Philadelphia-based Comcast (NASDAQ: CMCSA) remains the largest broadband provider in the U.S., according to Inside Towers Intelligence. At the end of 4Q24, the company, through its Xfinity brand, operated its cable network in 40 states plus the District of Columbia, passing nearly 63.7 million domestic homes and businesses. This figure represented a two percent increase year-over-year.

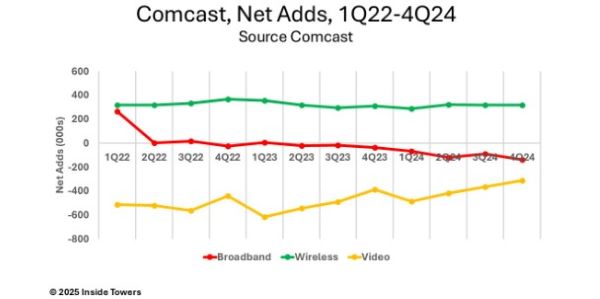

Comcast’s total relationships, defined as customers who purchased at least one of the company’s services, totaled 33.8 million at the end of 2024, a decrease of one percent from 34.3 million at the end of 2023. Broadband net additions declined by 411,000 during the year, ending with 31.8 million connections, reflecting a one percent year-over-year decrease. Comcast faces competition for broadband connections from fiber-to-the-home overbuilders and fixed wireless access offerings from mobile network operators.

At the end of 2024, domestic video customers numbered 12.5 million, an 11 percent YOY decline, as on-demand streaming video becomes more popular than programmed linear video. Over the past three years, Comcast has lost nearly 5.7 million video customers, although the rate of loss slowed in 2024 compared to the previous two years.

Wireless connectivity was a bright spot for Comcast. Under its Xfinity Mobile brand, which operates as a Verizon (NYSE: VZ) MVNO, the company had 1.2 million wireless net additions in 2024, slightly down from nearly 1.3 million net additions in 2023, reaching a total of 7.8 million wireless subscribers at the end of 2024. This represents an 11 percent YoY increase from the 6.6 million wireless subscribers at the end of 2023.

Comcast indicated that wireless subscribers represent a 12 percent penetration of its total passings, suggesting upside potential. The company says it is focusing more on a wireless and broadband convergence strategy similar to its telecom and cable competitors.

“We will lean into wireless more than ever before,” said Mike Cavanagh, Comcast Corporation President. “We are the challenger in a market that is 2.5 times the size of broadband with a capital-light strategy that does not require network tradeoffs. You will see us shift our strategy to package mobile with more of our higher tier broadband products both for new and many of our existing customers.”

Cavanagh added that Comcast will leverage its broadband and WiFi network capabilities by automatically boosting the speeds of Xfinity Mobile customers by up to 1 Gbps whenever they connect to its 23 million WiFi hotspots, which Comcast claims is the largest and fastest WiFi network in North America.

Total Connectivity & Platforms revenue, encompassing cable and wireless operations, was $81.3 billion in 2024, remaining essentially flat compared to 2023. Adjusted EBITDA for Connectivity & Platforms was $32.8 billion, reflecting a two percent year-over-year increase. The company says that the Connectivity & Platforms segment accounted for 66 percent of Comcast’s 2024 total consolidated revenue of $123.7 billion, which includes Media, Studios, and Theme Parks.

Connectivity & Platforms capex grew one percent year-over-year to $8.3 billion as Comcast extended its network and continued its network upgrades to the DOCSIS 4.0 standard for its hybrid fiber-coax architecture.

By John Celentano, Inside Towers Business Editor

Reader Interactions