Frontier Communications (NASDAQ: FYBR) believes that the traditional U.S. wholesale telecom sales model is outdated. Instead of calling on Enterprises and signing them up for dedicated circuits, one or a few at a time, Frontier aims to understand customers’ business needs and provide long-term solutions with bespoke services and tailored terms and conditions, similar to master lease agreements offered by tower companies and data centers.

“Over the last two years, we’ve made Frontier Wholesale a digital infrastructure platform,” Vishal Dixit, Frontier Chief Strategy Officer and EVP/Wholesale tells Inside Towers. “Our commercial strategies are similar to digital infrastructure platforms that data centers or large hyper scale-focused infrastructure companies use, unlike how a legacy copper-based telco works.”

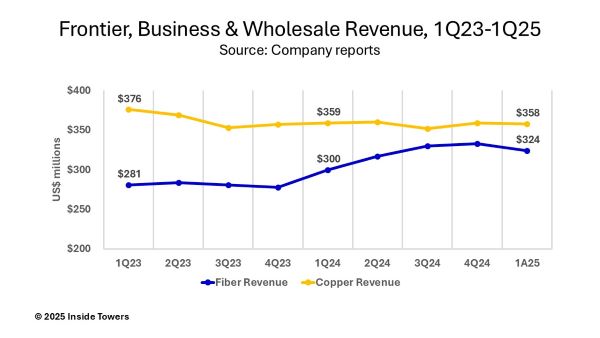

Dixit states that the company’s wholesale business reflects the overall Frontier turnaround. In its 1Q25 results, the company reported a 15 percent increase in Business and Wholesale Fiber revenue over the past two years, reaching $324 million, and accounting for nearly one quarter of Frontier’s total revenues. Dixit says legacy product revenues remain stable.

“Now we’re growing significantly in fiber-related products – fiber for hyperscalers, either to the data center or between data centers, fiber Ethernet for Enterprise, fiber to the tower, and fiber to the satellite base stations for high-capacity fiber backhaul. Fiber is where our Wholesale growth is coming from.”

Importantly, Dixit says the company moved the Wholesale division over to be part of Corporate Strategy. This move recognized that Wholesale involves strategic relationships with the end customers.

Dixit points out that Wholesale customers comprise a finite set of very large carriers or hyperscalers. “The difference is that our Wholesale division has grown revenue wise, despite the headwinds in all the legacy spaces, whereas most of the wholesale segment in the industry is declining by double digits on a revenue basis.”

Pricing strategies and partnerships have also been very strategic because the Wholesale business needs capital allocations in addition to residential fiber investments. Dixit says that Frontier is building its network to be optimized for residential, enterprise, carrier, and other Wholesale endpoints.

“If we need additional capital for connecting towers or for custom routes, we need strategic, long-term agreements with our customers to assure multi-year certainty in terms of revenue. This approach has allowed us to pivot away from the à la carte approach to multi-year agreements. We were selling two or three towers at a time, now it is hundreds.”

Dixit explains that with network delivery focused on a customer in a specific region over a period of time, Frontier can underwrite a business case based on long-term revenue projections, while having visibility into where customers are building.

“Once you make progress with a few large customers, they help densify your network. This becomes even more attractive to add new customers because your network, whether for towers or enterprise Ethernet endpoints, is already dense. When you’re selling to one building or one tower at a time, it’s hard to realize long term continuity.”

Dixit looks at the Wholesale business as a portfolio, with a focus on fiber-based revenue growth. In the end, he says, the product is the network.

By John Celentano, Inside Towers Business Editor

Reader Interactions