Tower companies operating in the U.S. are well-positioned for growth. Towers will remain the backbone of wireless networks for quite some time even as waves of small cell deployments are underway.

A confluence of factors is driving the towerco growth prospects. The current COVID-19 pandemic has created a critical dependency for broadband connectivity, whether wired or wireless, as an essential service. To ensure people staying at home stay connected, tower work is ongoing, albeit at a measured pace, as the carriers ensure coverage and capacity where it is needed and augment that coverage with loaned spectrum provided under FCC-granted Special Temporary Authority (STA) permits.

The T-Mobile-Sprint merger closure will bring significant site integration activity along with new site builds, particularly in the 600 MHz and 2.5 GHz bands that T-Mobile (NASDAQGS: TMUS) now controls and will use for 5G deployments at both existing and new towers. As an adjunct to the merger, DISH Networks (NASDAQGS: DISH) will gain assets from TMUS to move forward with its planned fourth national network build, further stimulating activity among the tower companies. Certainly, 5G rollouts will dominate the tower activity in macrocells and small cells alike for the next three to four years.

There are over 100 companies in the U.S. that own and operate more than 125,000 towers, rooftops and distributed antenna system (DAS) installations used for public cellular, public safety, broadcast and private network communications. These tower companies are a mix of publicly held entities, independent tower owners and private network operators such as railroads and utilities. The Big 3 towercos – American Tower (NYSE: AMT), Crown Castle (NYSE: CCI) and SBA Communications (NASDAQGS: SBAC) – together own or operate over 97,000 towers in the U.S., or roughly 78 percent of the total.

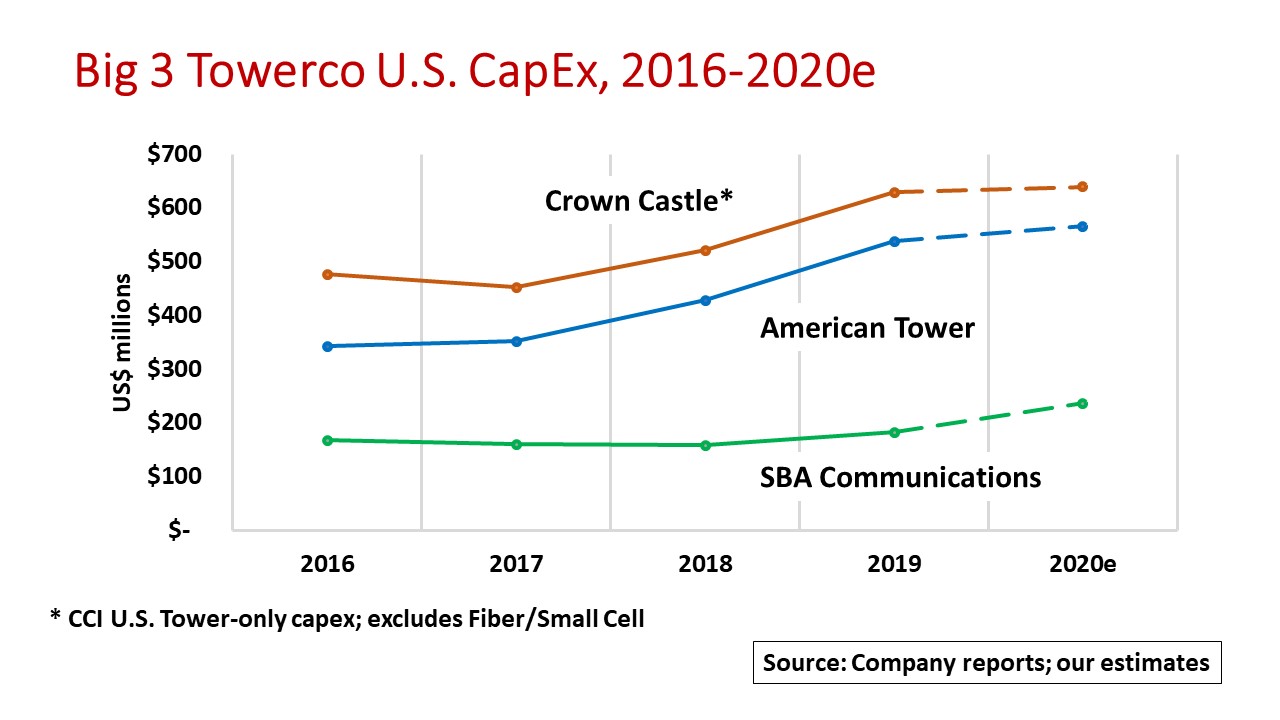

Their combined guidance for 2020e capital expenditures (capex) is $1.5 billion. That amount has grown steadily at a nine percent CAGR from the $1 billion that the Big 3 invested in 2016. Understand that this capex is just for the U.S. tower-only assets. At year-end 2019, AMT and CCI each had more than 40,000 and SBAC with over 16,000 towers in their respective U.S. portfolios. The chart shows U.S. tower-only capex for each of the Big 3 since 2016, along with their 2020e outlook. For data normalization and comparison purposes, the chart excludes international tower capex for AMT and SBAC, both of which have significant tower holdings outside the U.S. It also excludes CCI’s substantial annual investment in fiber and small cells which accounts for over two-thirds of CCI’s total capex. Big 3 towerco capex for acquisition of towers from other operators also is not included.

This tower-only investment is categorized two ways: discretionary and non-discretionary. Discretionary capex at over 80 percent of the total goes toward new tower builds, existing tower modifications and purchases of leases for the land on which the towers sit. The balance comprises non-discretionary or sustaining capex that is applied to tower and ground maintenance along with corporate IT expenditures. By comparison, carrier capex for network infrastructure including antennas, radios, cables, routers and power is a separate investment (and discussion). For 2020e, aggregate carrier capex is estimated at nearly $30 billion.

We will not know the full impact of COVID-19 on the pace of wireless network expansion and upgrades for several months. We do know that tower work will not stop. That’s good news for companies in the wireless infrastructure business and for the millions of consumers, businesses and institutions that depend on reliable wireless connectivity every day.

by John Celentano, Inside Towers Business Editor

Reader Interactions