Ericsson (NASDAQ: ERIC) reported its results for 3Q23, showing numbers down in key segments. As the world’s largest publicly held telecom equipment manufacturer, by revenue, according to Inside Towers Intelligence, the company’s performance reflects the current state of the global wireless infrastructure business.

Despite cyclicality in the mobile networks business, the company points out that escalating mobile data demand, along with new 5G use cases, remain underlying drivers for the wireless equipment market recovery. Nonetheless, Ericsson expects the prevailing uncertainty impacting its Mobile Networks business to persist into 2024. Moving forward, it is adjusting to the new normal by reducing costs while maintaining R&D investments in the 17-18 percent of sales range.

Ericsson claims the global 5G deployment cycle is still in its early stage. It states that 75 percent of all Ericsson radio base station sites, outside China, are not yet updated with 5G mid-band. Moreover, the company believes that ongoing MNO competition will lead to a relatively sharp increase in network investments when the market turns. It says it already sees some positive signs in developing 5G markets.

Total revenue for the quarter was $5.9 billion, down 5 percent on a year-over-year basis from $6.3 billion in 3Q22. EBITA excluding restructuring charges amounted to $432 million versus $708 million YoY, with an EBITA margin of over seven percent. It sees similar market trends extending into 4Q23. With increased cost cutting, the company expects 4Q23 consolidated EBITA margin to be around 10 percent while reiterating its long-term EBITA margin target of 15-18 percent. Part of the cost cutting involved field technician layoffs in the U.S. in July, Inside Towers reported.

Net income for the quarter was negative $2.8 billion after taking a $2.9 billion impairment of goodwill attributed to its Vonage acquisition.

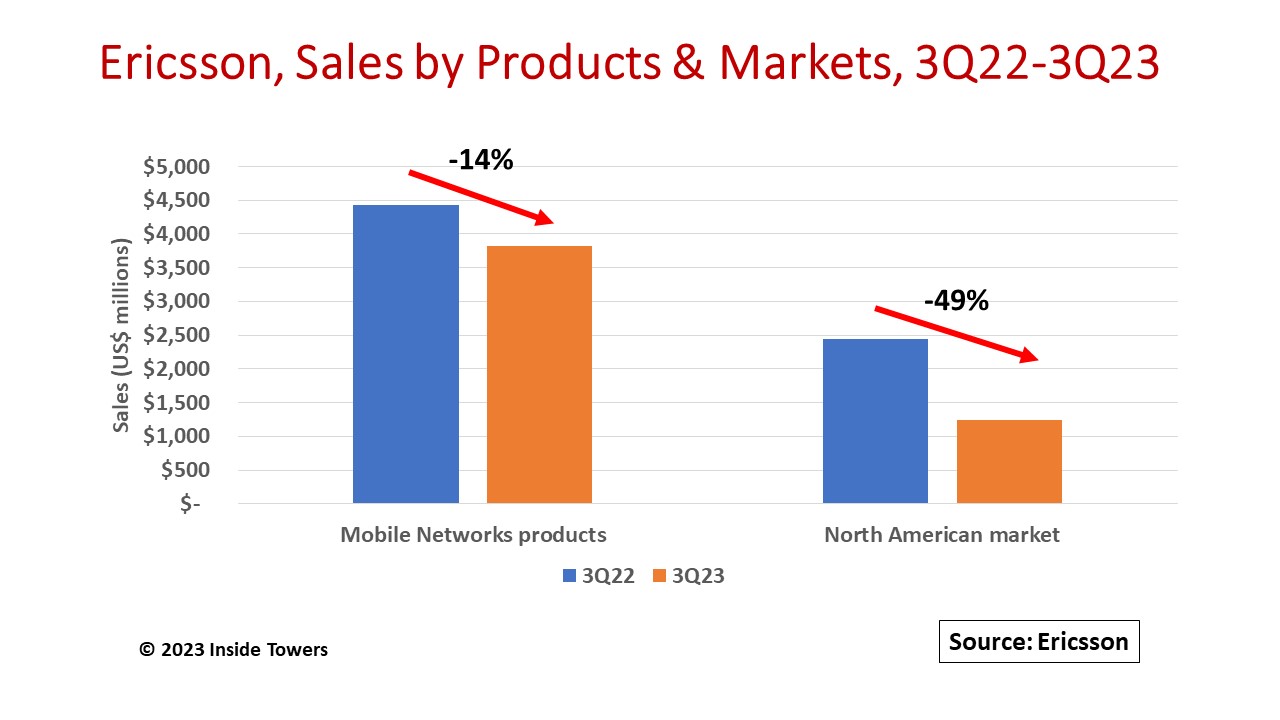

Ericsson took big negative hits in two areas – its Networks product segment, and its North American market. Networks, including RAN and Core products, account for two-thirds of Ericsson’s global revenue. The consolidated product sales decline of 5 percent YoY was a mix of a 14 percent drop in its Networks group partly offset by 10 percent growth in Cloud Software and Services, and a 34 percent increase in Enterprise private networks.

By region, Networks equipment and services sales in North America, the company’s largest market, dropped 49 percent YoY, accounting for 21 percent of sales in 3Q23 from 39 percent in 3Q22. The drop was due to MNO inventory adjustments and an overall slowdown of 5G deployments in the region. That North American market decline was partly offset by double-digit sales growth in India as well as some early 5G markets resuming investments.

“In a challenging operating environment, Ericsson delivered third quarter results in line with our guidance,” comments Börje Ekholm, Ericsson President and CEO. “Consistent with the rest of our industry, we expect the macroeconomic uncertainty to persist into 2024, which impacts our customers’ investment ability. We are addressing these challenges with a focus on elements within our control, namely cost management and operational efficiency.”

By John Celentano, Inside Towers Business Editor

Reader Interactions