In the evolving landscape of broadband connectivity, mobile network operators, T-Mobile (NASDAQ: TMUS), Verizon (NYSE: VZ), and AT&T (NYSE: T), are using excess 5G mid-band spectrum for fixed wireless access (FWA) services to deliver high-speed internet to consumers and businesses. This strategy targets areas with limited broadband infrastructure (read, fiber) and taps into growing dissatisfaction with traditional cable services. While FWA doesn’t yet match fiber’s symmetry or reliability, its rapid deployment and consumer-friendly terms are reshaping broadband competition, especially in fiber-scarce or cable-dominated regions.

To make a distinction, carrier-based FWA differs from facilities-based FWA that wireless internet service providers (WISPs) deploy. With carrier-based FWA, the MNOs share a portion of their mobile spectrum for a fixed wireless application. Here, a customer obtains a router from the MNO, installs it near a window in a home or office to get a signal from a nearby tower. Once activated, the router beams WiFi signals throughout the premises, providing internet connectivity.

By contrast, WISPs generally operate in small towns or wide rural areas where internet access is limited or non-existent. A WISP’s facilities-based FWA involves establishing a base station on a tower, then beaming a line-of-sight signal, over some distance, to an outdoor antenna mounted at the customer location. The antenna connects to a router inside the premises, which then similarly beams WiFi throughout the premises to provide high-speed internet connections.

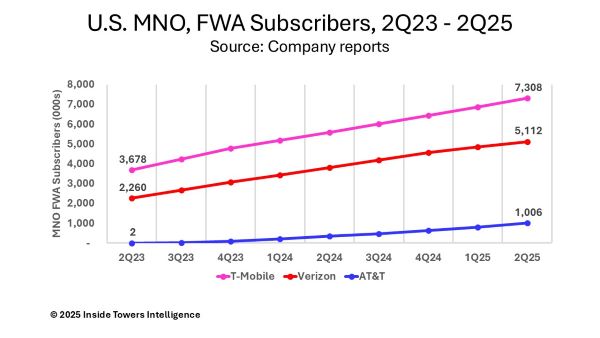

T-Mobile has emerged as a leader in carrier-based FWA, leveraging its 5G Standalone network to offer affordable, no-contract plans like T-Mobile Home Internet. At the end of 2Q25, the company reported 7.3 million 5G broadband customers and is predicting 12 million FWA subscribers by 2028. T-Mobile is leveraging its average national spectrum depth of roughly 162 MHz of 2.5 GHz mid-band spectrum to support its FWA offering. The company says it is focusing on suburban and rural areas where either fiber is not yet available or is attracting cable customers who may be looking for competitively-priced high-speed connectivity alternatives.

Verizon reached 5.1 million FWA subscribers in 2Q25 and has a goal of 8-9 million by 2028. Its 5G Home Internet complements its FiOS fiber network expansion. Covering 90 million households nationwide with its 5G UltraWideband service, Verizon is using its extensive portfolio of C-band licenses garnered in FCC Auction 107, along with millimeter wave spectrum, to reach urban, suburban and rural markets where it competes with cable or where fiber is not available. The company has set a goal of 30 million fiber passings by 2028.

AT&T is focused on expanding its fiber footprint both in-region, through organic expansion and out-of-region through its Gigapower joint venture, its pending acquisition of Lumen Technologies (NYSE: LUMN) Mass Markets business, and partnerships with open access fiber providers. Then it is marketing AT&T Mobility services to new fiber customers with a “converged” service package. AT&T is using Internet Air strategically to provide broadband connectivity in advance of fiber deployments or to provide internet connectivity where fiber is not likely to be built. From a standing start in 2Q23, the company reached one million Internet Air subscribers in 2Q25. AT&T has not set a goal for future Internet Air deployments.

By John Celentano, Inside Towers Business Editor

Reader Interactions