American Tower (NYSE: AMT) and Crown Castle International (NYSE: CCI) rank among the leading tower companies in the world. Beyond that similarity, each company’s growth strategy is completely different.

Tom Bartlett, American Tower President & CEO and Dan Schlanger, Crown Castle EVP & CFO, shared their respective companies’ perspectives at this week’s virtual National Association of Real Estate Investment Trusts (NAREIT) REITweek 2021 investor conference.

The best way to think about AMT is as a pure macro tower play. Once it completes its Telxius Towers acquisition from Madrid, Spain-based Telefónica, AMT will grow its base by 31,000 towers to more than 216,000 towers in 21 countries. This deal makes AMT the largest publicly held tower company in the world, second only to China Tower’s 2,000,000 sites in terms of tower count. (See, American Towers’ Global Ambitions)

At the end of 1Q21, AMT owned and operated over 185,000 towers. Almost 43,000 towers or 23 percent are in the U.S. and Canada and 142,000 towers or 77 percent are situated in Asia, Latin America, Africa, and Europe. India is its biggest market with over 75,000 towers.

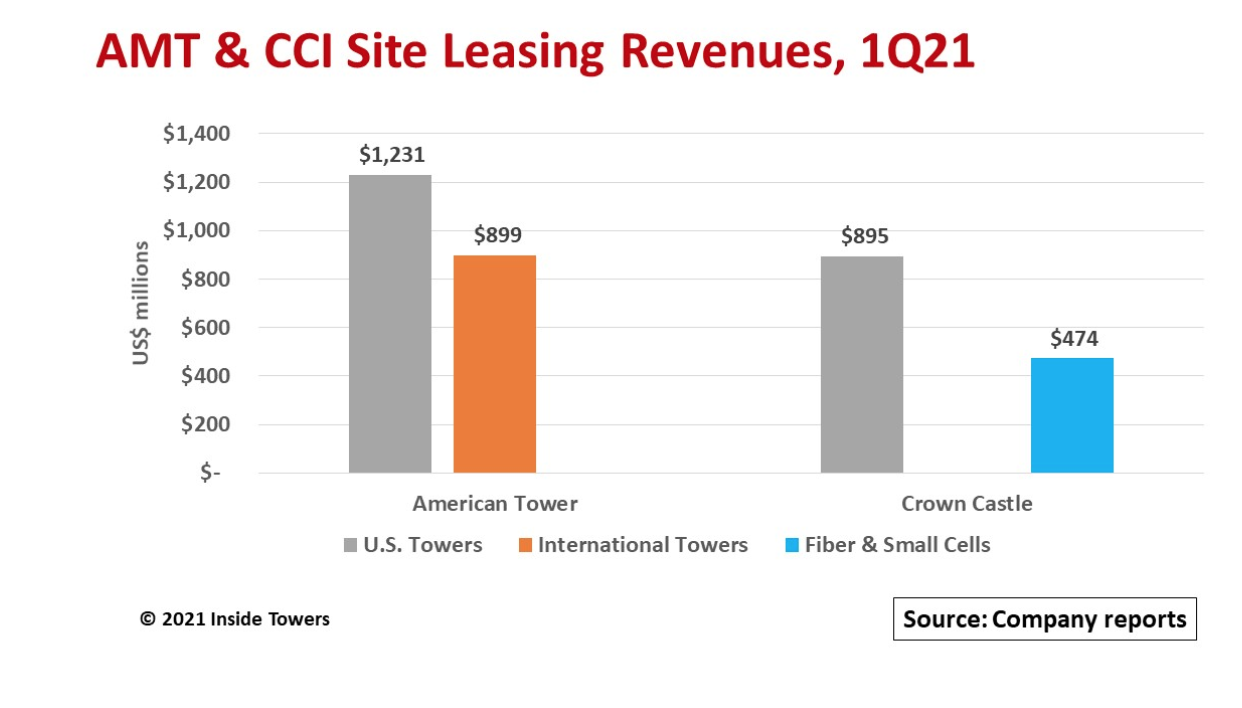

On the revenue side, the proportion flips. The company derived $1.2 billion or 58 percent of its $2.1 billion 1Q21 site leasing revenues from the domestic market with 42 percent coming from international markets.

Bartlett points out AMT’s non-traditional tower revenues, including 1,800 in-building and outdoor DAS sites, are less than 5 percent of total revenues.

When questioned about risks to the tower business from other forms of infrastructure and wireless technologies such as small cells and satellites, Bartlett was clear on where AMT stands, “… there is no better infrastructure from [an] economic, … propagation … [and] quality-of-service perspective, than the 150-foot to 175-foot tower.”

He explained that with over 200,000 sites around the world, the tower-only model is better for AMT to create value and drive return on investment by replicating that model in as many markets as is feasible.

“It’s known. Our customers are looking for it. It’s a neutral host. It’s based upon exclusive real estate rights. It’s multi-service, multi-tenant. And we can control all of the inputs,” Bartlett articulates.

He believes building new towers is the best capital allocation. In that light, AMT is operating on a large scale. “We’ll build 6,000, 7,000 sites this year,” he says. “I’ve got a roadmap that we’ll build 40,000 to 50,000 sites over the next three to five years. We generate double-digit ROIs right out of the gate with that kind of investment. There is no other model that will generate those kinds of returns. We’ll be able to enjoy the growth in those markets as carriers and other customers continue to come on those sites.”

Bartlett cites the Telxius deal as a prime example for growth and scale in existing and new markets, noting that the deal “… looks exactly like the model that we have in the United States.”

By contrast, CCI operates 40,000 towers only in the U.S. Unlike AMT, CCI owns 80,000 route miles of fiber and around 80,000 small cells already in service or under construction.

In 1Q21, CCI’s site leasing revenues grew to $1.4 billion, up 5 percent YoY. The tower segment accounted for $895 million or two-thirds of total leasing revenues. Fiber and small cells generated the $474 million balance.

CCI believes that its U.S. market focus yields the highest ROI at the lowest risk. Moreover, much of CCI’s infrastructure investment is concentrated on the top 30 U.S. markets where it expects the highest small cell deployments.

CCI thinks its mix of tower, fiber and small cell infrastructure is well-positioned to support carriers in delivering high-speed, low latency connections to a growing volume of mobile devices.

Schlanger explains that to achieve such performance carrier networks must become “densified.” That means adding more sites with new spectrum and more antennas on towers.

“All of our customers are very much focused on deploying 5G at scale, and therefore adding more antennas to more towers, which is driving a higher level of activity and leasing for our business than what we’ve seen historically,” Schlanger points out.

He adds that all these cell sites connect to the core network by fiber optic cable. “We have invested heavily in fiber and small cells because we believe that as the density of demand continues to increase. 5G will be a catalyst for them. That more … demand will happen [in] dense places like cities, and therefore, we want to own fiber and small cells in those cities.” CCI is on pace to construct roughly 10,000 small cells a year for the next several years.

Schlanger emphasizes that CCI’s combination of towers, fiber and small cells best supports its carrier customers’ densification requirements over the medium to long-term.

Both AMT and CCI see ways to add new revenue-generating services that support their carrier customers. Such services include mobile edge computing and backup power systems.

By John Celentano, Inside Towers Business Editor

Reader Interactions