UPDATE Two weeks ago, Inside Towers reported on T-Mobile US Inc.’s acquisition of SoftBank Group Corp. stock. For every share of common stock sold by T-Mobile in the public securities transactions, the “Un-Carrier” has agreed to repurchase one share of common stock from a subsidiary of SoftBank at a price per share equivalent to that received by T-Mobile in its sales.

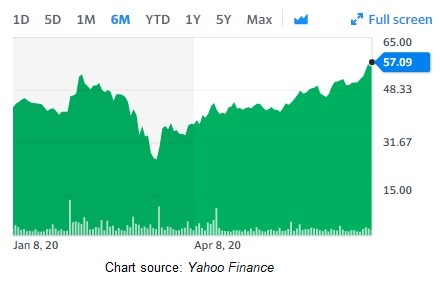

This week, SoftBank’s stock rose 4.6 percent to $58, the highest since March 2000, reported Bloomberg and gained $68 billion in market value since its all-time lows in mid-March. With the coronavirus pandemic cited as the catalyst for the lows, founder Masayoshi Son was prompted to reduce debt and bankroll record share buybacks. Earlier this year, Softbank also merged its Sprint Corp. with T-Mobile.

SoftBank’s Vision Fund, with close to 90 companies in its portfolio, lost almost $18 billion in the fiscal year ended March 31, reported Bloomberg. However, SoftBank can’t be ruled out just yet.

“SoftBank’s business model has evolved over the past 20 years to match the times, from software to wireless service and now to an investment fund,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management Co. “The way the coronavirus is reshaping our society, the winners will be communications infrastructure, networks, and AI…all businesses that SoftBank invests in.”

Reader Interactions