Digital Realty (NYSE: DLR) claims to be the world’s largest data center platform, in terms of number of data centers. As of December 31, 2021, the Austin, TX-based company owned or operated 287 data centers, including 50 data centers held as investments in unconsolidated joint ventures. These facilities house applications and capacity that are critical to the day-to-day IT operations of tech companies and corporate enterprise customers.

DLR is a global operation. Its data centers are located in 53 key metropolitan markets across 26 countries in North America, Europe, South America, Asia, Australia and Africa.

The company offers a mix of data storage and data processing services, colocation and interconnection solutions for its multi-tenant domestic and international customers. Its largest customers include the cloud and information technology services companies such as AWS, Microsoft, Google and Oracle, communications companies such as AT&T, Verizon and Comcast, and social networking platforms like Facebook.

DLR also serves enterprises in numerous vertical markets from financial services, manufacturing, energy, and healthcare to consumer products. Not counting renewals, the weighted average remaining lease term across its customer base is 4.7 years.

DLR’s portfolio comprises over 35.6 million of net rentable square feet (NRSF) of which 29.8 million sq. ft. or 84 percent of total NRSF is occupied. In addition, DLR has roughly 7.2 million sq. ft. of space under active development and another 2.7 million square feet of space held for future development.

At year-end 2021, DLR reported 178,000 cross-connects in its data centers. These connections bring together customers with multiple carrier networks for transporting customer traffic and workloads at the enterprise to and from those data centers. DLR’s total interconnected systems consists of over 700 network and content providers, about 600 Cloud and IT providers, and more than 800 Enterprises.

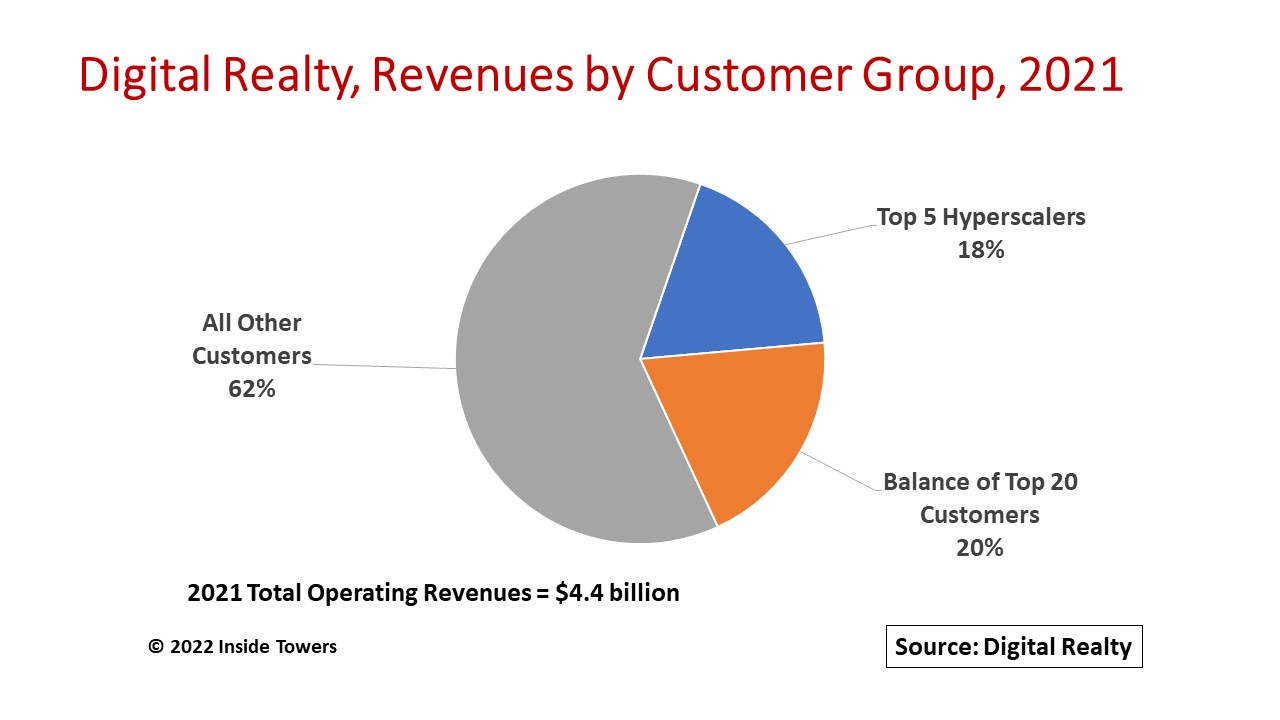

DLR reported revenues for 4Q21 of $1.1 billion, up 5 percent on a year-over-year basis. from the same quarter last year. Adjusted EBITDA was $584 million, a 1 percent YoY increase while over the same quarter last year. Funds from operations were $449 million. Full-year 2021 revenues were $4.4 billion and capital expenditures for data center construction, expansion and maintenance were $2.4 billion. DLR’s 2022 guidance is for $4.7-4.8 billion in total revenues and $2.3-2.5 billion in capex..

In the fourth quarter, DLR signed total bookings expected to generate $156 million of annualized rental revenue, including an $11 million contribution from interconnection. Note that the weighted-average lag between new leases signed during 4Q21 and the contractual commencement date is 14 months. This interval reflects the time for both new site construction and expansion at existing sites.

Of the new leases signed in the quarter, contracted capacity among smaller customers tallied 14.3 megawatts (MW) of power and 163,000 sq. ft. in the sub-1 MW category while bigger customers using more than 1 MW of power signed up for an aggregate of 79.8 MW and 714,000 sq. ft.

“Digital Realty delivered record bookings in the fourth quarter and for the full year, with over $500 million of new business globally in 2021, demonstrating the strength of our global value proposition,” said Digital Realty Chief Executive Officer A. William Stein. “Demand for data center solutions remains robust, and we are investing organically as well as strategically to expand our global platform to provide customers the capacity and communities they require to execute their digital transformation strategies around the world.”

By John Celentano, Inside Towers Business Editor

Reader Interactions