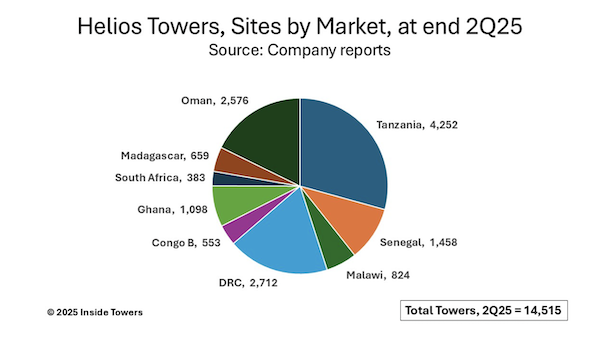

Helios Towers (LSE: HTWS), based in London, owned and operated 14,515 towers at the end of Q2 2025. That figure is up by 330 sites or two percent on a year-over-year basis across nine countries in the company’s three operating areas in Africa and the Middle East. Those towers supported 30,617 tenants, up by 2,433 or seven percent YoY from 28,574 in 2Q24 for a tenancy ratio of 2.11, up from 2.01 a year ago. The company has set a goal to achieve an average tenancy ratio of 2.2 across all its markets by the end of 2026.

Tanzania in the company’s East & West Africa regional operations is its largest market by tower count. The company added 76 sites in Tanzania in the past year for 4,252 at the end of 2Q25. Helios added 492 new tenancies to bring its tenancy ratio in Tanzania to 2.54. However, DRC in its Central & Southern Africa region is its fastest growing market. The company added 119 towers in DRC over the past year for a total of 2,712 towers at the end of 2Q25. Helios added 559 new tenancies in the same period, bringing the tenancy ratio for the DRC to 2.57.

For the quarter, the company reported revenue of $215 million, up five percent YoY. Adjusted EBITDA increased three percent YoY to $114 million while free cash flow jumped 27 percent YoY to $28 million.

During the first six months of 2025, Helios had capital expenditures totaling $54 million of which $38 million was discretionary capex which applies to new tower builds or upgrades to existing sites to add new tenants versus maintenance of existing sites.

The company points out that it is being very strategic in its infrastructure investments. It says discretionary capex is tightly controlled and only approved if returns on invested capital reach internal thresholds. This means adding a second and third tenant to a tower becomes significant and is the prime driver to achieve Helios’ ROIC goals.

Helios says it is well positioned for continued financial and operational growth, and long-term cash flows. As of the end of June, the company reported $5.3 billion of contracted future revenue with a seven-year average remaining minimum term.

In its earnings call, Helios management reaffirmed its full-year 2025 guidance: 2,000 – 2,500 tenancy additions, Adjusted EBITDA of $460-470 million, capital expenditure of $150-180 million including $100-130 million discretionary capex, and free cash flow of $40-60 million.

“We are extremely pleased with the progress we have made as we approach the culmination of our ‘2.2x by 2026’ strategy,” comments Tom Greenwood, Helios CEO. “We have achieved what we set out to, with our successful platform integration supporting free cash flow inflection and expansion, setting the business up for the next phase of our strategy.”

By John Celentano, Inside Towers Business Editor

Reader Interactions