SBA Communications (NASDAQ: SBAC) ended 2020 on a high note. Site leasing revenues for the year were nearly $2.0 billion, up 5 percent from $1.9 billion in 2019. In the same period, Adjusted EBITDA came in at $1.5 billion, a 6 percent year-over-year increase while Adjusted Funds from Operations (AFFO) were $1.1 billion, up 10 percent from $972 million in 2019.

For the year, SBAC expanded its portfolio of towers in both domestic and international markets. The company ended 2020 with a total of 32,923 towers, with 16,546 in the U.S. and 16,377 in International markets, mainly in Central and South America, and South Africa. Brazil is its largest international market.

The increase of 520 towers was the net result of acquisitions, new builds and decommissions throughout the year.

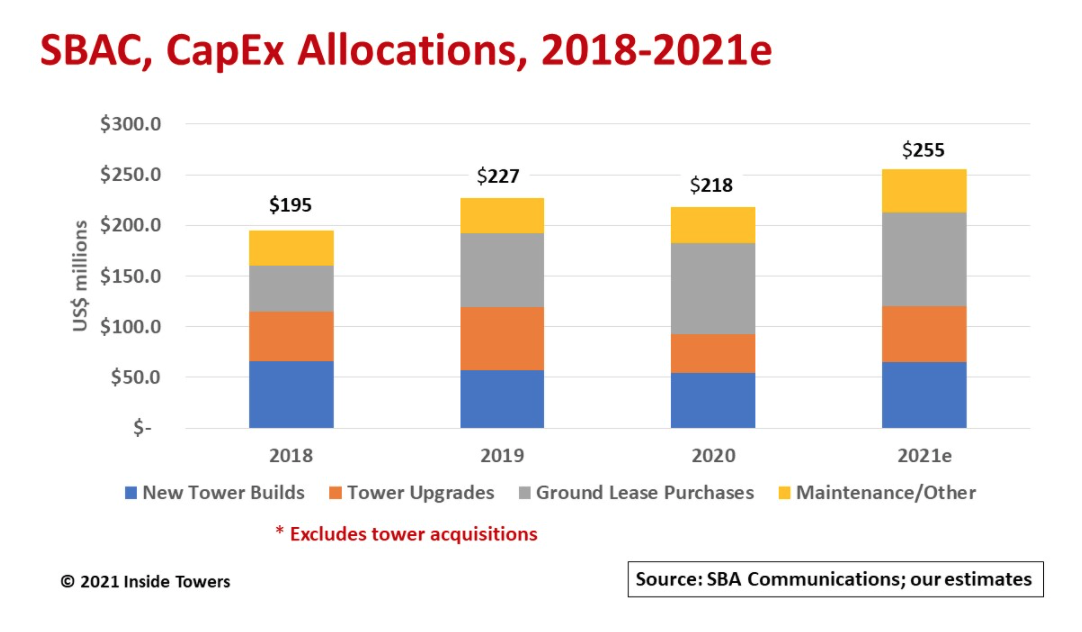

The company’s 2020 capital expenditures totaled roughly $400 million with $218 million for direct investment in tower infrastructure and the balance for acquisitions. That overall investment level is down 57 percent from 2019, when the company spent over $700 million to acquire a block of over 1,300 towers in Brazil.

Most of the 520 towers in 2020 came from new tower builds, mainly in international markets. SBAC invested nearly $55 million to construct 309 new towers, 296 of which were outside the U.S. It built only 13 new towers in the U.S.

The company acquired 233 towers for a total of $182 million. Of that site total, 146 were in the U.S. and 87 were in international markets.

For full-year 2020, SBAC invested $38 million in tower upgrades and augmentation, and another $90 million to buy land and easements and to extend ground lease terms. At the end of 4Q20, SBAC owned or controlled, for more than 20-year terms, the land underneath approximately 71 percent of its towers, with the average remaining ground lease life of approximately 35 years.

SBAC derives 91 percent of its 2020 U.S. site leasing revenues from T-Mobile, AT&T and Verizon. The company indicated that its customers are all focused on their 5G network deployments.

Moreover, it expects significant investment to flow from the current C-band auction. The company suggests that the primary use of C-band spectrum will be on macro sites outside of urban markets.

SBAC indicates that T-Mobile’s activity levels have been increasing as the carrier accelerates its network integration and upgrades to meet its 5G coverage goals, upgrading its sites with either 2.5 GHz or 600 MHz spectrum.

Two recent deals bolstered SBAC’s long term site leasing growth trajectory.

In a transaction with Pacific Gas and Electric, SBAC added almost 900 existing wireless tenant licenses on over 700 utility transmission and distribution structures to its portfolio. In addition, the company has the right to market these structures to additional tenants, with a majority of any additional rents retained by SBAC and the balance shared with PG&E.

As part of this transaction, SBA was granted exclusive rights to market over 28,000 additional PG&E structures with any resulting rents to be shared by SBA and PG&E under a predetermined revenue sharing arrangement.

When the deal closes, the cumulative purchase price is projected around $973 million. SBAC expects the assets to generate about $40 million in tower cash flow during the first 12 months.

This week, SBAC and DISH Network announced a master lease agreement in which DISH will have access to SBAC’s 16,500 towers in the U.S. to construct portions of its new 5G network, Inside Towers reported.

The DISH agreement includes standardization of processes under certain terms to improve DISH’s ability to efficiently access SBAC sites to meet its network build out commitments. The MLA also provides for DISH’s commitments to SBAC’s pre-construction services business and a substantial new minimum lease commitment over the next several years.

This deal helps secure SBAC as a major infrastructure provider for DISH’s new greenfield nationwide 5G network.

By John Celentano, Inside Towers Business Editor

Reader Interactions