Echostar (NASDAQ: SATS), the parent company of DISH Wireless, showed losses on all fronts for the full year 2023. The company reported 2023 total revenue of $17.0 billion, compared to $18.6 billion in 2022. The net decrease in revenue primarily resulted from subscriber declines, most significantly in its Pay-TV segment. Consolidated OIBDA totaled $1.32 billion, compared to $3.41 billion in 2022. The decrease in OIBDA was primarily attributable to the noncash impairment to goodwill and the subscriber declines.

EchoStar’s flagship Pay-TV business lost nearly one million subscribers during 2023, ending the year with 9.9 million DISH-TV and Sling-TV subscribers compared to 10.7 million at the end of 2022. Its Retail Wireless segment lost approximately 617,000 net Wireless subscribers during 2023 compared to the loss of approximately 576,000 net Wireless subscribers in 2022. This increase in net Wireless subscriber losses primarily resulted from lower gross new Wireless subscriber activations, partially offset by an increase in net ACP/Gen Mobile subscriber additions and a lower Wireless churn rate. The company ended the year with 7.4 million prepaid subscribers compared to nearly 8 million at the end of 2022.

The company’s wireless business is still trying to get traction. In the fourth quarter of 2022, it launched the Boost postpaid wireless service to a limited number of customers who had signed up for early registration. During 2023, the company expanded its Boost postpaid wireless service nationwide, and at the end of the third quarter of 2023, it began offering the iPhone 15 on its 5G Network and expanded its Boost postpaid offering through a distribution partnership with Amazon, Inside Towers reported. The company does not yet break out the number of postpaid subscribers.

Its Retail Wireless segment operates primarily as an MVNO using the T-Mobile and AT&T networks, as it continues its 5G network deployment and grows customer traffic on the 5G Network. EchoStar is transitioning the Retail Wireless segment to an MNO as the 5G network becomes commercially available. The company says it is currently activating Boost Mobile and Boost postpaid subscribers with compatible devices onto its 5G Network in markets where it launched Voice over New Radio or 5G voice services, Inside Towers reported.

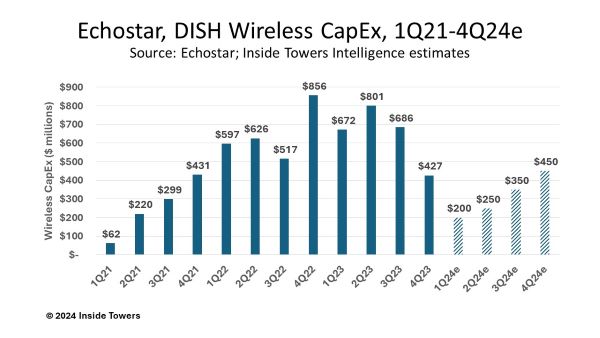

EchoStar invested $2.6 billion in its 5G Network Deployment segment in 2023. That capital expenditure was essentially flat with 2022, as it reached its 70 percent population coverage bogey in June 2023.

With over 20,000 cell sites already deployed, the company says that its 5G deployment capex in 2024 likely will decline to less than half of the 2023 level as it takes time to plan and acquire the remaining rural sites needed to meet its 75 percent of Partial Economic Area coverage milestone by June 2025. The company previously projected that it would build its nationwide competitive cloud-native, Open RAN 5G network for around $10 billion, Inside Towers reported.

“We closed the year with the completion of the merger with DISH Network. The transaction combined DISH Network’s satellite technology, streaming services, engineering expertise, retail wireless business, and nationwide 5G network with EchoStar’s premier satellite communications solutions, enterprise go-to-market capabilities, and U.S.-based manufacturing,” said Hamid Akhavan, EchoStar president and CEO.

“With the close of the merger, we will continue to integrate our business and realize savings and operational efficiencies. We also will increase our focus on identifying and targeting the best, most profitable customers in each of our addressable market segments – Pay-TV, Retail Wireless, and Broadband and Satellite Services.”

By John Celentano, Inside Towers Business Editor

Reader Interactions