T-Mobile (NASDAQ: TMUS), in its March 11 Analyst Day briefing, set a clear course for its network development activities for the next five years. The company highlighted that its network integration activities and 5G buildout are ahead of schedule and that it is realizing better-than-expected synergies.

When TMUS merged with Sprint a year ago, it gained a network of equivalent size for a combined infrastructure of around 120,000 cell sites. Moreover, TMUS garnered Sprint’s highly valued 156 MHz of 2.5 GHz upper mid-band spectrum. At the time, T-Mobile foretold a nationwide 5G rollout along with the integration and rationalization of the joint network, committing $40 billion in capital expenditures through 2023.

The combination of T-Mobile’s 38 MHz of 600 MHz low-band spectrum with the 2.5 GHz band gives T-Mobile the critical spectrum pieces it needs for 5G in both wide area and urban applications.

A year into the merger, T-Mobile has a better handle on its 5G build and what it must do to rationalize its overall network infrastructure.

The company expects by the end of 2021 to cover 300 million people or about 90 percent of the U.S. population with its “Extended Range 5G” using its 600 MHz low-band spectrum. By the end of 2022, Extended Range 5G will cover 97 percent of Americans.

Its “Ultra Capacity 5G” provides coverage in major metro markets using its extensive mid-band 2.5 GHz spectrum. TMUS also is using portions of its 1158 MHz holdings in millimeter wave spectrum at 28 and 39 GHz to deploy 5G in dense urban markets and for fixed wireless access applications. Ultra Capacity 5G will cover 200 million people by the end of 2021, growing to 250 million by year-end 2022 and covering 90 percent of Americans by the end of 2023.

TMUS participated in the recent FCC spectrum auctions for CBRS 3.5 GHz and C-band 3.7 GHz upper mid-band spectrum. It only spent $5.6 million for eight CBRS Priority Access Licenses but bid $9.3 billion for 142 C-band licenses in 72 PEAs.

In the C-band auction, TMUS was a distant third-place bidder behind Verizon and AT&T that spent $45.5 billion and $23.4 billion, respectively, with both companies incurring significant debt in the process. Note that most of TMUS’ C-band licenses are in B- and C-block allocations that will not be cleared for commercial cellular use until December 5, 2023. (see, Rockin’ the C-band)

TMUS argues that its 2.5 GHz spectrum fulfils most of its Ultra Capacity 5G needs for coverage and throughput while using one-third fewer cell sites than with 3.7 GHz. Once able to deploy, however, TMUS will use its C-band licenses to augment 2.5 GHz applications in key markets.

At this juncture, TMUS says its combined 4G LTE and 5G network will end up with 85,000 macro sites and 50,000 small cells. To reach those levels, it expects to decommission 7,000-8,000 macro sites by the end of 2021 and 35,000 macro sites in total by year-end 2022 while adding “thousands of new [small cell] coverage sites.”

TMUS is relying on its master lease agreements with the big three tower companies, American Tower (NYSE: AMT), Crown Castle (NYSE: CCI) and SBA Communications (NASDAQ: SBAC), to support its network integration activities. In September, TMUS signed with American Tower a new 15-year MLA covering AMT’s 40,000 U.S. sites.

With progress to date, TMUS emphasizes that it is ahead of schedule and is realizing significant operational and financial synergies. Since mid-2020, the company maintained an upgrade pace of about 1,000 sites per week while managing its overall network integration and 5G build costs.

Consequently, it lowered its capex outlook while raising its service revenue projections.

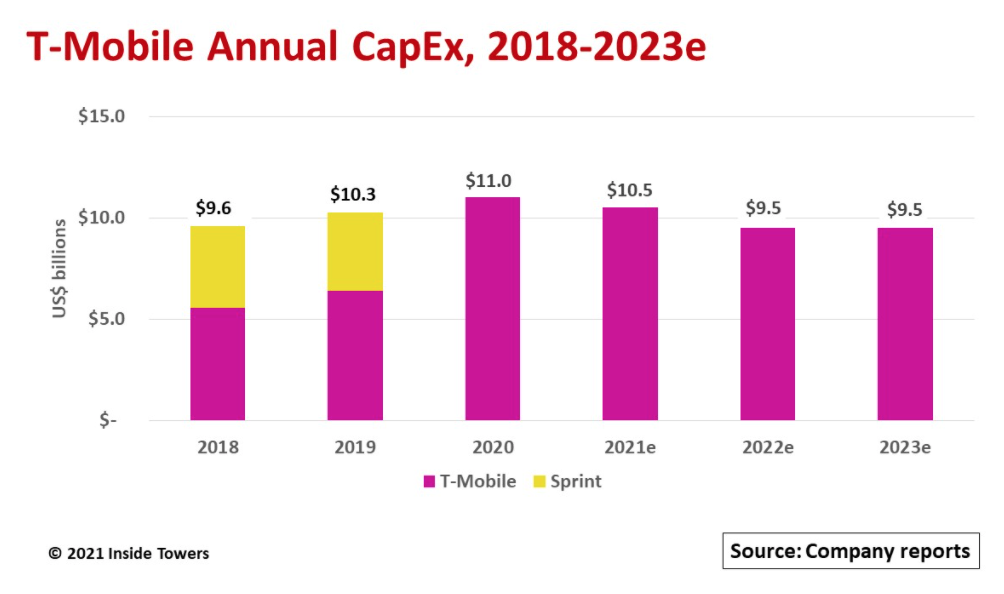

Pre-merger, on a pro forma basis, TMUS and Sprint invested in 2019 a combined $10.3 billion on total service revenues of $54.8 billion for a capital intensity level of 19 percent. A capital intensity level above 15 percent indicates network expansion activity.

Through 2020, TMUS invested $11 billion in capex even as its service revenues declined to $50.4 billion due to COVID-19 and customer churn impacts. Capital intensity jumped to 22 percent, reflecting the high level of network upgrades.

TMUS’ 2023 midpoint guidance is $61.5 billion in service revenues and $9.5 billion in capex for a capital intensity of 15 percent, indicating network expansion but at a slower pace.

For 2026, TMUS is guiding its service revenue growth to over $70 billion with capex at $9.5 billion. At that point, capital intensity declines to 14 percent, indicating a steady operational mode level.

By John Celentano, Inside Towers Business Editor

Reader Interactions