EchoStar (NASDAQ: SATS) portrayed a positive picture on its results and outlook. While the numbers still are moving in the wrong direction, the company is confident that transactions in recent months give it the financial latitude and timing flexibility to significantly grow its 5G network and retail subscriber base.

At the end of 3Q24, the company reported 7.0 million wireless subscribers, down seven percent from 7.5 million on a year-over-year basis. Net losses were approximately 297,000 in the quarter compared to the loss of approximately 225,000 net Wireless subscribers during the same period in 2023. Excluding the impact of net losses of Government subsidized subscribers, the company added approximately 62,000 net wireless subscribers in the quarter. The Retail Wireless segment boasted a churn rate of 2.99, down 29 percent YoY and ARPU increased nearly two percent YoY to $36.27.

Wireless service revenues of $779 million in the quarter declined over four percent YoY from $814 million in 3Q23. The company expects to stanch those losses. It points out that it offers wireless subscribers competitive consumer plans with no annual service contracts and monthly service plans including high-speed data and unlimited talk and text, and device financing arrangements for certain qualified subscribers.

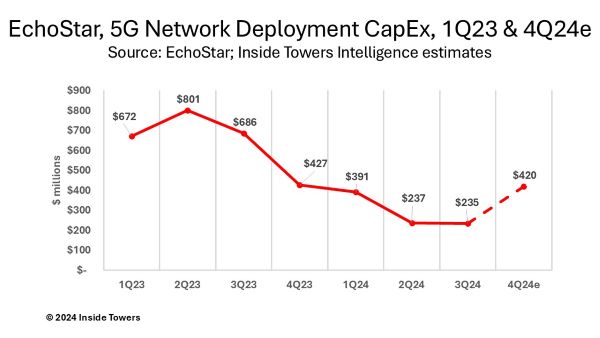

In 3Q24, Echostar invested $235 million in its 5G network deployment compared to $686 million in 3Q23. The company says it continues to be disciplined with its approach as it transitions from building and deploying to running and optimizing its network. The company expects its 5G network deployment capex to be roughly half of the $2.6 billion it spent in 2023.

Given the network investment through nine months of 2024 and the company’s guidance through year-end, Inside Towers Intelligence expects 4Q24 5G capex to uptick significantly to over $400 million. The company did not offer any guidance for its 2025 capex, although we can anticipate increased spending to achieve nationwide coverage.

Echostar acknowledged it has a better deployment runway with the recent FCC approval of an updated framework for its 5G network build-out commitments. The new framework provides a three-year extension for certain spectrum licenses, enabling the company to focus resources on making the Boost Mobile business more competitive in markets where the Boost Mobile network is live and it has a retail presence.

EchoStar expects to provide 5G broadband access to more than 80 percent of the U.S. population by the end of this year. It says it is committed to offering low-cost wireless plans and 5G devices to consumers nationwide, plus the updated framework enables the company to more efficiently build its network and increase competition in highly populated areas.

Today, the Boost Mobile network covers over 250 million Americans with 5G broadband and more than 208 million Americans with 5G voice over new radio (VoNR), and the company continues to expand and optimize the network. It will expand its voice service with 5G VoNR set to live in three additional markets – Boston, Pittsburgh and Seattle – increasing its 5G voice coverage to over 216 million Americans by the end of the year.

By John Celentano, Inside Towers Business Editor

Reader Interactions