QTS Realty Trust (NYSE: QTS) continues to ride the data tsunami.

As a medium-sized data center operator with 28 sites in North America and Europe, QTS is expecting robust growth throughout 2021 and beyond. The company reported 1Q21 total revenue and Adjusted EBITDA of approximately $149 million and $82 million, up 18 percent and 22 percent year-over-year, respectively.

Construction capital expenditures in 1Q21 totaled $283 million covering expansion at eight existing sites and two new sites under development in Ashburn and Manassas, VA, along with a separate 50-50 joint venture site in Manassas.

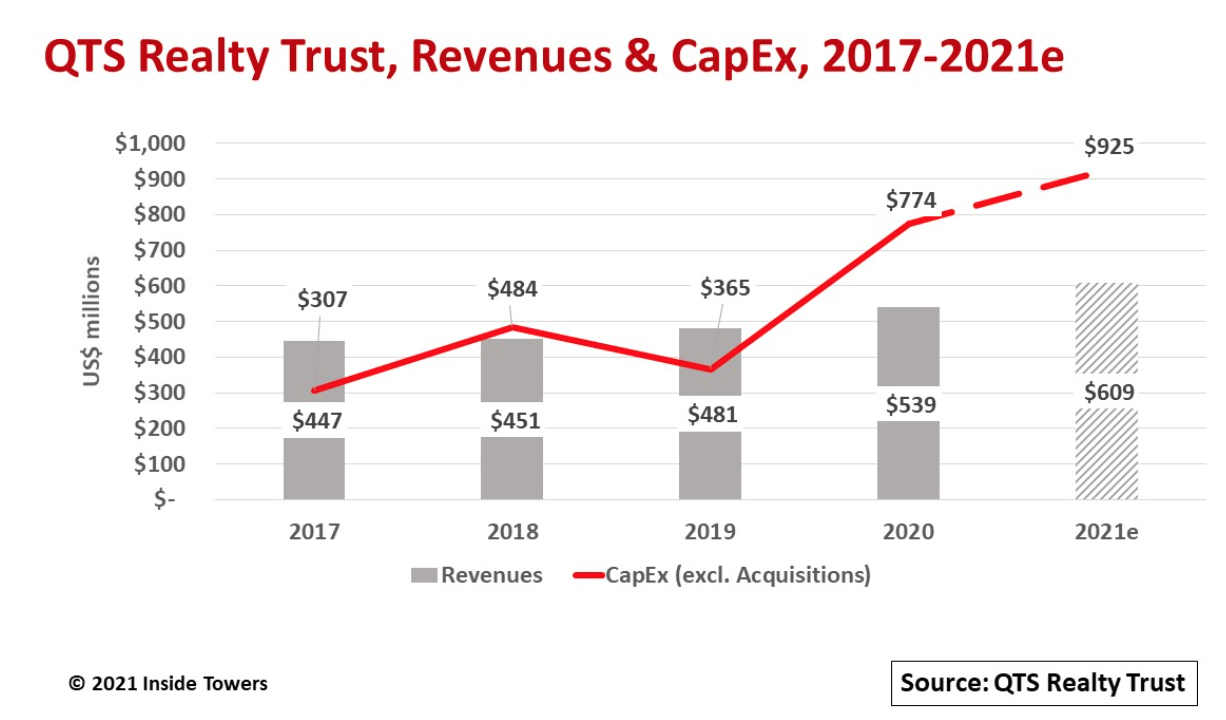

With upbeat 1Q21 performance, QTS raised its full-year 2021 financial mid-point guidance for revenues of $609 million and Adjusted EBITDA of $337 million, representing YoY growth of roughly 13 percent and 12 percent, respectively. Capex is expected to grow 20 percent YoY to $925 million. This figure reflects QTS’ cash capex, excluding acquisitions, but includes the company’s proportionate share of cash capex in the Manassas joint venture.

The data center business model has parallels with the tower business.

Data center operators, with extensive site planning and market demand projections, construct an empty building, basically, a shell, on a large plot of land. The building has access to a large utility power supply and includes backup power facilities such diesel generators and uninterruptible power supplies (UPS), high-capacity HVAC to maintain a controlled environment, and connections to high-speed fiber optic routes.

Data center operators sign multiple tenants to long term lease agreements with set rental rates and annual rent escalators. The data center operator builds-to-suit a portion of the space inside the shell to meet a specific tenant’s specifications including the number of equipment racks they require for servers or data storage units, power consumption, typically measured in kilowatts (kW) or megawatts (mW), and cross-connects between the customer’s computing equipment and fiber terminals located in the data center. Equipment racks are installed on raised floors so that power and fiber cables can be run under the floor for secure cable management and maintenance.

Data center capacity is measured in terms of gross floor space of the building in square feet, and net rentable square feet (NRSF), which is revenue-generating space. At the end of 1Q21, QTS’s 28 data center properties comprised 7.8 million gross sq. ft. with 3.5 million basis-of-design NRSF and a gross utility power capacity of over 1,050 mW. QTS has approximately 785 acres of expansion capability with capacity to nearly double the NRSF within existing powered shells.

During 1Q21, QTS brought online approximately 18 mW of gross power and approximately 56,000 NRSF of raised floor at its Atlanta (DC-2), Ashburn (DC-1), Irving and Hillsboro facilities at an aggregate capex of approximately $112 million.

The company’s significant development activity continued at the Ashburn (DC-2), Manassas (DC-2), Atlanta (DC-2), Richmond, Piscataway, Chicago, Fort Worth, Santa Clara, Hillsboro, Irving, and Manassas (DC-1) facilities to have space ready for customers in 2021 and beyond.

Including the Manassas joint venture, QTS expects to bring an additional 275,000 raised floor NRSF into service by the end of 2021 at an aggregate construction capex of $543 million.

QTS serves two main vertical markets: Hyperscale which includes Cloud & IT Services and Content & Digital Media from leaders such as Amazon Web Services, Microsoft, and Google along with two dozen other smaller companies; and Enterprise Hybrid Colocation that includes financial services, healthcare, retail, network and government and security.

New leases in 1Q21 came in roughly 50-50 between the Hyperscale and Hybrid Colocation segments.

In 2021, QTS expects to sign 2-4 large 5-plus mW Hyperscale leases along with smaller expansions among existing Hyperscale customers. A 8-mW lease with a Hyperscale cloud provider anchors the company’s new 42-mW Ashburn DC-2 development, scheduled to come online by mid-2021.

Hybrid Co-location remains QTS’ core growth source as Enterprise customers continue to outsource their growing IT infrastructure requirements. The company is seeing a resurgence of opportunities that stalled in 2020 along with new requirements in the financial services, health care and technology verticals. During 1Q21, 34 new Enterprise logos contributed approximately 37 percent of QTS’ total Hybrid Colocation leasing.

Moreover, the average size of Enterprise deployments is increasing. In 2020, QTS signed 14 Enterprise leases of 250 kW or greater, at an average deal size of approximately 650 kW.

Year-to-date, the company already has signed seven Enterprise leases of 250 KW or greater, with an average deal size of nearly 1 mW, including two 1-mW leases signed since the end of 1Q21. These leases include a 2-mW requirement from one of the U.S.’s largest commercial banks, a 1.8-mW deployment for a Fortune 500 diversified financial services company and a 1-mW lease with a large independent advertising firm.

By John Celentano, Inside Towers Business Editor

Reader Interactions