Charter Communications (NASDAQ: CHTR) is walking a tightrope. The company, headquartered in Stamford, CT, operates across 41 states. Its network passes over 57.5 million locations and of that, Charter had 31.2 million residential and small businesses customers at the end of 2Q25. That figure is down from 31.8 million in 2Q24.

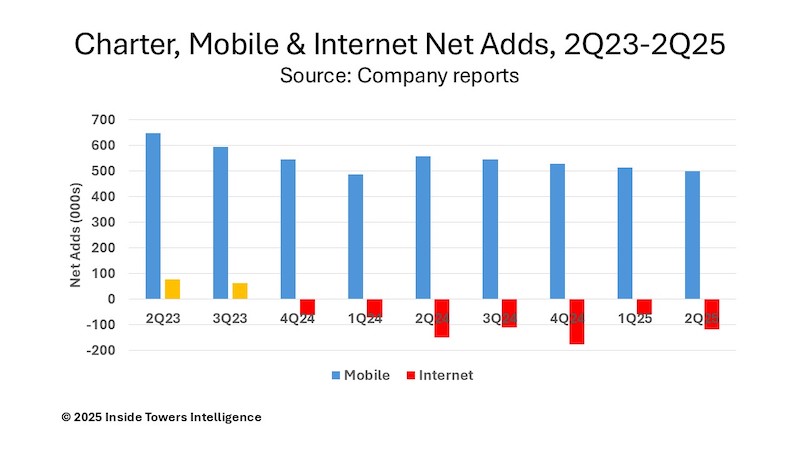

The main reason for the decline is that Charter continues to lose internet subscribers primarily to mobile network operator’s fixed wireless access offerings and to fiber overbuilders arising in Charter’s operating territory. In 2Q25, Charter incurred a net loss of 117,000 residential and small business internet subscribers. Since 4Q24, the company has experienced a total of 746,000 net losses. Over that period, its internet customer base has declined to 29.9 million from 30.6 million.

At the same time, Charter has added mobile subscribers at a steady, albeit, slowing pace since the company launched Spectrum Mobile as a Verizon (NYSE: VZ) MVNO in 2018. The company reported 500,000 mobile net adds in the quarter to reach a total of 10.3 million mobile subscribers, with roughly half of those added in the last two years.

The good news is that revenues have not declined but rather have stayed flat even with customer losses and Charter is still showing small EBITDA growth. Total revenue for the quarter was $13.8 billion and Adjusted EBITDA was $5.7 billion, both up by less than one percent on a year-over-year basis. Internet services are the big revenue contributor, accounting for 43 percent of the total in the quarter. The company has been able to increase ARPU by two percent YoY through bundling services and raising prices for value-added features.

Charter acknowledges that it is operating in a competitive environment. Chris Winfrey, Charter, President, CEO & Director, says that the company “has not seen a material change in the competitive landscape, and we remain confident that we’ll return to Internet customer growth over time through our operating strategy of delivering the best networks and products at the best value for customers, combined with unmatched service.”

He is talking about MNO FWA penetration plateauing in the next couple of years, then Charter picking up the internet net adds pace. That may be wishful thinking. Both T-Mobile (NASDAQ: TMUS) and Verizon together raised their outlook for FWA subscribers to a combined total over 20 million by 2028, Inside Towers reported.

In the interim, Charter is making major technology upgrades to its cable network with DOCSIS 3.1 and DOCSIS 4.0 deployments, allowing the company to offer up to symmetrical 10 Gbps connectivity. Winfrey explained that he expects, in addition to Verizon MVNO-based mobile services, the company will be in full deployment mode of its hybrid mobile network operator, or HMNO network, deploying CBRS small cells across 23 markets.

Charter invested $2.9 billion in capex in 2Q25, up slightly compared to 2Q24. The company offered full-year 2025 capex guidance of $11.5 billion, up two percent YoY, but revised downward from the $12.0 billion guidance at the beginning of 2025.

Winfrey also highlighted a new long-term MVNO relationship with T-Mobile is intended to enhance business connectivity services and accelerate Spectrum Mobile growth. He emphasized that the mobile business is now “becoming a real tailwind to our free cash flow growth.”

He also pointed that the agreement for Charter to acquire Cox Communications, announced in May, as Inside Towers reported, will yield strategic benefits including expansion into new markets, increased competition, and accretion to growth, margin, and free cash flow per share.

By John Celentano, Inside Towers Business Editor

Reader Interactions