Crown Castle (NYSE: CCI) reported solid results for 2Q23. “We delivered second quarter results in line with our expectations and continue to be excited by the long-term opportunity ahead with the majority of the 5G deployment in the U.S. still to come,” stated Jay Brown, Crown Castle CEO. “As the carriers have reduced network spending, we anticipate lower tower activity for the remainder of this year, resulting in lower contribution from services and a decrease to our full year 2023 outlook.”

Brown explains that the 5G activity to-date has reflected the “initial surge” similar to 4G deployments. The first wave is to install cell sites on towers using low-band frequencies to achieve wide area coverage in a relatively short period followed by a short slow down. After that, a much longer deployment cycle will focus on densifying the network from both towers and, increasingly, small cells using mid-band and millimeter wave spectrum to increase network call handling capacity.

Brown points out that with multi-year, holistic master lease agreements in place, the company expects the reduction in tower activity would have little impact on its long-term site rental revenues. Total site rental revenues were up 10 percent on a year-over-year basis to $1.7 billion, Adjusted EBITDA was also up 10 percent YoY to $1.2 billion while AFFO grew 14 percent YoY to $891 million.

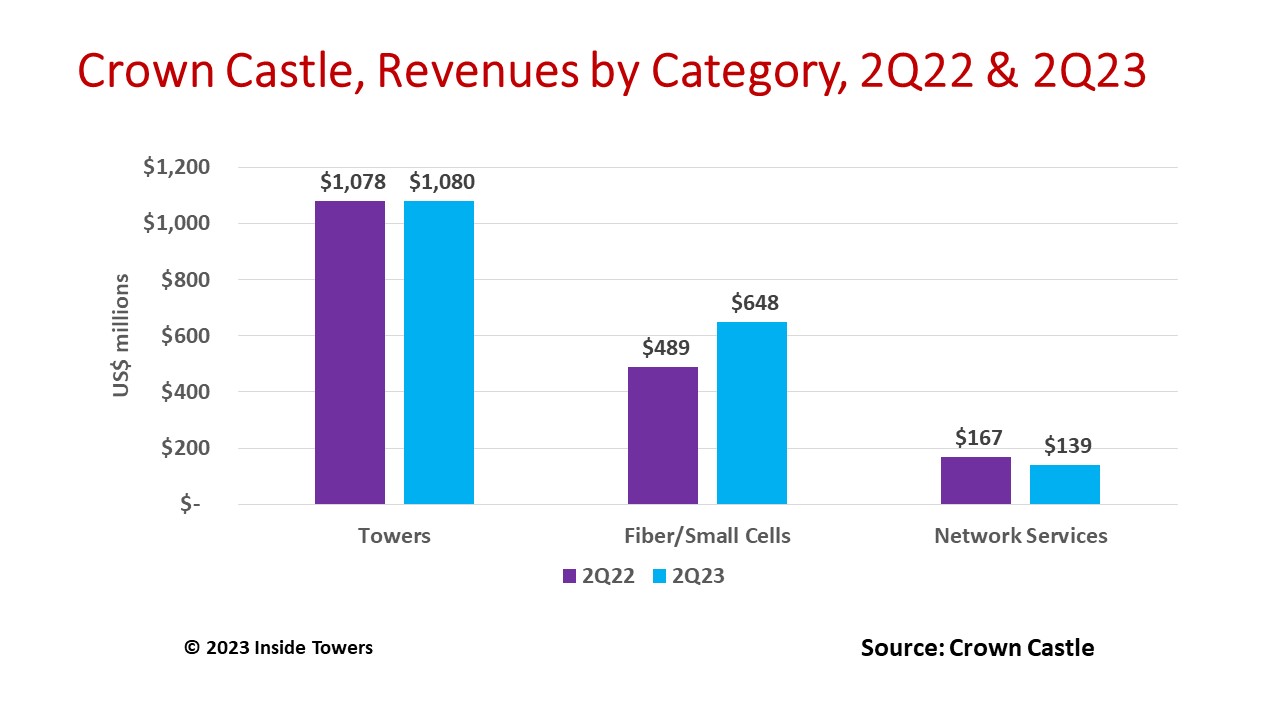

Tower revenues in the quarter were $1.1 billion, essentially flat with 2Q22. The company had 40,025 towers in service at the end of 2Q23. In the quarter, T-Mobile accounted for 42 percent of site rental revenues, followed by Verizon at 18 percent, AT&T at 17 percent and other tenants accounting for 23 percent balance.

CCI has set a goal of achieving 5 percent organic revenue growth over the 2024 to 2027 period. As of June 30, CCI has $34 billion in receivables on existing tenant contracts that account for 75 percent of its 5 percent organic growth target.

With MLAs providing long-term revenue assurance, most of this revenue reduction was on activity outside the scope of contracted revenues. In particular, Network Services that CCI provides to its MNO tenants fell in 2Q23 by 17 percent YoY to $139 million.

The activity decline occurred across multiple carriers. Verizon and AT&T completed their C-band Phase I deployments, T-Mobile finalized its Sprint network integration and DISH hit its 70 percent population coverage bogey in June. Moreover, MNOs are still looking for ways of monetizing 5G and are exercising caution about the next big 5G investments. Still, the long-term view is positive as there are new spectrum bands to be deployed. CCI stood by its 1Q23 comment that only about 50 percent of its towers have 5G cell sites. As such, the company also sees a long period of good growth beyond the surge.

Fiber leasing revenue in the quarter grew 33 percent YoY to $648 million. The company expects the fiber business to achieve a 3 percent organic growth run-rate by the end of the year, CCI says it is on track to reach its target of 10,000 small cells in 2023. The company has a backlog of 60,000 small nodes, most of which will be collocated cost-effectively on its own fiber routes.

The company expects full-year capital expenditures, after prepaid rent additions, to be about $1 billion with about $150 million for the Towers segment and $850 million for Fiber and Small Cells.

By John Celentano, Inside Towers Business Editor

Reader Interactions