DigitalBridge Group (NYSE: DBRG) continues to raise new capital from multiple diversified sources and to invest that money into growing and profitable digital infrastructure assets. The company is one of the few alternative asset managers that is focused exclusively on digital infrastructure. DigitalBridge has investments in over 40 portfolio companies that span towers, fiber, data centers, small cells and edge infrastructure in North America, Latin America, Europe and Asia Pacific. At the end of 3Q24, the company had over $88 billion of digital infrastructure assets under management on behalf of its limited partners and shareholders. DigitalBridge makes its money from management fees on those infrastructure investments that generate returns for the investors.

DigitalBridge made several notable deals during 3Q24 and into October that it says reflect its continued investment activity across the AI infrastructure ecosystem. Management says it is positioning the company for significant infrastructure growth driven by AI over the next five years. Inside Towers reported on: VerticalBridge to operate and manage 6,339 towers for Verizon (NYSE: VZ) in a $3.3 billion deal; taking private JTOWER, the largest independent tower company in Japan with 7,700 towers; a $2 billion equity raise for Databank with $1.5 billion investment from AustralianSuper and acquiring European data center company, Yondr, that has current leased capacity of 420 MW with capacity for over 1 GW.

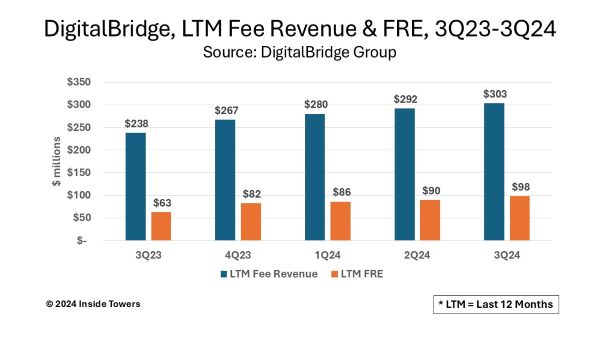

For the quarter, fee revenue of $77 million was up 16 percent year-over-year, driven by higher fee earning equity under management (FEEUM) which increased 14 percent YoY to $34 billion. Fee related earnings (FRE) were $26 million, up 42 percent YoY. However, distributable earnings of nearly $11 million were down 67 percent YoY as the company recorded a $28 million carried interest and incentive fee amount in 3Q23 that did not repeat in 3Q24.

New capital formation is a big part of the company’s activity. DigitalBridge brings in limited partners through a variety of investment vehicles including the DigitalBridge Partner series, credit and co-investment. The company says it is on track to raise $7 billion in 2024, having already received commitments of $6.1 billion through October.

In addition, DigitalBridge recently opened a new investment vehicle, referred to as the data center sidecar, having hired an experienced wealth manager to raise capital primarily via private wealth channels. The company expects to raise $1 billion that will be used as a direct-invest vehicle in DigitalBridge’s portfolio of data center platforms.

The company revised its full-year 2024 midpoint guidance on key metrics noting that the composition and timing of some capital commitments are closing later in the year than originally projected. This means that some of the money raised will not be deployed before the end of the year resulting in lower “in-period” FRE for 2024, although the company expects to make that shortfall up in 2025.

With that adjustment, FEEUM of $36 billion is up 10 percent YoY. New capital formation of $7 billion is unchanged. Fee revenue of $313 million, is projected to increase 17 percent over the $267 million in 2023, while FRE of $105 million will be up 28 percent YoY.

By John Celentano, Inside Towers Business Editor

Reader Interactions