Like flying an airplane, building and operating a telecom network involves constant adjustments. That is certainly the case with Frontier Communications (NASDAQ: FYBR). The company is converting its legacy local wireline network to fiber at a significant pace. Despite near term turbulence, the company continues to accelerate its fiber-to-the-premise buildout. It is taking a long-term approach to deliver high-value fiber internet connectivity and broadband services for residences and businesses that it expects will drive revenues and profit growth. Working from a base of 15.4 million copper and fiber passings across its 25-state operating area, Frontier’s goal is to convert 10 million of those passings to fiber by 2025.

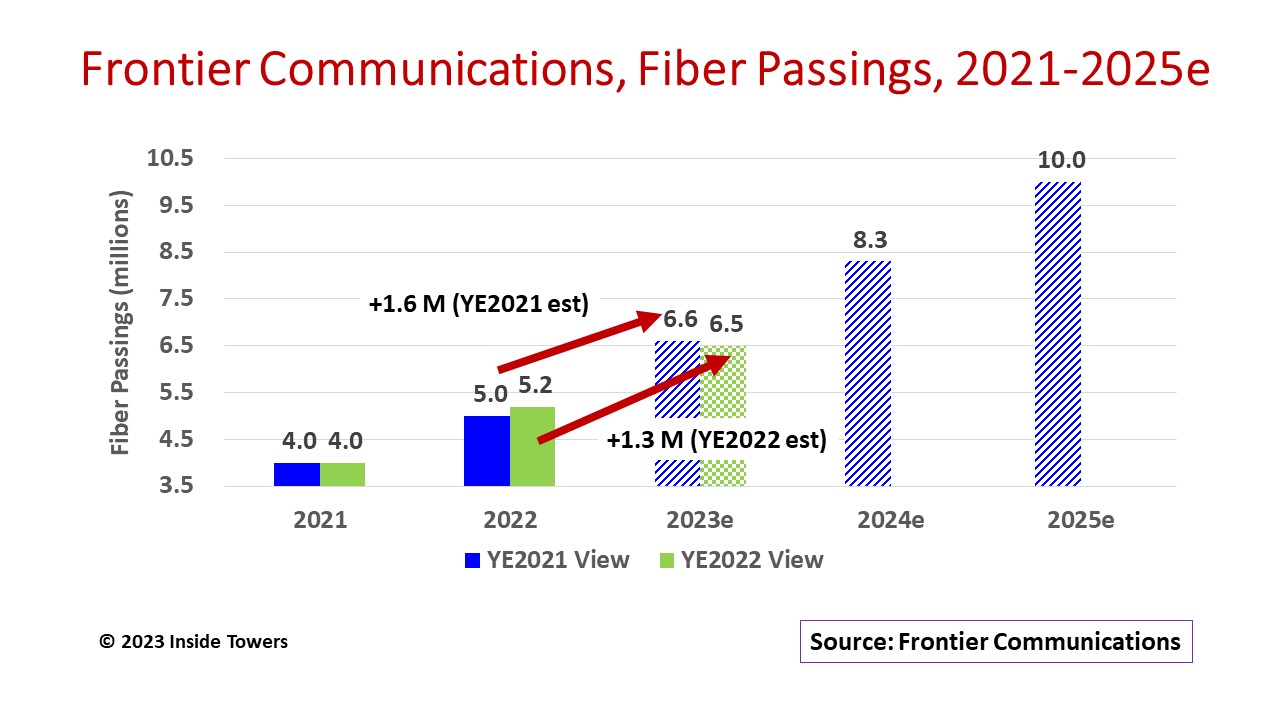

During 2022, the company installed 1.2 million fiber passings (a company record of 381,000 in 4Q22 alone) to reach a total of 5.2 million. That figure is over half of its 2025 fiber passings goal. What Frontier accomplished in 2022 was nearly double the 638,000 fiber passings installed in 2021. More importantly, the 2022 figure surpasses the 1.0 million projection that Frontier made at the end of 2021. At the time, the company said it expected to add another 1.6 million fiber passings in 2023 to reach 6.6 million by year-end. Given its better-than-projected performance in 2022, the company has moderated its pace to install 1.3 million passings in 2023. It now expects to reach 6.5 million fiber passings at year-end 2023.

Note that the company did not update its outlook for 2024 and 2025 at year-end 2022. Based on the earlier projections, it would have to step up to 1.7 million fiber passings in both 2024 and 2025 to reach the 10 million mark by year-end 2025.

All this network activity comes at a price, however. Revenues declined to $5.7 billion in 2022, down nearly 10 percent on a year-to-year basis. The decline is mainly from customers with copper connections that sought alternatives to legacy voice and video services. Revenues from these legacy services dropped 14 percent YoY. At the same time, data and internet service revenues grew over 1 percent.

Adjusted EBITDA for 2022 dropped 15 percent YoY to $2.1 billion. Of that total, the copper-based segment declined 17 percent YoY even as the fiber component was up nearly 6 percent. Still, the company is confident in its progress and is guiding 2023 Adjusted EBITDA up to the $2.11-2.16 billion range, reflecting an increase of around 3 percent.

Certainly, all this buildout activity costs money. The company says that its fiber build costs are running $900-1,000 per passing. Inside Towers’ checks with industry contacts suggest Frontier is achieving buildout efficiencies compared to a typical $1,000-1,500 per passing cost range. The company reported capital expenditures of $2.74 billion in 2022 and expects to spend another $2.8 billion in 2023. Frontier added that due to inventory management and timing-related factors, it expects capex to be front-end loaded in 2023, with the first quarter higher than the fourth quarter of 2022 and then stepping down in the second half of the year.

Given the number of passings, it must install to reach its 2025 target, Frontier likely will maintain its capex at comparable high levels for the next several years.

By John Celentano, Inside Towers Business Editor

Reader Interactions