EchoStar (NASDAQ: SATS) is at a critical juncture. The company continued to lose subscribers in 2Q24, albeit at a slower rate than in the same period a year ago, both in its flagship satellite TV and broadband businesses and in its wireless business. Aggregate revenues are down over 9 percent year-over-year, and the company continues to lose money. Moreover, it is facing a $2 billion debt maturity, due in November, and it must complete the buildout of its 5G network to 75 percent of all PEAs by June 14, 2025.

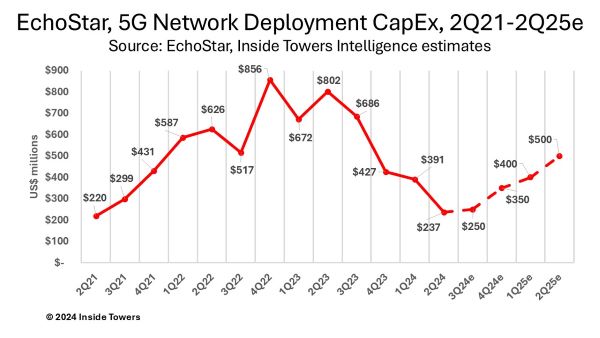

To save money, EchoStar has slashed operating costs, laid off people, and cut back on capital expenditures. Still, work continues on preparing the 5G network to meet the June 2025 deadline. In the quarter, the company reported 5G network deployment capex of $237 million, down over 70 percent year-over-year from $802 million in 2Q23. Note that through 2Q24, the company has spent $8.4 billion of the $10 billion it originally budgeted for its 5G buildout. EchoStar says that it is currently doing all the preparatory work that is not capital intensive and has shifted much of its 2024 capex to the second half to get ready to meet its 2025 commitments.

Boost Wireless, its prepaid business, is still losing subscribers. The company ended the quarter with roughly 7.3 million prepaid wireless subscribers compared to over 7.7 million in 2Q23. The rates of decline did improve and except for a loss of ACP subscribers, the base would have grown modestly.

The company claims to have about half a million postpaid subscribers on its 5G network although it is not yet reporting any service revenues from those subscribers. EchoStar acknowledged that its 5G network is still “empty.”

EchoStar started in the wireless when it acquired from T-Mobile (NASDAQ: TMUS), the Boost Mobile prepaid business that operates as an MVNO on both the T-Mobile and AT&T (NYSE: T) networks. The idea was to eventually migrate these subscribers to EchoStar’s standalone 5G network as postpaid subscribers. Operating as an MNO serving its own postpaid subscribers produces better margins and profits, referred to as owner economics, compared to MVNO yields.

The company attributes its slow growth of postpaid subscribers, up to now, to the lack of a variety of smartphones compatible with its 5G network. It says that there are now 20 smartphone models that can work on its network.

EchoStar also highlighted the fact that other MNOs have locked their customer’s phone from working on other networks thus preventing their customers from switching to other carriers. The FCC is taking action to remedy that situation, Inside Towers reported.

EchoStar still has its work cut out for it to become a viable competitor in the wireless business. Hamid Akhavan, EchoStar president and CEO commented in the company’s 2Q24 earnings call that “there is nothing more dangerous than an empty network.” While he was not suggesting the company would engage in disruptive tactics to gain customers, he did advocate for more open and fairer competition with the Big 3 MNOs.

At the same time, he acknowledged that the company has several hurdles that he said are solvable but will take time to work through. First is distribution. EchoStar does not have retail stores like MNO competitors, instead relying on signing up subscribers through online channels such as Amazon (NASDAQ: AMZN).

Akhavan also advocated for the FCC to move forward with actions to require wireless competitors to unlock their customers’ phones which he claimed will open opportunities for EchoStar.

Lastly, he acknowledged their branding strategy needs to be streamlined. While the Boost name is associated primarily with prepaid brands, the company is sticking with the Boost Mobile logo to cover both postpaid and prepaid offers.

By John Celentano, Inside Towers Business Editor

Reader Interactions