T-Mobile (NASDAQ: TMUS) acknowledges it has more work to complete the Sprint merger and to extend its nationwide 5G coverage. Nonetheless, management remains confident of delivering on its network performance and financial metrics while staying competitive with its mobile network operator peers.

For 3Q21, TMUS reported total service revenues of $14.7 billion, up 4 percent on a year-over-year basis. Core adjusted EBITDA of $6.0 billion was up over 4 percent from $5.8 billion in 3Q20 while free cash flow reached $1.6 billion, increasing 4.5 times over the $352 million achieved in 3Q20.

The company added 1.3 million total net customers bringing its total postpaid and prepaid customer connections to 106.9 million at the end of the quarter. That figure lags Verizon’s 122 million connections but leads AT&T’s 99 million retail connections.

TMUS continued to make progress on integration activities, ending 3Q21 with about 90 percent of Sprint customer traffic now on the TMUS network and close to 53 percent of Sprint customers fully transitioned to TMUS.

Certainly, TMUS touts the breadth and depth of its 5G network. At the end of the quarter, its Extended Range 5G using 600 MHz low-band spectrum covered 308 million people (POPs). Its Ultra Capacity 5G with 2.5 GHz mid-band spectrum, and millimeter wave in future, is expected to cover 190 million POPs with an average of 100 MHz of bandwidth by the end of 2021. The company plans to expand that coverage to 300 million POPs with up to 200 MHz bandwidth by year-end 2023, providing users with over-the-air data connections of around 400 Mbps.

At the end of 3Q21, the combined TMUS-Sprint network consisted of approximately 105,000 macro sites and about 39,000 small cells and distributed antenna systems. At this juncture, TMUS’ challenge is rationalizing its merged network. This means that TMUS will be decommissioning redundant (and aged) Sprint sites. Some Sprint cell sites are co-located with TMUS sites, referred to as overlap sites. Others are on different towers that are close to a TMUS installation, referred to as proximity sites.

That rationalization process will take several years and has started slower than the tower companies were expecting. Most think it’s a timing issue as TMUS assesses and prioritizes the decommissioning process.

The tower companies in their recent earnings calls have indicated that they all expect ‘Sprint churn’ to negatively impact their site leasing revenues beginning in 4Q21 and extending over the next five years. Sprint churn refers to the expiration of existing leases, many of which extend to 2025. The timing and negative dollar amount impacts will vary according to the number of Sprint leases that each towerco holds.

On the plus side, TMUS gains investment synergies as it rationalizes its network infrastructure. In its 3Q21 call, the company updated its guidance for full-year 2021 on two key aspects.

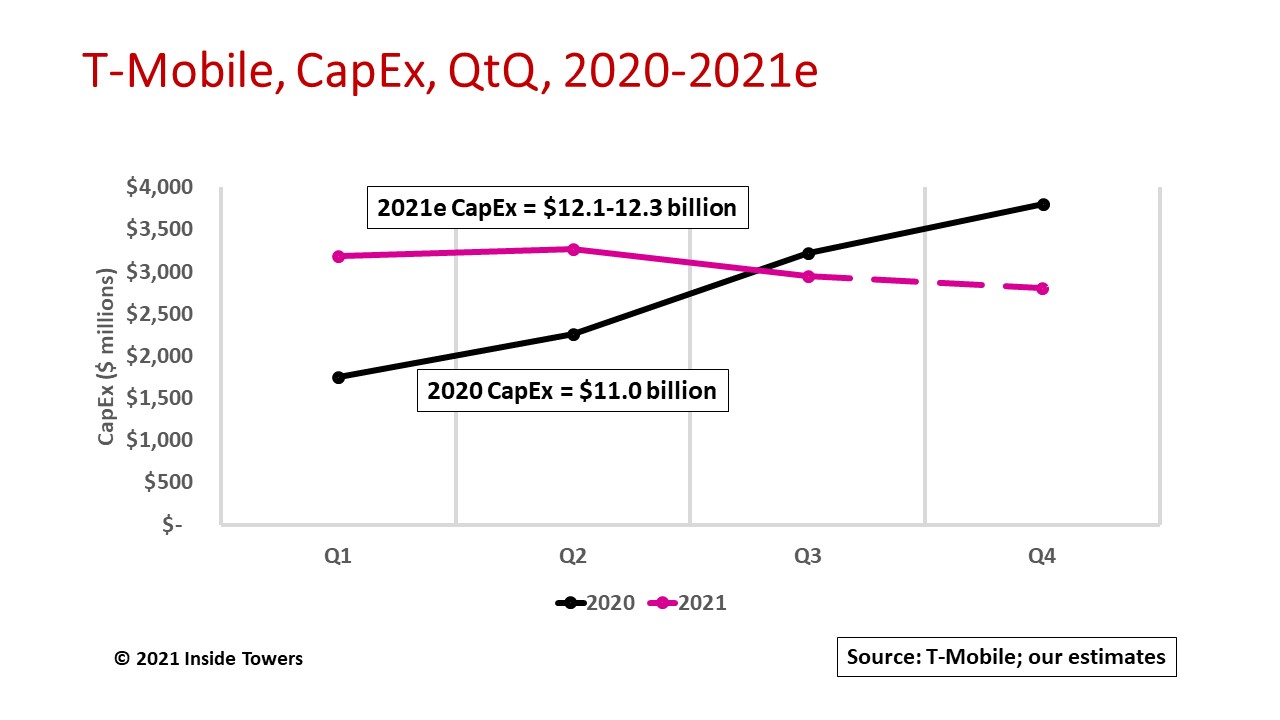

Through the first nine months ending September 30, 2021, TMUS’ capital expenditures totaled $9.4 billion, up 30 percent from the $7.2 billion invested in the same period in 2020. Until the merger deal closed on April 1, 2020, TMUS was operating at its historical pace. Since then, TMUS has throttled up its network activity and associated capex.

It finished full-year 2020 at $11 billion, nearly double the $6.4 billion spent in 2019. The company kept its pedal to metal going into 2021 with planned capex of $12.0-12.3 billion for the year. In its 3Q21 report, TMUS updated that capex guidance to $12.1-12.3 billion for full-year 2021.

Aggregate capex through the end of 3Q21 accounted for 77 percent of the total revised guidance compared to 65 percent through 3Q20. Expect TMUS to taper off its network capex for the balance of the year.

While not yet providing 2022 capex guidance, TMUS previously indicated that, if on plan, it would operate at an annual capex run rate of $9-10 billion through 2025, effectively running on cruise control. These capex estimates include Phase II C-band deployments in 2024 and 2025. TMUS spent $9.3 billion for 142 C-band licenses in 72 PEAs in Auction 107.

TMUS’ network integration will also yield substantial synergies that allow it to reduce or avoid capex altogether. Based on the continued strength of its current execution, TMUS raised its merger synergies guidance range to $3.2-3.5 billion for 2021, including roughly $1.0 billion it thinks it can eliminate from new site builds.

By John Celentano, Inside Towers Business Editor

Reader Interactions