IHS Towers, the operating unit of London-based IHS Holdings Limited (NYSE: IHS), showed double-digit growth across its operations in 2022. In its 4Q22 earnings call, the company reported revenue of nearly $2 billion, up 24 percent year-over-year, with organic revenue growing 20 percent. Aggregate inorganic revenue was up almost 10 percent reflecting acquisition activity during the year.

Adjusted EBITDA came in at $1 billion for the first time, an increase of 11 percent from 2021. Recurring levered free cash flow (RLFCF) was $363 million. Capital expenditures were $633 million, up 54 percent from $402 million in 2021. This increase is largely due to investments in sustainability, under its Project Green, along with increased capex for its I-Systems fiber deployment and refurbishing towers acquired in South Africa.

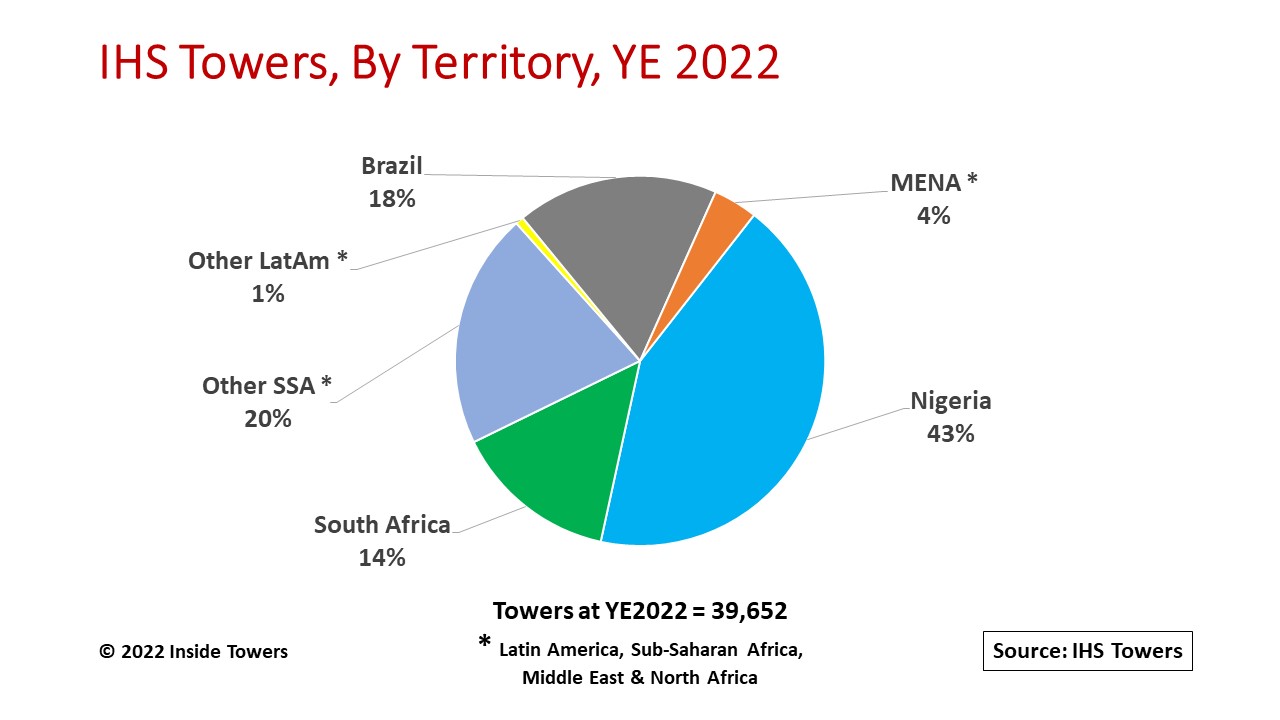

Through acquisitions during 2022 in Brazil and South Africa, IHS grew its portfolio by 28 percent YoY from 31,048 towers at the end of 2021, and ending 2022 with 39,652 towers in 11 countries across Sub-Saharan Africa, Latin America, the Middle East and North Africa. Tower portfolio growth in 2022 was driven by those acquisitions along with 1,184 build-to-suit (BTS) towers. Tenants grew 26 percent YoY to 58,573 and lease amendments increased 17 percent to 31,674. Inside Towers Intelligence ranks IHS Towers among the top five global independent, multinational tower companies by tower count.

In March, IHS gained 2,115 towers with the Grupo Torresur SP5 acquisition in Brazil, Inside Towers reported. With BTS construction, IHS ended 2022 with 6,994 towers in Brazil, its second largest market behind Nigeria. In addition, the company says it is making progress in building its neutral host fiber business, I-Systems, acquired from TIM in November 2021. The 18,000 fiber route kilometer network passed 7.5 million homes at year-end 2022 with about 4.5 million homes-connected. IHS has a goal of 10 million fiber passings by the end of 2026.

In May, IHS acquired 5,691 towers from mobile network operator MTN South Africa, making it the largest independent tower operator in the country, Inside Towers reported. As part of that deal, IHS signed a power Managed Services Agreement on an additional 7,100 sites for MTN. It believes there could be significant additional opportunities for power managed services throughout the country.

In October, IHS announced Project Green, the next phase of its carbon reduction roadmap. Under Project Green, the company expects to invest $214 million between 2022 and 2024, to connect more sites to the grid and add more batteries and solar solutions to its towers in six different markets. The company aims to reduce Scope 1 and Scope 2 greenhouse gas emissions intensity per kW by about 50 percent by 2030.

For 2023, the company is providing midpoint guidance of $2.2 billion in revenue, $1.2 billion in Adjusted EBITDA, $440 million in RLFCF and $630 million in total capex. In 2023, IHS plans to build around 1,200 new sites of which roughly 150 will be in Nigeria and approximately 750 in Brazil, triple what it built in Brazil in 2022.

By John Celentano, Inside Towers Business Editor

Reader Interactions