DigitalBridge Group (NYSE: DBRG) CEO Marc Ganzi, during the company’s 4Q24 earnings call, presented a compelling argument regarding capital expenditures required to enhance the overall data handling capacity of digital infrastructure. He emphasized that this expansion is necessary not only in data centers but also across the entire infrastructure as AI transitions from large learning models to inferencing applications. Inferencing involves drawing conclusions or making predictions based on data, which in the context of AI and machine learning, refers to using a trained model to make predictions or decisions on new, unseen data.

Ganzi noted that these inferencing applications will extend beyond data centers to where they are used by enterprises, government agencies, small businesses, and homes. He claims this shift necessitates substantial investments in fiber, macro towers, small cells, edge infrastructure, and intelligent devices to ensure high-speed transport and low latency connectivity required for inferencing.

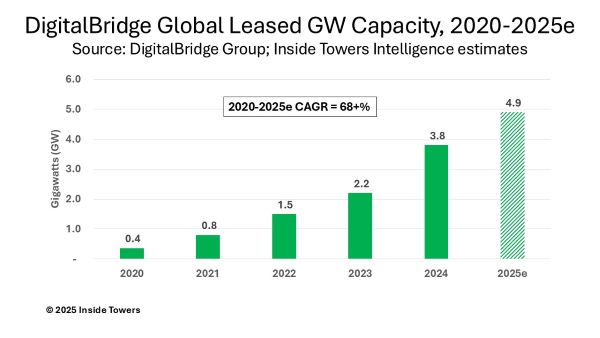

He highlighted DigitalBridge’s own investments and positioning as a prime example. As an alternative asset investor focused on digital infrastructure, Ganzi mentioned that their portfolio comprises nearly 30 companies worldwide, covering all key infrastructure asset classes. In 2024, the company’s capital investment across its portfolio amounted to $16 billion, up from the previous estimate of $15 billion, with expectations to reach around $20 billion in 2025.

DigitalBridge raised $24 billion in debt and equity capital in 2024 to fund portfolio growth, increasing assets under management from $80 billion to $96 billion. Ganzi anticipates AUM to grow to approximately $112 billion in 2025, with fee-earning equity under management projected to rise to $40 billion.

“Raising and deploying capital successfully gives us the global scale that drives efficiency, growth, and market presence,” Ganzi commented. “At the end of the day, this allows us to show up for our customers where they need us.”

By the end of 2024, DigitalBridge’s global data center portfolio included over 200 data centers in more than 90 markets, with 16 GW of secured power to meet future demand. The company also claims one of the largest tower portfolios, comprising 10 tower companies, led by Vertical Bridge, with more than 500,000 total owned or master lease tower sites and 96,000 active sites in over 15 countries.

Ganzi reported significant growth in the fourth quarter across fiber, small cells, and towers, noting Vertical Bridge achieved the best January leasing performance in its U.S. market history. He predicts a massive increase in mobile data traffic as generative AI moves to mobile devices, estimating a 3-5 times increase in the next five years.

With limited spectrum, Ganzi expects mobile network operators to engage in frequency reuse, involving cell splitting and adding more macro cells, then densifying the network with small cell infrastructure. This has driven increased macro tower leasing activity, which is anticipated to continue globally. He says that all of DigitalBridge’s portfolio tower companies have exceeded 2024 leasing guidance.

At the same time, DigitalBridge’s fiber companies report strong performance in hyperscale bookings, with hyperscalers securing high fiber strand count leases to support AI workloads. Ganzi emphasized the importance of a comprehensive ecosystem, from data centers to the small cell business handled by portfolio companies like FreshWave, Boingo, and ExteNet.

Ganzi believes the 2026-2029 period will be crucial for small cell densification for 5G, with the number of nodes in the U.S. expected to double to two million in that period. He concludes, “densification may not progress as quickly as desired, but it is anticipated to bring generative AI to the mobile edge within this timeframe.”

By John Celentano, Inside Towers Business Editor

Reader Interactions