DigitalBridge Group (NYSE: DBRG) is investing heavily along with co-investors to take advantage of the exponential demand for hyperscale AI data center development. In the company’s 2Q25 earnings call, DigitalBridge CEO Marc Ganzi presented a compelling picture of hyperscale data center demand in terms of the new leasing requirements, and the subsequent requirements for land and power needed to support the projected data center capacity, along with the corresponding capital expenditure required to build that capacity.

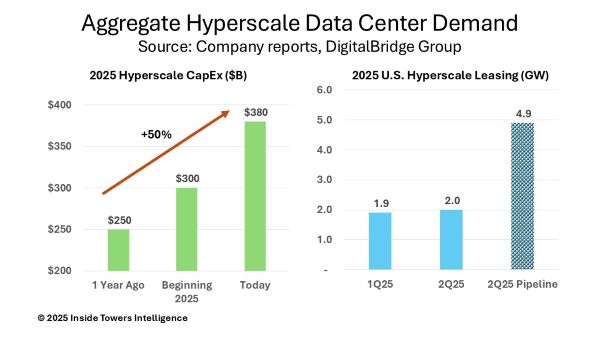

Ganzi shared analyses that show the U.S. hyperscale data center leasing pipeline is “the largest we have seen in history, standing at approximately 4.9 GW,” according to a recent TD Cowen report. Globally, hyperscalers have upped their investment commitments with data center capex jumping 50 percent year-over-year to roughly $380 billion.

For its part, DigitalBridge has expanded its data center portfolio with two strategic investments that help the company to catch the AI wave. In July, the company completed the transaction to acquire Yondr, the London-based hyperscale data-center developer/operator with data centers in nine markets in Europe, North America and Asia. Yondr currently has leased 450 MW of its more than 1 GW development capacity.

The company says adding Yondr strengthens its data center portfolio that now comprises eight companies which can address all aspects of the data center ecosystem. Vantage Data Centers, Scala Data Centers and Yondr serve public cloud hyperscalers. Switch caters mainly to private cloud enterprise applications. Databank, AIMS, AtlasEdge and Expedient provide interconnection edge applications.

Ganzi showed that collectively these portfolio companies have 2.1 GW built capacity and another 3.2 GW under construction. He pointed out that collectively these data center operators have a power bank of 20.9 GW of total secured power. DigitalBridge has committed $43 billion in capex for 2025-2026 across the portfolio.

Ganzi emphasized that power is the most critical area for the projected data center development to be realized. To that end, the company made another strategic investment of $500 million in Takanock along with Arclight, a company that manages and operates electric power, renewables, battery storage and natural gas infrastructure.

Takanock develops shovel-ready powered land and onsite power generation solutions enabling hyperscale data centers to deploy faster in power-constrained markets. With Takanock, a data center operator can access land with available power initially from alternative power generation, then from the grid. This business model enables data center operators to get up and running faster with on-site power than relying on grid connections. Takanock is focusing on Tier I and Tier II data center markets like Northern Virginia, Phoenix and others, and has 1,600 acres that it is developing under this model.

Ganzi emphasized that data centers are part of the large digital infrastructure ecosystems which encompasses fiber, towers and small cells. Demand at the data centers eventually will extend across the entire ecosystem. Beyond the AI training phase, AI inference will take place mainly at the edge. Moreover, Ganzi believes that 80 percent of AI inference will take place on mobile devices.

By John Celentano, Inside Towers Business Editor

Reader Interactions