Frontier Communications (NASDAQ: FYBR) is on a rapid pace to upgrade its network to fiber. The company’s network in its 25-state operating area passes 15.4 million residential and business locations with copper and fiber cable facilities. Its goal is to convert more than 10 million of those to fiber by 2025.

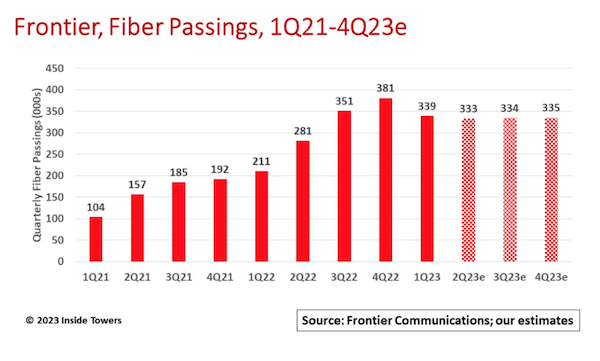

At the end of 1Q23, FYBR surpassed the midpoint of that goal, ending the quarter with 5.5 million fiber passings. It added 339,000 new fiber passings in the quarter, up 60 percent over the 211,000 installed in 1Q22. FYBR is striving to install 1.3 million or more passings by the end of the year, bringing its total fiber passings to over 6.5 million. It expects to reach the 10-plus million milestone with another 1.3-1.4 million passings in each of 2024 and 2025.

Nick Jeffery, FYBR President and CEO comments, “Our first growth engine, consumer fiber, is firing on all cylinders. We had another record quarter, and more fiber broadband net adds than the entire cable industry in the U.S. combined. Even with a footprint that’s just 1/20 the size.”

Revenue for the quarter of $1.4 billion decreased nearly one percent compared to the first quarter of 2022 as growth in consumer, business and wholesale fiber was more than offset by declines in legacy copper services. Fiber revenue accelerated eight percent year-over-year growth driven by healthy consumer and business performance.

Adjusted EBITDA was $519 million, up YoY due to higher fiber and subsidy-related EBITDA. Of that total, $322 million was generated from fiber-based products.

FYBR ended the quarter with nearly 2.9 million total residential and business broadband customers, compared to 2.8 million in 1Q22. The company had 87,000 fiber broadband nets adds in 1Q23, up 61 percent on a YoY basis, with many coming from cable competitors.

Many residential customers signed up for 1+ Gbps service, with ARPU now in the $65-70 per month range. Fiber-to-the-tower is a big part of the company’s wholesale business strategy. It indicated that all four major wireless operators have signed up to use its fiber infrastructure for backhaul.

FYBR is demonstrating that more customers are subscribing to its fiber service once it is available to them and those “take rates” increase over time. It showed in the first 12 months of new passings, take rates average around 20 percent. By the end of 24 months, take rates increase to the mid-20 percent to 30 percent range. Longer term, FYBR expects to realize penetration rates of 40-45 percent across its markets.

Capital expenditure for the quarter was up significantly on a YoY basis. Capex was almost $1.2 billion in 1Q23, up substantially from $447 million in the first quarter of 2022, as the company’s fiber expansion initiatives accelerated. FYBR expects its fiber build costs per passing to be in the $1,000 to $1,100 range for 2023, suggesting that the total project build costs could be around $1,000 per location as a result of a mix in lower cost locations in new build states, aerial builds, and more focus on multi-dwelling units.

FYBR updated its 2023 guidance. Adjusted EBITDA is unchanged from previous midpoint guidance of $2.14 billion. The fiber passings target for the year remains at 1.3 million or more. Capex midpoint guidance was increased to $3.1 billion, up from the previous $2.8 billion level. The company says the higher anticipated capex reflects higher fiber equipment inventory levels and associated construction costs.

By John Celentano, Inside Towers Business Editor

Reader Interactions