Frontier Communications (NASDAQ: FYBR) is firing on all cylinders. Three years ago, the company set a goal to become a pure fiber player (meaning, just fiber, no wireless) under its Building Gigabit America initiative with fiber-to-the-premise as its primary growth vehicle. At the end of 2023, Frontier ranked as the third largest telco fiber provider in the U.S. behind AT&T (NYSE: T) and Verizon (NYSE: VZ), according to Inside Towers Intelligence.

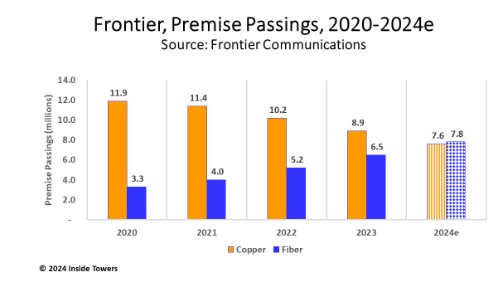

With a base of over 15 million premises passed by copper and fiber in its 29-state operating area, Frontier added 1.3 million fiber passings in 2023 to reach 6.5 million total fiber passings, or 65 percent of its 10 million fiber passings target by 2025. The company plans to add another 1.3 million fiber passings in 2024, surpassing copper passings for the first time. Frontier reported two million fiber broadband customers at the end of 2023, accounting for two-thirds of its total customer base.

The increased fiber availability drove revenue growth. While the top line remained flat year-over-year at $5.8 billion, fiber revenue for full-year 2023 grew eight percent to $3 billion and accounted for 52 percent of total revenue. Copper revenue declined 10 percent YoY to $2.7 billion. Fiber Adjusted EBITDA increased to $1.3 billion, up 14 percent YoY on accelerated customer and ARPU growth, and a significant cost reduction program.

Capital expenditures for the year were $3.21 billion, plus $4 million of vendor financing for total capital investment of $3.22 billion. As the company expected, the fiber capex was front end loaded with 69 percent spent in the first half of 2023. Spending then declined sharply in the second half of the year, as Frontier worked through an inventory backlog, managed working capital, and benefited from lower fiber build costs.

Frontier’s 2023 direct build cost per location was within its $1,000-1,100 per location projection. Since the company began building fiber in 2020, it has passed roughly 3.3 million new fiber locations at a direct bill cost of approximately $920 per location. It expects future passings will remain in the $1,000-1,100 per location range, resulting in a total project spend around $1,000 per location passed.

The company expects the mix of capital investment will continue to evolve in 2024. While the cost per location-passed is expected to decline, Frontier believes its cost per location-connected will increase with higher gross adds.

Overall, it expects capex in 2024 to be lower than 2023. Frontier believes that 1.3 million new locations-passed in 2024 to be its “optimal build pace” as it balances deployment speed with operational efficiency.

In terms of cadence, Frontier expects capex to be front-end loaded in 1Q24 at a level similar to the first quarter of 2023, before stepping down materially in the second, third and fourth quarters. It is guiding to cash capital investment, which includes capex and vendor financing payments, of approximately $3.1 billion at the midpoint, representing a three percent decline versus 2023.

With the build plan set, Frontier says it will step up fiber revenue growth in 2024, by adding more fiber broadband customers than it added in 2023 and accelerating ARPU growth at or above 3-4 percent. Growth will be mainly from consumers as Business and Wholesale customers remain relatively stable. The company guidance for 2024 Adjusted EBITDA is $2.2-2.25 billion, up 4 percent YoY at the midpoint.

By John Celentano, Inside Towers Business Editor

Reader Interactions