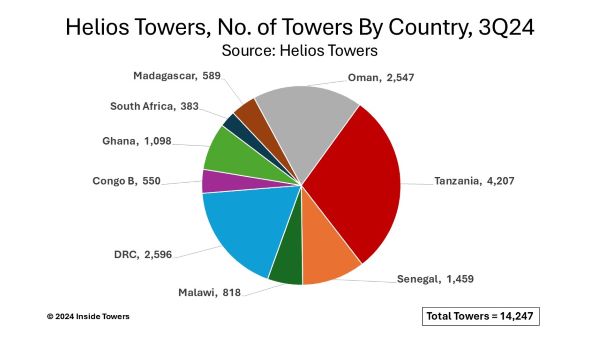

Helios Towers (OTC: HTWSF), based in London, in its 3Q24 earnings report, upped its guidance for the full year 2024 and its outlook for 2025, on the strength of new colocations on its towers in nine countries in Africa and the Middle East. Helios Towers’ portfolio at the end of the quarter grew to 14,247 towers, up from 14,024 in 3Q23. The company added 223 new towers since 3Q23 including 150 new sites in 2024, and 62 in the quarter. Helios Towers says its towers cover a population of 149 million with Tanzania, DRC, Oman and Ghana as its largest markets by tower count.

Tenants increased nine percent year-over-year to 29,021 from 26,624 in 3Q23. The tenancy ratio across the portfolio averaged 2.04x, up from 1.9x in 3Q23 with the addition of 2,397 new colocations over that period, largely in Tanzania and Oman. The number of mobile network operators averages over three per country from five MNOs in South Africa to two in Malawi and Congo B. Consequently, tenancy ratios vary by country from a high of 2.53x in DRC and 2.46x in Tanzania to a low of 1.12x in Senegal. The company data at the end of 3Q24 shows that MNOs in these countries still own a large number – 19,500 – of their own towers in Helios Towers’ operating area.

For now, the company has decided to forego any acquisition overtures and focus on adding new tenants to its existing portfolio. The company has the advantage of long-term leases in place with the MNOs. These leases typically include annual price escalators that are adjusted to local inflation rates. Moreover, Helios Towers can pass along to its tenants variable expenses related to diesel generator fuel costs to power the sites.

With those new tenancies, the company reported 3Q24 revenue of $195 million, up six percent YoY. Adjusted EBITDA of $106 million was up 11 percent YoY and portfolio free cash flow (PFCF) came in at $76 million, a four percent YoY increase.

For full year 2024, Helios Towers expects to add more than 2,400 new tenancies, up from its earlier guidance of 1,900 to 2,100, to achieve a tenancy ratio of more than 2.0x. It is looking to raise that figure to over 2.1x in 2025 and has set a longer-term goal of achieving 2.2x by 2026.

With the increased tenancy ratio, the company is projecting for full year 2024, Adjusted EBITDA of $420 million, up roughly 14 percent YoY, and PFCF of $290 million, an 8 percent increase over $268 million in 2023. Capex of $175 million will be down 14 percent YoY compared to $203 million in 2023, reflecting a slowdown in new builds and acquisitions.

“Our Q3 results reflect continued execution of our 2.2x by 2026 strategy, with strong tenancy growth supported by our leading positions in structurally high-growth markets,” said Tom Greenwood, Helios Towers chief executive. His comment refers to the strategic shift the company made earlier this year when it switched its focus from adding more towers to raising its tenancy ratio. “Looking forward to FY 2025, we expect further progress in our tenancy ratio expansion strategy,” added Greenwood.

By John Celentano, Inside Towers Business Editor

Reader Interactions