DigitalBridge Group (NYSE: DBRG) has completed its transition phase or “rotation” to 100 percent digital infrastructure and away from traditional real estate holdings and investments. In its recent 4Q21 earnings call, the company reported over $45 billion of digital infrastructure assets under management (AUM) at year-end 2021 compared to $30 billion at the end of 2020. Its final real estate divestiture, Wellness Infrastructure, is expected to close in 1Q22.

The company is already in its “acceleration” phase, expanding its digital assets rapidly through both strategic acquisitions and expansion of existing businesses around the world. The DigitalBridge Partners II (DBP II) fund is its prime investment vehicle. DBRG received contributions to DBP II from Limited Partners (LPs) of $8.3 billion, exceeding its $6.0 billion fundraising target.

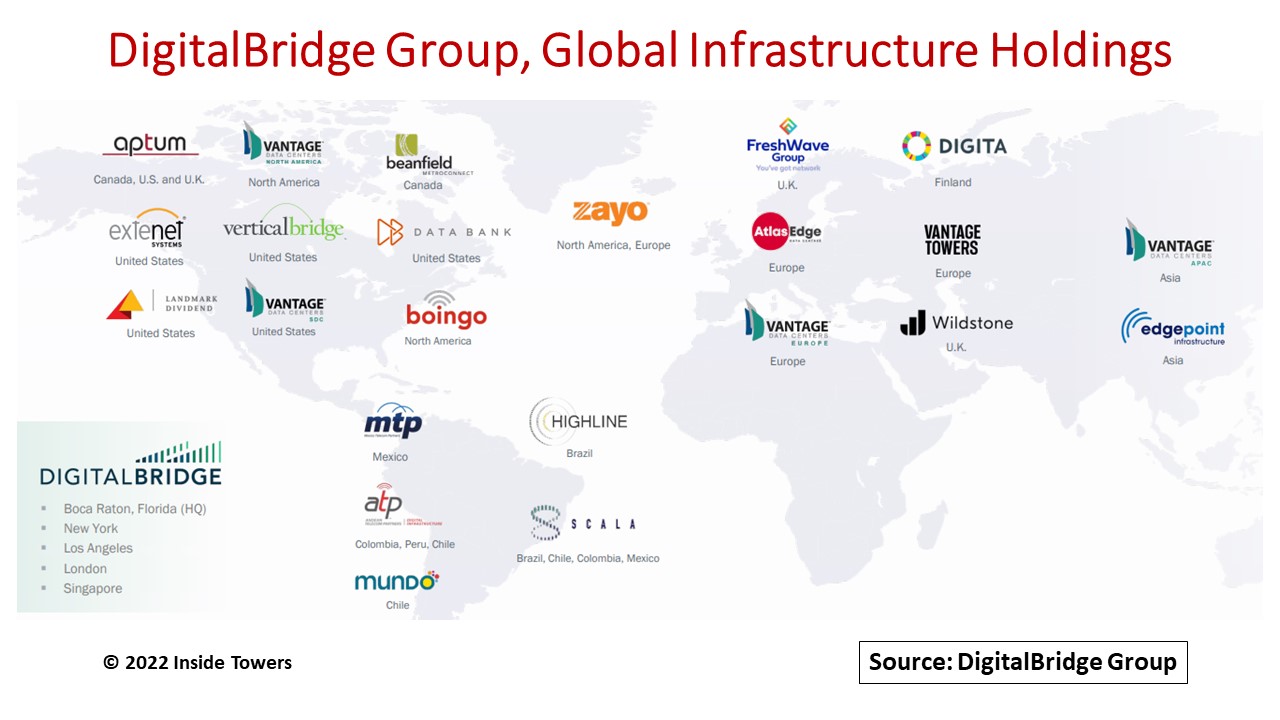

It has committed $7.8 billion in 2022 capital expenditures for growth and expansion among its 23 portfolio companies. These portfolio companies own and operate diverse infrastructure assets including towers (e.g., Vertical Bridge), fiber networks (Zayo), data centers (Vantage), small cell networks (ExteNet), edge infrastructure (AtlasEdge) along with digital real estate (Landmark Dividend), across four geographic regions – North America, South America, Europe and Asia. DBRG’s latest acquisition is Mondo, a fiber-to-the-home operator in Chile with more than 3 million homes-passed. All these companies make money by leasing space and capacity on their respective infrastructure assets.

How DBRG Makes Its Money

DBRG makes money two ways. It earns digital investment management (Digital IM) fees by attracting LP contributions into investment funds such as DCP II then deploying those funds into digital infrastructure both among its existing portfolio companies and for new acquisitions. DBRG takes a fee for managing these investments.

Secondly, the company’s digital operating segment (Digital Operating) involves balance sheet capital in two data center businesses, Vantage Stabilized Data Centers and DataBank, comprising 78 data centers with nearly 2 million sq. ft. of critical IT space, 80 percent of which is leased. Here, DBRG takes a proportional share of each companies’ revenues and adjusted EBITDA.

At year-end 2021, the company reported Digital IM free related earnings (FRE) of $71 million, up 2.5 times the $28 million generated in 2020. Its share of Digital Operating consolidated revenues and adjusted EBITDA from its two data center companies were $132 million and $56 million, respectively, both up year-over-year by an average of 142 percent.

For full-year 2022, DBRG is guiding to midpoint Digital IM FRE of $120 million, and Digital Operating EBITDA of $70 million on operating revenues of $173 million.

Time To Build

DBRG claims that it is the only global investment firm to “own, manage, and operate across the entire digital ecosystem with a flexible investment framework built to capitalize on evolving networks.”

On that score, it is constantly weighing buy-versus-build options. For 2022, DBRG will accelerate its digital infrastructure expansion with large-scale investments to acquire new platforms, accretive M&A bolt-on acquisitions on existing platforms, and organic growth through build-to-suit programs for global customers.

The company plans to “build” across all asset classes in its operating regions in 2022. It sees “buy” opportunities for towers in Europe and Asia, data centers and edge infrastructure in North America and Asia, and fiber in Asia.

Of the $7.8 billion of 2022 capex, DBRG is allocating $4.7 billion or 60 percent in North America, another $2.2 billion or 28 percent in Europe and 12 percent balance split between Latin America and Asia. The company believes that investors are “under allocated” to digital infrastructure and thinks it can grow its AUM to $100 billion by 2025.

Marc Ganzi, DigitalBridge President and CEO, says, “The simplicity of what we built is what I think should really make investors excited. Two businesses that are scaling, two businesses that are performing. And most importantly, our ability to form capital and execute ideas quickly. This is really the hallmark of the investment thesis of DigitalBridge, and why we’re excited to accelerate in the build.”

By John Celentano, Inside Towers Business Editor

Reader Interactions