating loss in 1Q19.

Note that Nokia is maintaining overall R&D at 20 percent of sales, percentage-wise higher than its peers. Sustained R&D investment reflects Nokia’s commitment to improving product price/performance and helping customers achieve lower total cost of ownership (TCO).

Nokia’s Networks business unit accounted for over €3.8 billion or 76 percent of 1Q20 sales, mainly to communications service providers (CSP) worldwide. The primary Networks revenue generator is the Mobile Access operating unit, a combination of a Mobile Networks segment that sells macrocells, small cells and cloud-based radio solutions, and the Global Services segment that offers professional services for planning, building and managing networks. Networks BU also includes Fixed Networks that supplies copper and fiber access products, and IP/Optical Networks (ION) that makes IP routing, packet core and optical transport systems.

In 1Q20, 17 percent of Mobile Access’ 5G shipments included its “5G Powered by Reefshark” proprietary chipset developed with Intel. Nokia expects Reefshark-enabled radios to reach 35 percent of shipments by year-end 2020 despite more COVID-19-related economic impacts expected in 2Q20. The company also launched its Dynamic Spectrum Sharing (DSS) solution that extends dynamic sharing beyond 4G–5G to include 2G, 3G, and 4G, offering a path to 5G deployments for CSPs with legacy networks; Nokia expects DSS volume shipments by July.

As it scales up production, Nokia believes its ‘4G+5G’ global market share will be about 27 percent by the end of 2020, excluding China. At the end of 1Q20, Nokia reported its 5G win rate in the mid-90 percent range including China. To date, Nokia has 70 5G deal wins and 21 live networks deployed, adding 1Q20 wins at Chunghwa Telecom Taiwan, Orange Slovakia and Bell Canada.

Other business units – Nokia Software, Nokia Technologies, and Group Common and Other – together contributed over €1.1 billion to total 1Q20 sales, up 4 percent YtY.

Among Customers, CSPs accounted for €4.1 billion or 83 percent of 1Q20 total sales, down 3 percent from €4.2 billion in 1Q19. The decline was attributed to a COVID-19 related Networks supply chain disruption in China, not lost sales. Sales of Private LTE networks to Enterprise were a bright spot. Though just 6 percent of Customer sales, Enterprise added 30 logos in 1Q20, boosting sales by 19 percent YtY to €311 million.

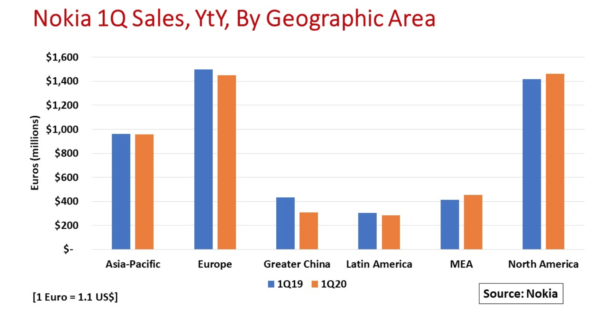

Geographically, Europe and North America each accounted for 30 percent of Nokia’s global sales for the quarter. North American sales grew 3 percent to €1.46 billion on CSP demand for strengthening existing network infrastructure and early 5G adoptions. Europe declined 3 percent YtY to €1.5 billion. Middle East and Africa (MEA) grew 9 percent YtY to €452 million, particularly in Saudi Arabia with large 5G network rollouts for Mobily, STC, and Zain. In the Asia Pacific region, declines in India due to a Supreme Court ruling unfavorable to Indian telco operators were offset by strong sales growth among telcos outside of that country. In a major win, Nokia signed a multi-year contract with Bharti Airtel in India, the world’s second-largest telecom market by subscribers. This deal will boost Bharti Airtel’s network capacity and set the stage for 5G in India.

By John Celentano, Inside Towers Business Editor

Reader Interactions