TELUS Corporation (NYSE: TU), based in Vancouver, British Columbia (B.C.), segmented its operations on January 1, 2021, into two strategic business units: TELUS technology solutions (TTech) that operates its mobility, fixed wireline and its IoT connectivity business and, separately, what the company calls, Digitally-led customer experiences-TELUS International (DLCX).

TTech includes service and equipment revenues mainly from mobility, data (IP, TV, cloud-based services, data management and analytics, security systems), healthcare technology, and voice. DLCX supports customers’ digital experience and transformation using artificial intelligence and content management solutions provided through TELUS International.

TELUS’s consolidated revenues at the end of 3Q21 were $3.4 billion, up 7 percent on a year-to-year basis. TTech accounted for 86 percent of that total, with DCLX contributing the balance. TTech’s revenues grew 4 percent from 3Q20, while DCLX’s revenues were up 23 percent over the same period. Adjusted EBITDA for the quarter increased by 7 percent YoY to $1.2 billion, 90 percent of which was generated by TTech.

TTech’s operations consist of TELUS’ nationwide wireless operations and its fixed wireline operations in select areas of the country. Most of its wireless network is in its home base in B.C, Alberta and parts of Manitoba in western Canada, and parts of southern Ontario and eastern Quebec in the east. TELUS has a network sharing agreement with Bell Mobility to extend its wireless coverage to the majority of Canada’s population in areas where it does not own its own infrastructure. (See, Wireless Network Sharing, Canadian Style).

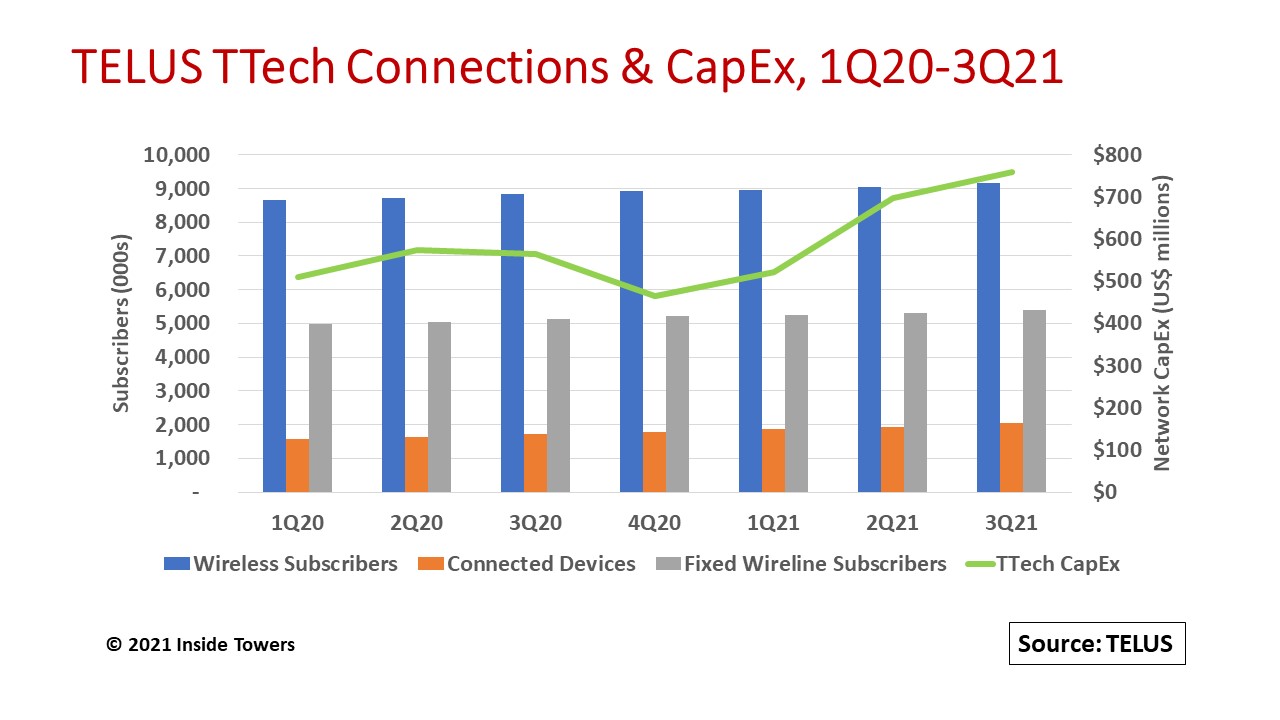

At the end of 3Q21, the company reported 9.2 million wireless subscribers, up 3 percent since the end of 2020. TELUS also provides connectivity for nearly 2.1 million IoT devices of all types, an expanding segment that grew 14 percent since the end of 2020.

The company is responding to growing demand for mobile data as the industry transitions to 5G. TELUS is broadening its network coverage and capacity to support the data consumption growth among its mobile subscriber base in such a geographically diverse country. Investments include wireless small cells that are connected directly to TTech’s fiber technology.

TELUS participated in the 3500 MHz auction conducted by Innovation, Science and Economic Development Canada (ISED), as Inside Towers reported. The company successfully acquired 142 wireless licenses in B.C., Alberta, Manitoba, Ontario and Quebec. TELUS’ combined 3500 MHz spectrum holdings are 25 MHz nationally and 40 MHz in its key markets.The company now holds key mid-band spectrum in AWS-4, 2500 MHz and 3500 MHz bands.

At the end of 3Q21, TELUS’ 4G LTE technology covered 99 percent of Canada’s population and its LTE Advanced technology reached over 96 percent of Canadians. Its 5G network, launched in June 2020, currently covers 64 percent of Canada’s population.

Under its PureFibre® fiber-to-the premise (FTTP) brand, TELUS is investing in broadband in urban and rural communities across B.C., Alberta, and Eastern Quebec with homes and businesses connected directly to fiber. The company has increased broadband internet speeds, expanded its IPTV video-on-demand library and HD content along with home and business security monitoring with smart devices. Moreover, fiber is integral to enabling 5G deployments.

At the end of 3Q21, TELUS’ fixed wireline network served 5.4 million internet, TV, voice and security subscribers. Its fiber network passed more than 2.6 million households and businesses in B.C., Alberta and eastern Quebec, up from more than 2.4 million premises in the 3Q20. As of September 30, 2021, approximately 12 percent of its TV and internet customers within its PureFibre footprint are serviced by copper, down from 15 percent at the end of 2Q21. The company expects to migrate the remaining customers to PureFibre by the end of 2022.

With COVID restrictions easing in Canada, TTech ramped up its network capital expenditures. In 3Q21, TTech’s capex was $760 million, up 35 percent from $564 million in 3Q20. This increase went to accelerated investments in its 5G network, the broadband FTTP build, and operational digitization including advanced purchases of equipment to mitigate supply chain risks and support subscriber growth. Year-to-date, TTech’s capex was almost $2.0 billion and likely will reach $2.5 billion for full year 2021, compared to $2.1 billion invested in 2020.

By John Celentano, Inside Towers Business Editor

Reader Interactions