UPDATE A funny thing happened on the way to the acquisition close. The company being acquired, Frontier Communications (NASDAQ: FYBR), keeps getting better. That raises the question: Should the acquiring company, Verizon (NYSE: VZ), pay more? Hey, it’s a rhetorical question – it’s a $20 billion done deal that is scheduled to close in Q1 2026, subject to obtaining all regulatory approvals and meeting merger terms.

But you have to give the Frontier team their props. Since the deal was announced on September 4, 2024, as Inside Towers reported, Frontier has consistently met or exceeded its quarterly fiber passings and fiber broadband net adds goals, raised ARPU and grew revenues.

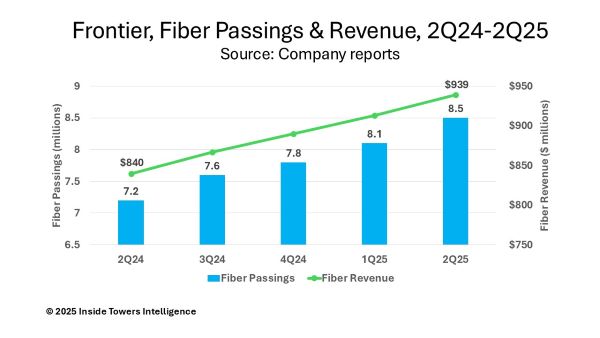

In 2Q25, the company reported that it added 334,000 new fiber passings bringing the total to 8.5 million out of a total base of 15.5 million passings. That’s an 18 percent year-over-year increase and puts the company on track to reach its previously stated goal of reaching more than 10 million fiber passings by the end of 2026.

Fiber broadband customers increased by 20 percent YoY to 2.625 million, on the strength of 126,000 new broadband adds in the quarter. At the same time, fiber ARPU grew five percent YoY to $68.54 per month driving fiber revenues to $939 million in the quarter, up 12 percent from $840 million in 2Q24.

Total copper and fiber revenue increased four percent YoY to $1.54 billion. Fiber Adjusted EBITDA jumped 21 percent YoY to reach $463 million in the quarter. Total Adjusted EBITDA grew to $607 million in 2Q25 from $560 million in 2Q24, up eight percent YoY which the company claims leads all other fiber providers.

In our May interview with Nick Jeffery, Frontier Communications President & CEO, he said that the growth was a combination of having an established supply chain, working efficiently to achieve cost per location passed somewhere in the $1,000 to $1,100 range before considering macroeconomic factors, and having the ability in their fiber platform to offer customers higher speeds, at higher monthly rates, without replacing the fiber electronics.

The results speak for themselves. Jeffery and his team seem to be firing on all cylinders.

With Verizon acquisition close still pending, the company has not provided guidance for full-year 2025. But Jeffery indicated that the company is not slowing down.

By John Celentano, Inside Towers Business Editor

Reader Interactions