Vodafone Group, PLC (NasdaqGS: VOD), based in the U.K., is creating the largest tower company in Europe.

In July 2019, Vodafone announced its intention to spin off its European tower infrastructure into a new, legally separated organization, referred to as “TowerCo,” while exploring ways to monetize those assets. TowerCo became operational with a dedicated management team in May 2020.

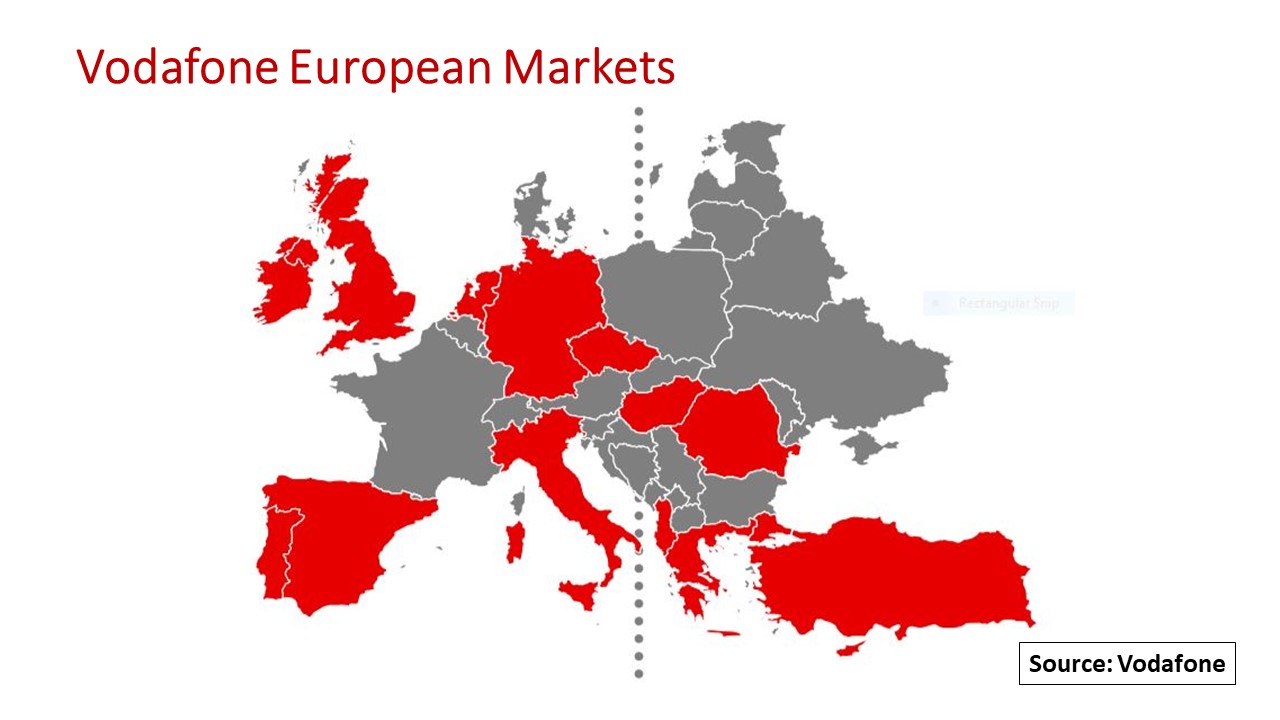

TowerCo will have Europe’s largest towers portfolio, totaling 61,700 towers across 10 countries. Almost 76 percent of these sites are in Vodafone’s four major markets: Germany, Italy, Spain and the U.K.

Comparing market benchmarks for anchor tenant lease rates, existing third-party revenues and the attributable cost base, Vodafone believes that TowerCo could generate proportionate annual revenue of nearly U.S.$2.0 billion and adjusted EBITDA of US$1.0 billion. The company expects TowerCo’s annual maintenance and expansion capital expenditures (capex) will be about U.S.$225 million.

Other towers in these markets are owned either by competing wireless service providers or by other tower companies. For instance, U.S.-based American Tower (NYSE: AMT), the largest multinational tower company with roughly 180,000 towers in 19 countries, has a small presence in Europe with over 2,500 towers in France and 2,200 towers in Germany.

TowerCo’s formation supports continuation of Vodafone’s active and passive network sharing strategy. The company touts several models for network sharing with other communications service providers (CSPs).

Passive infrastructure sharing involves co-location of radio access network (RAN) equipment on physical mobile sites such as towers and rooftops. Deep Passive infrastructure sharing takes it a step further to include reciprocal capacity access on microwave and fiber backhaul facilities.

Active infrastructure sharing involves reciprocal access to both the physical mobile sites and RAN equipment, mainly at sites located outside of major urban areas.

Vodafone wants to monetize its infrastructure assets in these different scenarios. The company believes that a standalone TowerCo can facilitate efficient network sharing through substantial capex and operating expense (opex) savings while accelerating Vodafone’s 5G technology roll out across its primary European operating markets.

To that end, Vodafone has secured network sharing partnerships with CSPs across Europe including Deutsche Telekom in Germany, Telecom Italia in Italy, Orange in Spain and Romania, Telefonica in the U.K. and Wind in Greece.

In March 2020, the company completed the merger of its passive tower infrastructure in Italy with INWIT S.p.A., creating Italy’s leading tower company with over 22,000 towers. Vodafone holds 33.2 percent of INWIT shares and will retain joint control alongside Telecom Italia.

Vodafone intends to monetize a substantial proportion of TowerCo over the next 18 months, depending on market conditions. An initial public offering (IPO) is one consideration. Alternatively, the company may sell a minority stake in TowerCo along with potential disposals of minority or majority stakes at an individual country level. Proceeds will be used to pay down Group debt.

Vodafone is one of the world’s leading telecom and technology service providers. The company has mobile operations in 25 countries, partners with mobile networks in 41 more, and has fixed broadband operations in 19 markets.

Through a series of acquisitions, mergers and divestitures, Vodafone now focuses on two regions. It offers converged connectivity services to residences and businesses in 12 countries in central and southern Europe. At the same time, Vodafone is a leader in mobile data and payments services for consumers in seven southern African countries.

For FY2020, ending March 31, Vodafone Group reported service revenues of U.S.$42.5 billion, adjusted EBITDA of US$16.7 billion and capex of U.S.$8.3 billion. Europe accounted for 77 percent of the Group’s service revenues.

The company closed FY2020 with approximately 313 million mobile customers, 24 million fixed broadband customers and 22 million TV and fixed voice line customers, including all customers in Vodafone’s joint ventures and associates.

Vodafone will release TowerCo’s first financial results in its mid-year FY2021 earnings report in November 2020. With favorable results to that point, an IPO potentially could come in early calendar 2021.

By John Celentano, Inside Towers Business Editor

Reader Interactions