Vantage Towers AG (VTWR.F), headquartered in Frankfurt, Germany, is finding its way as a standalone organization. The company reported over two percent site leasing revenue growth on a year over year basis to U.S.$290 million* (€246 million) in its Q1FY22 earnings call.

At the same time, even with Vodafone Group PLC (NASDAQ: VOD) as its primary tenant, VT’s non-Vodafone revenues grew nearly five percent in the quarter to over $47 million.

The company was formed when Vodafone spun off its European tower assets into a separate operating unit. In March, VT became a publicly held company on the Frankfurt stock exchange after a successful initial public offering that valued the company at over $14 billion. Vodafone still retains 81 percent ownership. Since the IPO, VT’s shares have risen by 25 percent, with a current valuation at $17.8 billion.

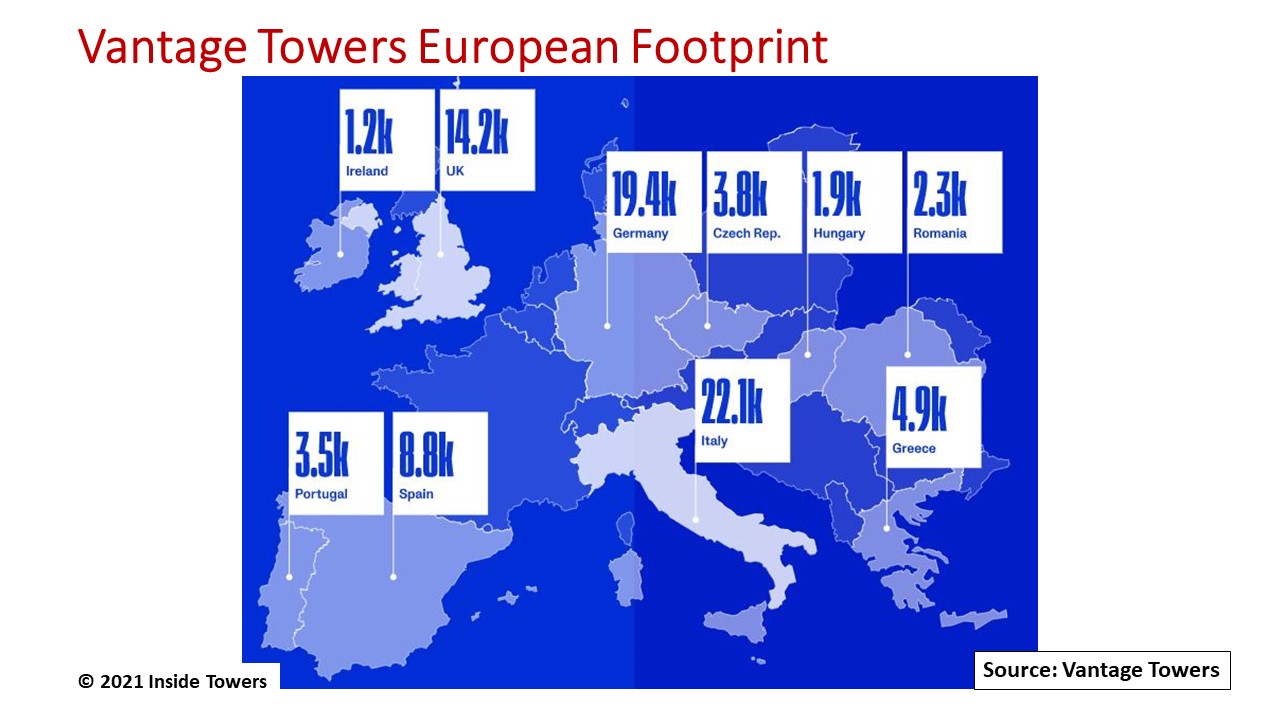

VT is one of the largest tower companies in Europe with 82,000 ground-based towers and rooftops. Of these, the company has 45,700 of its own sites across eight countries with an average of 1.4 tenants per site. Germany is VT’s largest market with 19,400 sites or 42 percent of the total with an average of 1.2 tenants per site.

The company has access to another 36,300 sites through a 50 percent joint venture with Cornerstone, a U.K. mobile infrastructure services company, and a 33.2 percent share in a JV with Infrastrutture Wireless Italiane S.p.A. (INWIT), Italy’s major tower operator. The JVs average 1.9-2.0 tenants per site.

As 5G deployments gain momentum among European mobile network operators, ready access to wireless infrastructure becomes critical. VT wants to attract MNO tenants beyond Vodafone. In doing so, however, it competes with other large, independent tower companies such as Spain’s Cellnex and U.S.-based American Tower (See, American Tower’s Global Ambitions) as well as large wholly-owned MNO tower operations such as Deutsche Telekom’s Deutsche Funkturm.

VT is developing its commercial business by expanding operations and driving efficiencies. It added 100 build-to-suit (BTS) macro sites across its markets in the quarter. At the same time, new BTS activity was slightly offset by decommissioning of roughly 100 sites in Spain and other European markets, mainly associated with an active infrastructure sharing agreement in Spain.

The company expects its BTS program to capture increased MNO network build activity that is typical in the second half of the year. Vivek Badrinath, Vantage Towers CEO says, “[There is] a lot of work going on to scale-up and make more efficiencies inside our BTS programs, and that’s what we have been focusing on during this quarter.”

Moreover, VT added 200 new non-Vodafone tenants in the quarter, bringing total tenants to 64,200 for an average of 1.41 per site. The company has set a full-year goal of achieving 1.5 or more tenants per site.

VT is driving operating efficiencies with a concerted ground lease buyout program directed at landlords. This GLBO initiative produced almost 250 agreements in Spain in the quarter. It is accelerating in Germany with another 80 contracts and is showing early results with roughly 60 agreements in other European markets.

The company also sees promising commercial opportunities aside from its MNO customers. In Spain, VT signed an eight-year partnership agreement with LineoX, a wholesale connectivity provider, for access to around 9,000 VT sites across the country for radio links to existing and future customers. LineoX has a network of 10,800 radio links in Spain to provide internet connectivity, especially in those remote areas that cannot be accessed by cable or fiber.

VT expanded its collaboration with Masmóvil, the fourth largest telecom operator in Spain. The agreement includes 5G upgrades for Masmóvil tenancies at both urban and rural sites.

An agreement with Sigfox Greece is helping VT become what it refers to as a “5G superhost.” The agreement is a 10-year framework contract with over 280 tenancies expected by the end of calendar year 2023, of which roughly 180 will occur in CY2022.

In addition, with other partnership contracts in Greece and the Czech Republic, VT is developing commercial opportunities with new partners and customers across our footprint in Europe.

With growing prospects, VT confirmed its FY22 guidance for leasing revenues at $1.17-1.19 billion, with a medium-term growth target of a mid-single digit CAGR, stable EBITDA margin in the mid- to upper-50 percent of revenue range, and recurring free cash flow of $460-472 million with medium term growth at a mid to high single-digit CAGR.

*All figures in $U.S.

By John Celentano, Inside Towers Business Editor

Reader Interactions